Gold: A New Bretton Woods Moment

(Image Courtesy: IMF)

Kristalina Georgieva, IMF Managing Director, gave a speech on October 15, 2020, in which she compared the Bretton Woods Agreement to today. In 1944, 44 men signed the Bretton Woods Agreement in Bretton Woods, NH. The agreement was designed to address the devastation caused by World War II and to create the foundations for a peaceful and prosperous future. The agreement created the International Monetary Fund (IMF).

Just as in 1944, the world and the IMF face another major point in history. The coronavirus pandemic has killed more than a million people, and the world’s economy will be about 4.4% smaller this year than last.

The goal today, just as in 1944, is to fight the immediate crisis while building the foundations for a better future.

Health measures must be taken to stem the pandemic. Vaccines and therapies must be developed to combat the coronavirus. Businesses and workers must also be supported until the pandemic has eased. Globally, governments have spent $12 trillion on the pandemic and central banks have increased their balance sheets by $7.5 trillion. These actions have, Georgieva argued, stopped the destructive macro-feedback seen in other crises. Even so, developing and emerging markets, as well as developed markets, are all still hurting. Many smaller banks in the developing world are at risk.

She also identified persistent problems, including “low productivity, slow growth, high inequalities, a looking climate crisis.”

Georgieva recommends three imperatives:

First, the right economic policies to ensure prudent macroeconomic policies and strong institutions. Each country must be dealt with individually, depending on its needs. She recommends reforms to increase trade, competitiveness, and productivity. She warns about keeping a close eye on rising public debt, ranging from 50% of GDP in low-income countries to 125% in advanced economies. The IMF is providing debt relief, and the World Bank is supporting extending the G20 Debt Service Suspension Initiative. If the debt is too high, then it should be restructured immediately. She encourages debt transparency and creditor coordination.

Second, policies must be for people. We must invest in people to underpin growth and resilience. Health systems must be strengthened, as must education, training, gender equality, internet access, and a focus on young people.

Third, we must focus on climate change and its profound threats to every human being and the world. In the past decade, direct damage from climate-related disasters amounted to $1.3 trillion. With a mix of green investment and higher carbon prices, we could reach zero emissions by 2050 while creating millions of new jobs. With low-interest rates, we could invest now and yield a quadruple dividend in terms of averting future losses, spurring economic gains, saving lives, and creating a more equal and healthier environment for everyone.

The IMF has committed more than $100 billion since the pandemic began to deal with its effects. It has a $1 trillion lending capacity, so it has more to give if needed. It will focus on low- and middle-income countries to ensure their healthcare systems remain solvent and operating. IMF members have stepped up to support increased lending.

The IMF is working hard to minimize the damage caused by the pandemic while using it as an opportunity to build a better future.

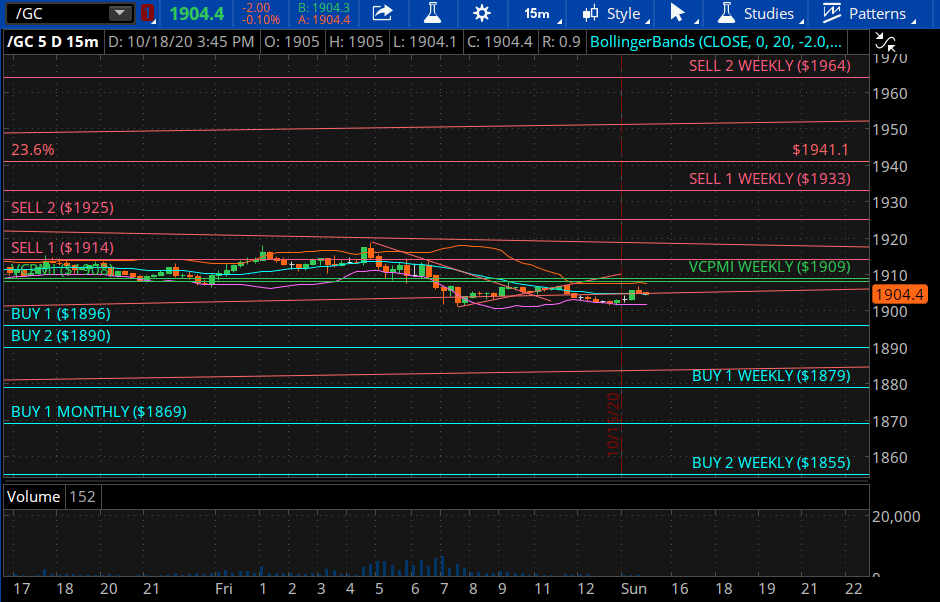

Gold Weekly Report

Summary

- The weekly trend-momentum of 1930 is bearish.

- The weekly VC PMI 1909 is bearish.

- A close above 1909 stop negates this bearishness neutral.

- If short, take profits 1879-1855.

For the weekly Variable Changing Price Momentum Indicator (VC PMI) for gold, we can see that for the first filter, the trend momentum is bearish. The price closing below $1930 confirms that the weekly trend momentum is bearish. The alternate count is that if it closes above $1930, then it would negate the weekly bearish short-term trend to neutral.

The VC PMI weekly level of $1909 is also coming in bearish this week. The market closing below $1909 activates the targets below of the Buy 1 level of $1878 and Buy 2 of $1855. If we get a reversion back above $1909, the weekly price momentum or the second filter, which is the average weekly price, will activate targets of $1933 to $1964. The VC PMI says to take profits on shorts into corrections at the Buy 1 and 2 levels of $1879 and $1855, and to go long on a weekly reversal stop, using the $1855 level as a stop, close only and good until cancel an order to protect your position. If we get back above $1909, it is telling you that the trend momentum is reversed to bullish and the targets of $1933 to $1964 will be activated.

(Chart Courtesy: TDAmeritrade)

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from SA). I have no business relationship ...

more