EUR/USD: It Takes Time To Chop Down A Tree

There are many important indicators strongly suggesting that the EUR/USD should be lower, but despite that, the currency pair is stubborn. What’s happening?

Germany, France, and now Spain have all lowered their growth estimates. Europe is lagging behind the U.S. in economic performance, printing money like crazy, and Covid-related restrictions are tightening. Still, the EUR/USD won’t budge, and gold is enjoying this delayed action. But the EUR/USD will have to face the music eventually, and when that happens (and it will), gold will no longer be singing in tune (for the medium-term).

Before looking at the EUR/USD, let’s first examine how gold, miners, and the USD Index are faring.

In yesterday’s (Apr. 9) analysis, I put the following in bold:

Please keep in mind that since gold might reverse today, it could rally a bit first – this would not be bullish, but relatively normal.

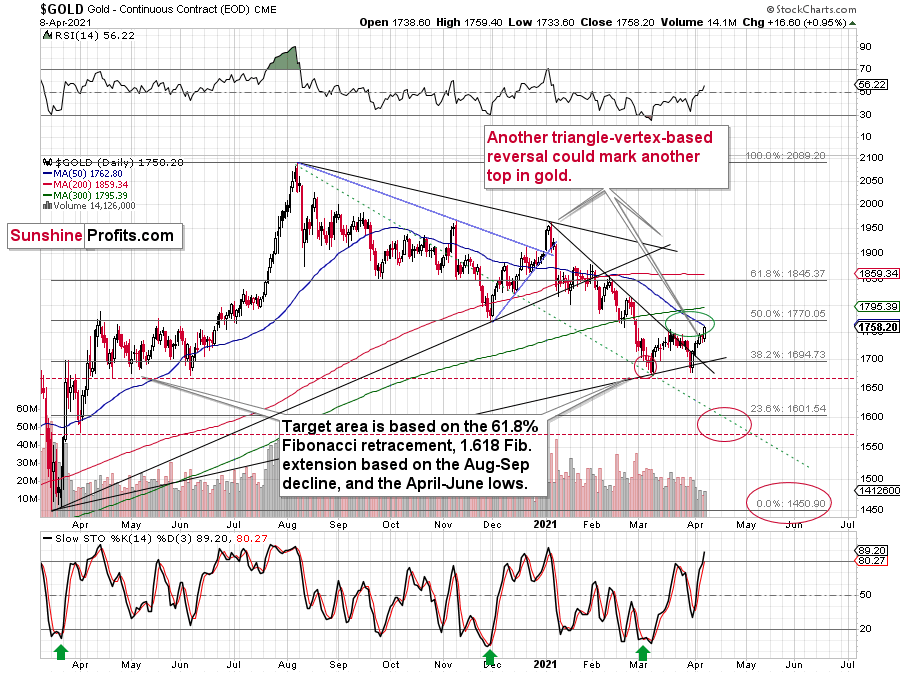

Here’s what happened in gold yesterday:

And here’s what’s happening in today’s pre-market trading:

Simply put, gold rallied yesterday, and it seems to have topped right at its triangle-vertex-based reversal.

Moreover, gold has not only topped at the reversal point, but it also seems to have topped at the line that’s parallel to the line connecting two previous short-term bottoms. This means that the recent monthly rally was a near-perfect zigzag (a.k.a. ABC) correction – the most classic way in which a flag formation can form.

The moves that follow such continuous patterns tend to be similar to the moves that preceded them. In this case, the move that preceded the zigzag pattern was the January – March decline, during which gold fell by more than $150. Repeating this kind of move would mean a decline in gold to about $1,600. This would be in perfect tune with what I wrote previously about gold’s likely interim downside target.

