From Short Squeezes To Silver

Two ounce Canadian silver "Kraken" coins via user u/Geltmascher on the Silverbugs sub-Reddit.

Heavily Shorted Top Names Fared Well

Last week, two heavily-shorted stocks made our daily top ten names list. Both have fared well since. Here, we'll briefly update their performance, and then turn our focus to silver, which was prominently featured on our top ten list on Monday.

Fulgent Genetics Update

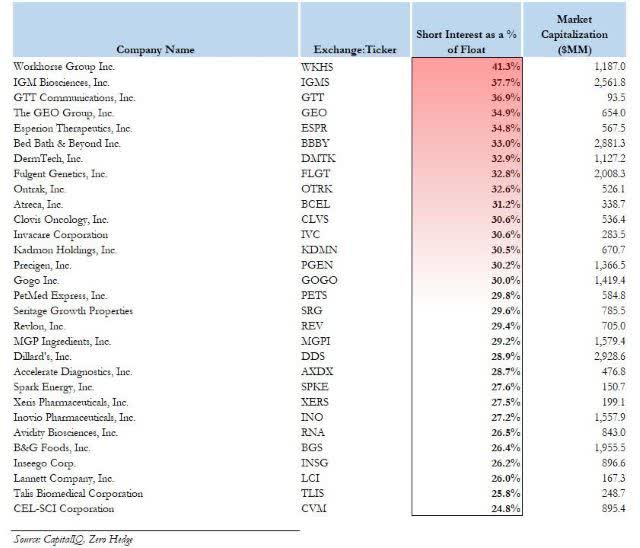

In a post last week (AMC Goes Parabolic), we mentioned that AMC had been one of our top ten names on April 1st and we wrote about looking for the next short squeeze candidate. We included this graphic showing the most heavily shorted stocks as of last Wednesday.

Screen capture via ZeroHedge.

Then we noted,

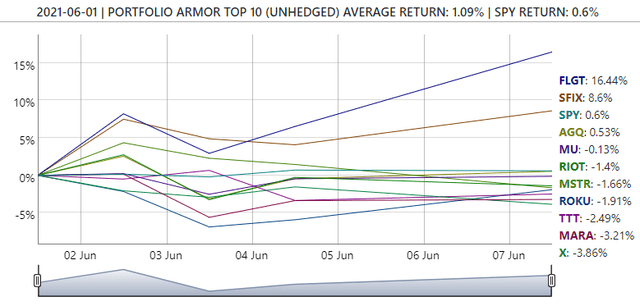

One of those names, Fulgent Genetics, Inc. (FLGT), was one of our site's top names on Tuesday. It's the top performer from Tuesday's top names cohort so far.

Since then, FLGT shares were up 16.44% as of Monday's close.

Screen capture via Portfolio Armor as of 6/7/2021.

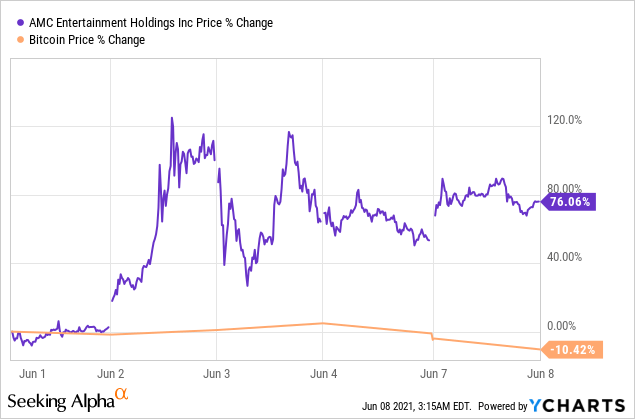

AMC Entertainment Holdings Update

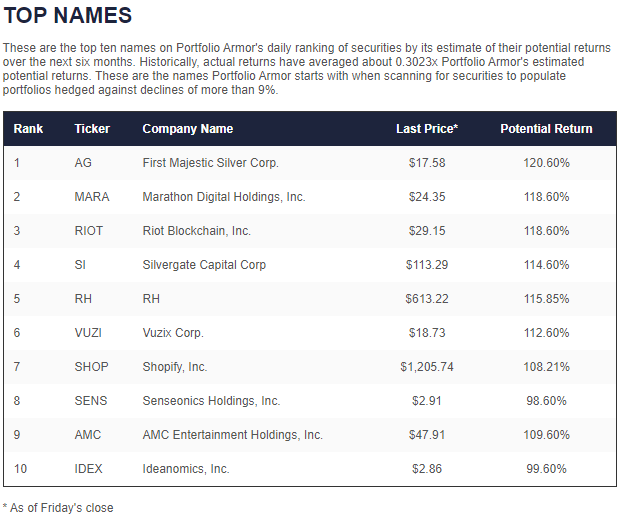

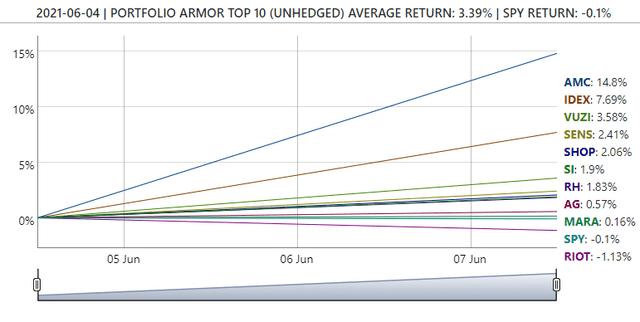

Over the weekend, we expressed our surprise at AMC Entertainment Holdings (AMC) appearing in our top ten again on Friday (AMC: Another Chance To Be Wrong):

I hadn't planned on writing about AMC Entertainment Holdings (AMC) again this weekend, but the stock hit our top ten names again on Friday.