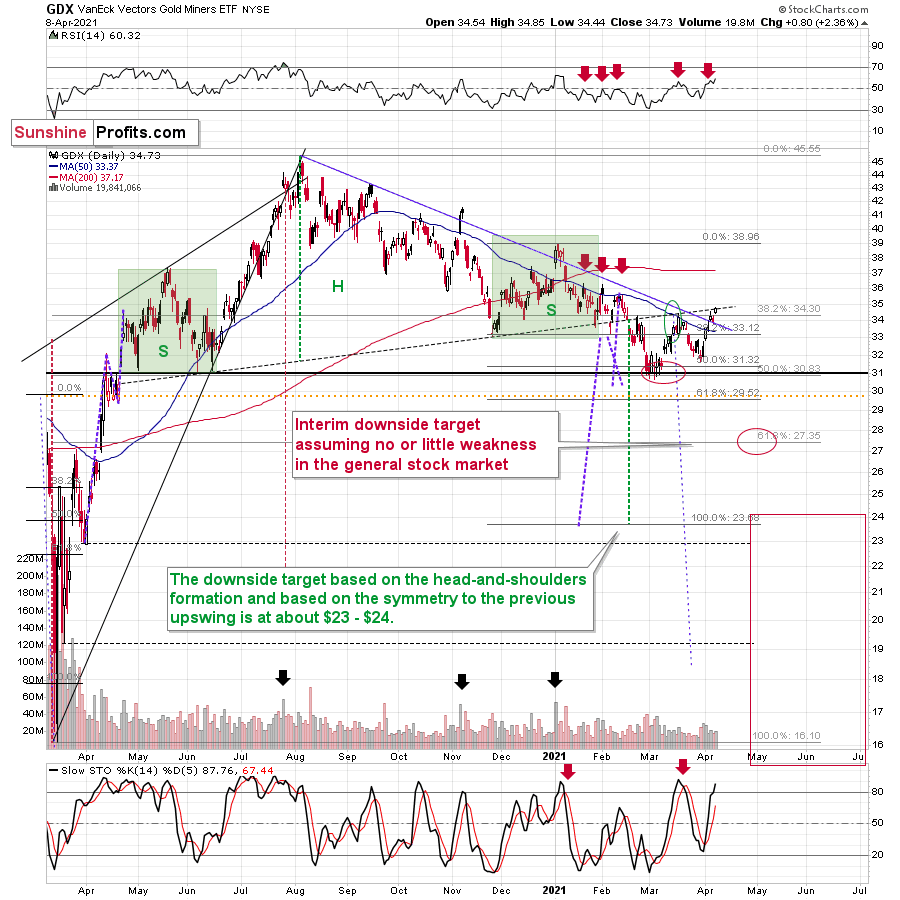

The Miners

What about other gold stocks – did they confirm the top as well?

Yes, although the confirmation wasn’t particularly clear.

The GDX ETF didn’t soar yesterday, but rather moved higher at a moderate pace. It moved visibly above the declining blue resistance line, but it stopped at the neck level of the previously completed broad head-and-shoulders pattern. This is a strong resistance that already worked once (in mid-March), so it’s quite likely that reaching it marked the end of the short-term correction.

USD Index

And the USD Index?