Screen capture via Portfolio Armor on 6/4/2021.

That's the first time AMC has appeared in our top ten since April 1st, when it was trading at $9.36.

On Monday, Robert Sloan of S3 Partners told Bloomberg TV's Matt Miller that AMC was still a prime short squeeze risk.

Screen capture via Bloomberg's Twitter page.

AMC was up 14.8% Monday.

As we've mentioned before, the huge rally in cryptocurrencies earlier this year had sucked some of the speculative fervor out of meme stocks like AMC; Bitcoin languishing over the past week likely contributed to AMC's renaissance.

Shifting To Silver

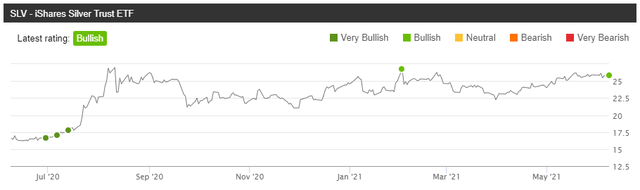

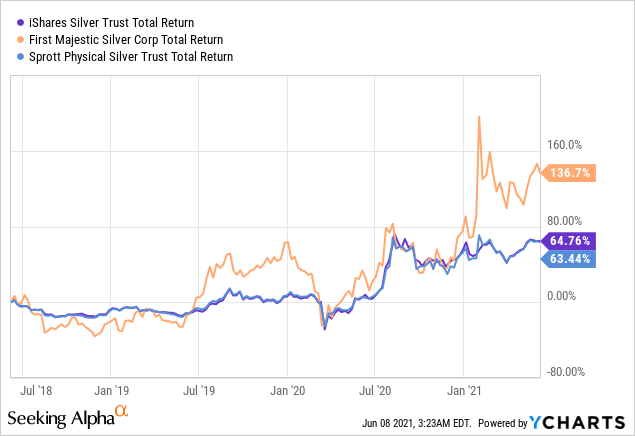

Another one of our top names last Friday was the silver miner First Majestic Silver (AG). On Monday, it was our top name again, along with the iShares Silver Trust (SLV) and another silver ETF. Coincidentally, over the weekend, Stuart Allsop posted his thesis that silver was deeply undervalued, with a bullish call on SLV. He's had a pretty good track record on his calls over the last year, writing a few bullish posts on SLV before its big move last August.

In our view though, the sliver miner AG is a better bet now than silver itself, or the ETF tracking it. With good management, plus inherent operating leverage, a silver miner can outperform the price of silver. We've seen that with First Majestic versus SLV and Sprott Physical Silver (PSLV) over the last few years.

We wouldn't be surprised to see AG outperform SLV over the next six months as well.

In Case We're Wrong About AG

In case we're wrong about First Majestic, here are a couple of ways to hedge it.

Uncapped Upside, High Cost

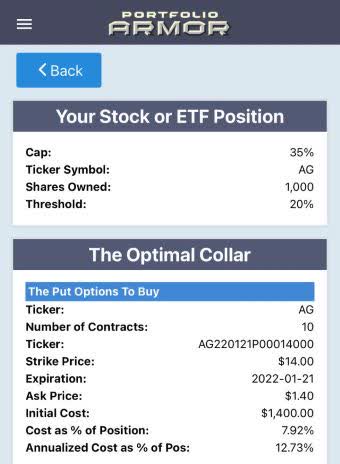

These were the optimal puts to hedge 1,000 shares of AG against a greater-than-20% drop by January 21st.

This and subsequent screen captures are via the Portfolio Armor iOS app.

As you can see there, AG was a pretty price to hedge with puts: the cost of that protection was 16.06% of position value. To be conservative, that was calculated at the ask, so your actual cost would have likely been a little lower. Still, quite steep.

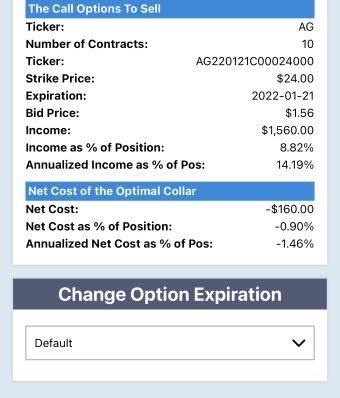

Capped Upside, Negative Cost

If you were willing to cap your possible upside at 35%, this was the optimal collar to protect against a >20% drop in 1,000 shares of AG over the same time frame.

This time, the net cost was negative, meaning you would have collected a net credit of $160, or 0.9% position value, assuming, to be conservative again, that you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more