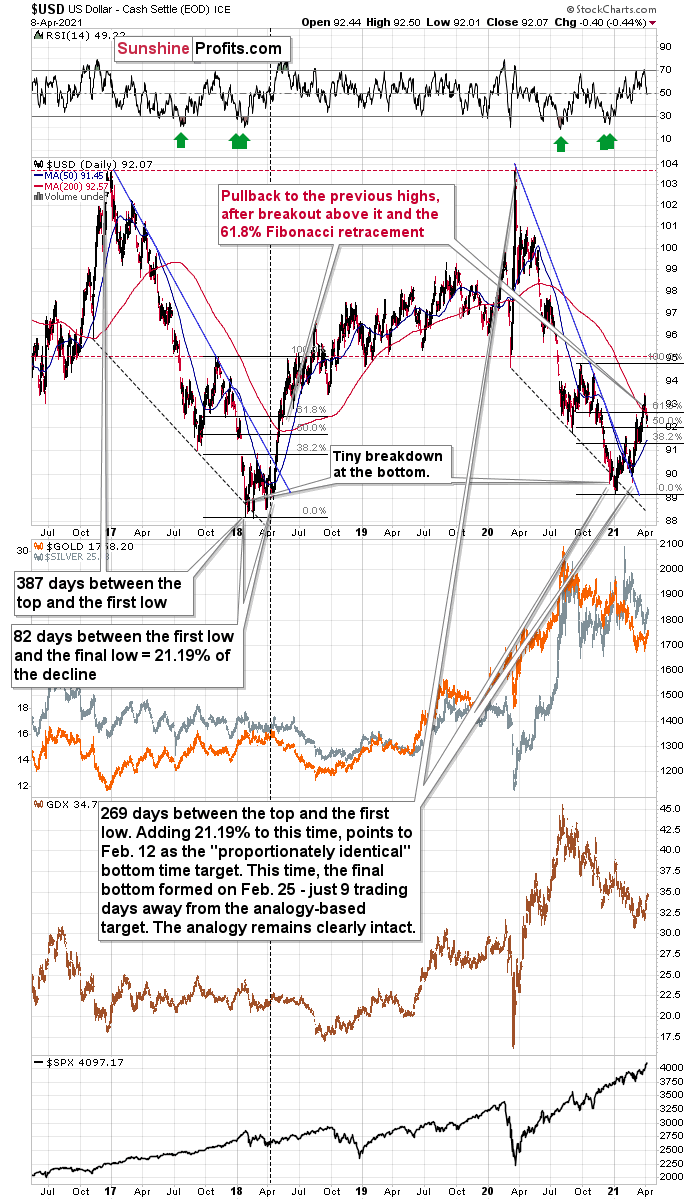

It declined a bit more than seemed likely based on the 1:1 analogy to how much it declined back in 2018, but the deviation from this analogy is not big enough to say that the link is broken – far from it.

I previously wrote the following with regard to the short-term bottoming target for the U.S. currency:

What we saw yesterday definitely qualifies as a small correction. In fact, even if it was doubled it would still be small. And – more importantly – it would be in perfect tune with what happened in 2018 during the big rally.

After rallying visibly above the:

- 93 level

- 200-day moving average

- 61.8% Fibonacci retracement level based on the final part of the decline

the USD Index moved back below the 93 level. This happened in May 2018 and it happened last week.

Since both rallies are so similar, it’s nothing odd that we see a pullback in a similar situation.

Back in 2018, the pullback was small and quick. It ended without the USD Index reaching its 200-day moving average. The pullback ended when the USDX moved approximately to its previous high and slightly below the 61.8% Fibonacci retracement.

Applying this to the current situation (previous high at about 92.5, the 61.8% Fibonacci retracement at about 92.7, and the 200-day moving average at 92.66), it seems that the USD Index would be likely to find its bottom in the 92.3 – 92.7 area.

Yesterday’s close at 92.07 and today’s pre-market move above 92.3 suggest that the bottom might have been formed just a little below the lower border of the above-mentioned target area. Since the history doesn’t necessarily repeat itself to the letter, but it often rhymes, the two situations – the current and the 2018 rallies – continue to be similar and the implications continue to be bullish. This, in turn, is bearish for the precious metals prices – at least in the next several weeks.

All in all, gold and mining stocks seem to have reversed, while the USD Index seems to have bottomed or is quite close to bottoming. As gold and miners decline, the same is likely to be the case with silver.

Having said that, let’s take a look at the market from a more fundamental angle.

The More Things Change, The More They Stay the Same

With gold hitching its carriage to the EUR/USD’s horse, the latter’s recent strength has enabled a smooth ride for the yellow metal. Case in point: since Apr. 1, the two have clearly enjoyed each other’s company.

However, in ironic fashion, three important developments have occurred along the journey.

- Germany (Europe’s largest economy) had its 2021 GDP growth estimate reduced from 3.5% to 3.35%

- France (Europe’s second-largest economy) had its 2021 GDP growth estimate reduced from 6% to 5%.

And the third?

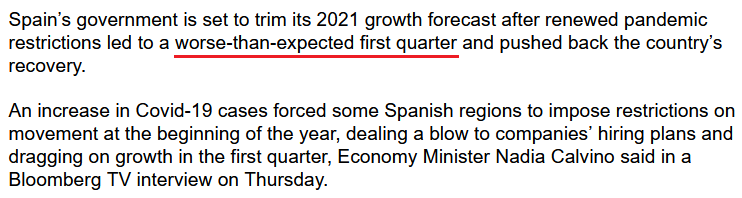

Well, on Apr. 8, Spain’s Economy Minister Nadia Calvino told Bloomberg that Europe’s fourth-largest economy will also reduce its 2021 GDP growth estimate.

Please see below:

Source: Bloomberg

And as the dominoes continue to fall, also on Apr. 8, The Independent Authority for Fiscal Responsibility (AIReF) – an agency that oversees the sustainability of Spain’s public finances – reduced its 2021 GDP growth estimate from 8.2% to 6.6%.

Source: AIReF

But hey, who cares about GDP growth, right?

If that wasn’t enough, Klaas Knot, a member of the European Central Bank (ECB) Governing Council, told CNBC on Apr. 8 that “we don’t want the run-up in bond yields to prematurely tighten our financing conditions.”

Translation? Last week’s €343 billion expansion of the ECB’s balance sheet – the largest since June 2020 – was likely not a one-off event. Why so? Because Knot hinted at this himself.

Please see below:

Source: CNBC

And why all of the concern?

Well, because the Eurozone economy remains on ice. Case in point: a German constitutional court recently blocked the EU’s €750 billion recovery plan (Europe’s version of COVID-19 fiscal stimulus). And because the plan requires full support, The European Commission can’t raise the funds unless all EU member states agree. And with only 22 of the 27 EU nations on board, it could be months until the funds reach the real economy (if ever).

But in the meantime, French Finance Minister Bruno Le Maire told Bloomberg on Apr. 7 that the recovery plan is “not on the right track” and that he’s “deeply concerned.”

“We are in April 2021, and once again I have not seen any single penny,” he said.

And why is Le Maire so concerned?

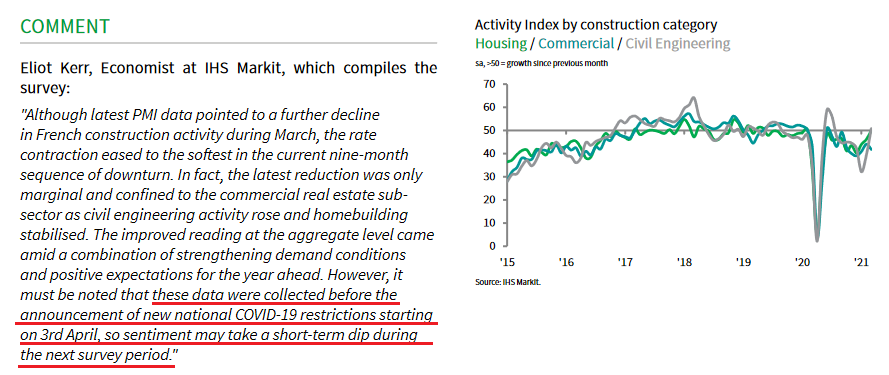

Because his country is in lockdown as Europe struggles to control the coronavirus pandemic. Take a look at IHS Markit’s France Construction PMI (released on Apr. 8): in what passes for good news these days, “a further decline in French construction activity” gave way to “positive expectations” because the contraction was the softest in nine months.

However, notice the caveat at the end of Eliot Kerr’s comments?

That’s right: before the recent lockdown.

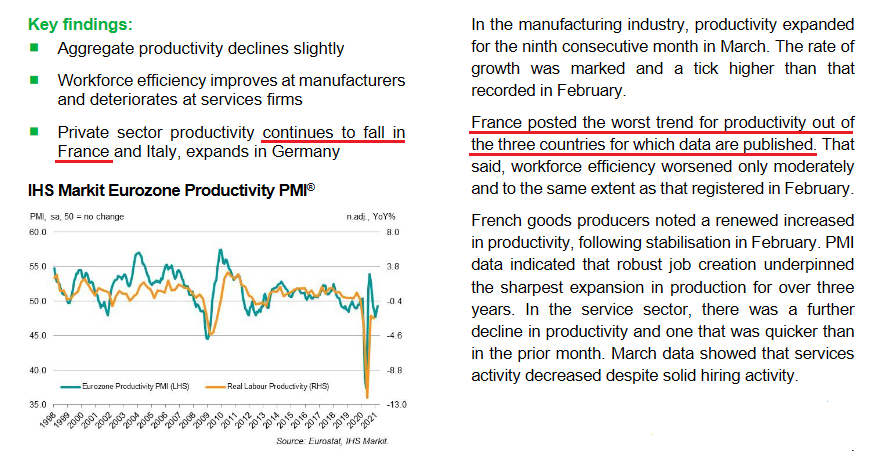

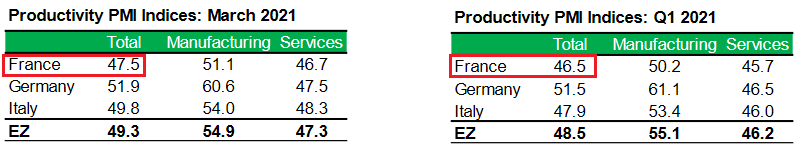

Moreover, IHS Markit’s Eurozone Productivity PMI (also released on Apr. 8) showed that efficiency remains sluggish in France.

Please see below:

Furthermore, despite improving moderately in March, France is easily the worst performer of the major Eurozone economies.

Source: IHS Markit

For context, PMI (Purchasing Managers’ Index) data is compiled through a monthly survey of executives within industries that are integral to regional economic performance. A PMI above 50 indicates business conditions are expanding, while a PMI below 50 indicates that business conditions are contracting.

Keep in mind though: since the data was weak before France went into lockdown, the virus surge will likely quash any and all momentum.

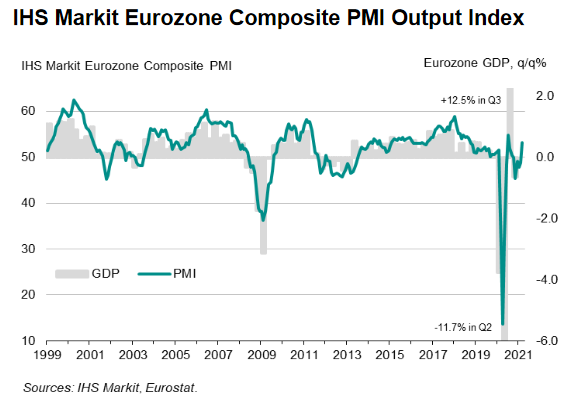

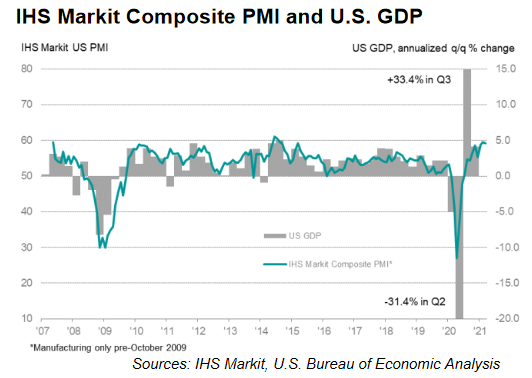

Furthermore, while IHS Markit’s Eurozone Composite PMI (released on Apr. 7) hit 53.2 (service sector still in contraction at 49.6), overall Eurozone activity still lags behind the U.S.

As an apples-to-apples comparison, IHS Markit’s U.S. Composite PMI (released on Mar. 24), stood at 59.1, while service sector activity jumped to 60.0.

Please see below:

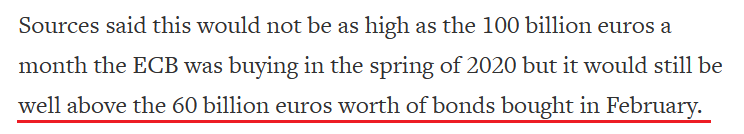

And with fiscal stimulus left to the German courts and the fundamental risks rising, as mentioned, the ECB will be forced to pick up the slack. If you analyze the chart below, you can see that the ECB’s monthly PEPP purchases in March were the highest since November. And because currencies trade on a relative basis, relative outprinting by the ECB is fundamentally bearish for the EUR/USD.

To that point, Reuters hinted that the ECB has no plans of slowing down.

Source: Reuters

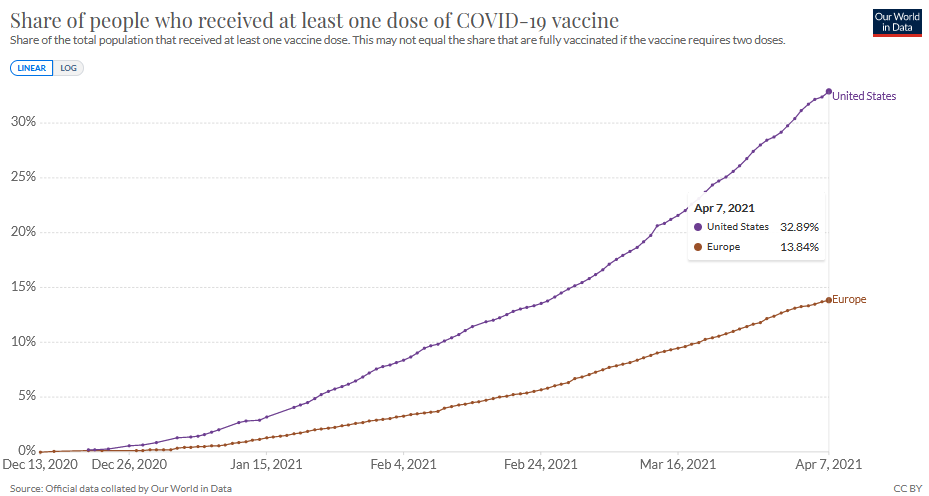

Adding to the list of laggards, Europe has made little progress in its vaccine rollout. On Mar. 31, the U.S.-Eurozone spread between the share of people who have received at least one dose of a COVID-19 vaccine was 16.53%. However, on Apr. 7, the spread increased to 19.05%.

So let’s review:

Relative to the United States:

- The economic outlook is worse in Europe

- The money printer is working overtime in Europe

- The virus spread is worse in Europe

- The vaccine rollout is much slower in Europe

Thus, should the above developments coincide with a stronger euro?

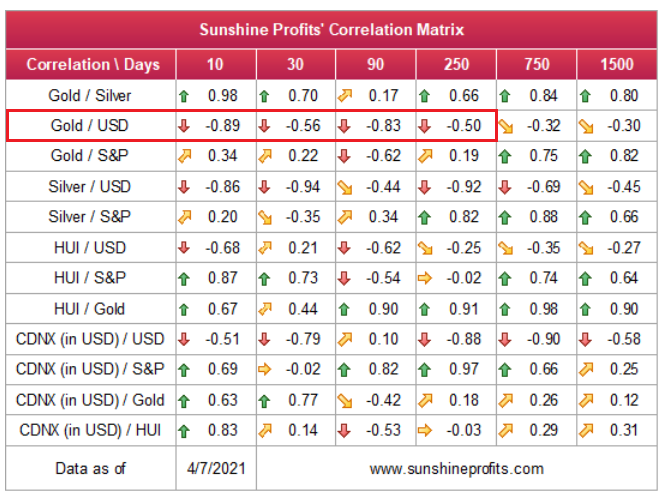

Either way, once the EUR/USD decides to reflect these realities, a move lower will propel the USD Index higher. And because gold has a strong negative correlation with the U.S. dollar, the falling dominoes are profoundly bearish for the yellow metal.

And seemingly front-running the action, gold’s strongest supporters have now become its largest detractors. Case in point: gold-backed ETFs have suffered massive outflows in recent months, with total assets declining to their lowest level since May 2020.

Please see below:

To explain, the yellow line above tracks the gold price, while the white line above tracks the total assets of gold-backed ETFs. For context, gold-backed ETF holdings have declined in four of the last five months and the only comparable example is the massive drawdown that we witnessed in 2012-2013. More importantly though, if you analyze the middle of the chart, you can see that even as gold rallied on Apr. 8, gold-backed ETFs still suffered outflows, with total holdings declining by 0.01%.

In conclusion, up is down, down is up and the EUR/USD continues to follow in equities’ footsteps. Thus, for now, despite the myriad of fundamental indicators supporting a lower EUR/USD, the currency pair wants what it wants. However, after displaying this same behavior in December 2020, before rolling over, fundamentals are akin to chopping down a tree with an axe: it takes several swings to bring down the evergreen. And because gold’s recent strength is likely to fade with the EUR/USD, the medium-term weather forecast still signals cloudy skies ahead.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more