Energy Stocks Jump After Goldman Hikes Oil Price Target To $65; MS Overweights Exxon

In a day when tech stocks are hurting, with both the S&P and DJIA red on the day (if having recovered much of their early losses), it is energy names that are outperforming on Monday, with Exxon XOM surging over 3% above $47, the highest price since June, thanks to strength in oil and an upgrade from Morgan Stanley (see below) which just upgraded the company to Overweight, making it a top pick over Chevron CVX.

(Click on image to enlarge)

A reason for the rise in energy names is the continued strength in oil, with Brent trading as high as $56.39...

(Click on image to enlarge)

... which in turn is up on the back of a report published by Goldman's chief commodity strategist Jeffrey Currie who writes that "the events of last week substantially reduced the downside risks to our bullish commodity narrative — a fact reflected in the rise in oil and copper alongside the sharp decline in gold."

First, Saudi Arabia agreed to a unilateral production cut that neutralized current lockdown risks but more importantly set the stage for a tighter market as the vaccine roll-out accelerates this spring.

Second, the Democrats’ win in Georgia tipped US politics toward Redistributional and Environmental policies which are central in to our REV (Redistributional, Environmental and Versatility) policy-driven structural rise in commodity demand thesis.

Third, EM governments around the world are looking to ensure the Versatility in their commodity supply chains - particularly in agriculture. Their efforts to secure domestic supplies have exacerbated the fundamental tightness in grains, with Argentina banning corn exports, Russia putting an export tax on wheat, and China emphasizing the requirement for strategic stockpiles of grains and pork in its latest 5-year plan.

These three drivers have helped propel commodities up 24% since November, and "while the recent rally reinforces our October call for a structural bull market, we believe the Democratic sweep and Saudi production cut have left commodity markets with a tighter medium-term outlook, leading us to raise our 3/6/12 month forecast for the S&P GSCI ER to 200/207/208 from 183/189/205, generating commodity returns of 6%/9%/10%, as we pull forward forecasted oil market tightness, raise metals demand forecasts and incorporate lower agriculture yields" according to Goldman which adds that "given the magnitude of the recent rally, however, markets are likely to consolidate near-term."

In addition to being bullish on commodity stocks, Goldman has also hiked its oil forecast, and on the back of the abovementioned market "tightness" Goldman now expects Brent prices to reach $65/bbl this summer as opposed to year-end, here's why:

With vaccines being rolled out across the world, the likelihood of a fast tightening market from 2Q21 is rising as the rebound in demand stresses the ability of producers to restart production. While higher prices pose the risk of a shale response - as WTI spot prices are now at $50/bbl allowing for higher activity and positive free cash flows — we see this response remaining muted in the first instance, as higher capital costs and producer discipline curtail the US E&P’s reaction function. Moreover, OPEC+ March production level will still be near the recent lows just as global demand starts rebounding sharply driven by warmer weather and rising vaccinations.

As Goldman concludes, this suggests that the traditional bogeyman of higher oil prices - shale production - won't be a factor immediately as it "struggles to ramp-up output quickly enough, with our balance currently reflecting a 1.3 mb/d deficit in April-July despite OPEC+ increasing production by 4 mb/d, a historically tall order."

In summary, Goldman recommends a long Dec-21 Brent trade (currently trading at $53/bbl vs. our $65/bbl forecast) and expect sustained backwardation and lower implied volatility.

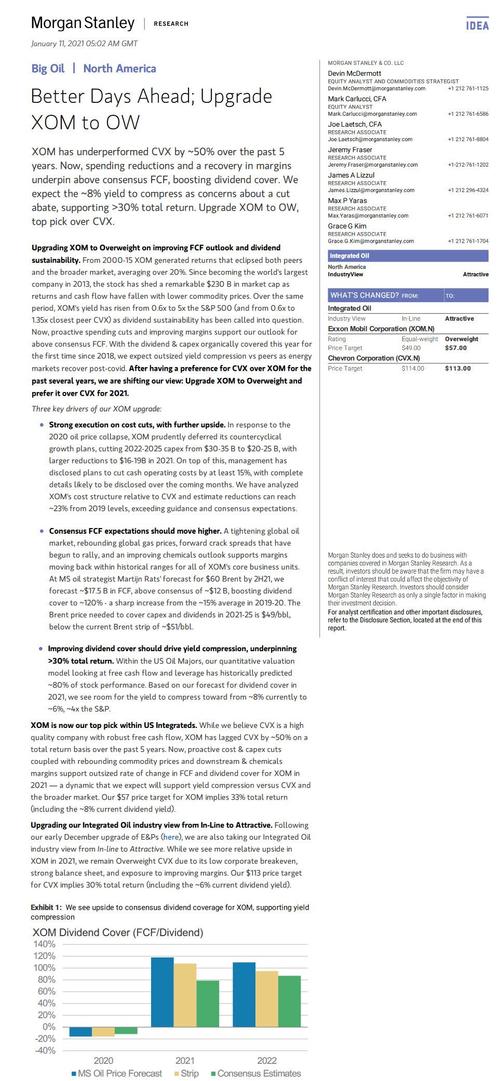

Finally, it is also worth noting that Exxon is also surging on the back of an upgrade from Morgan Stanley (which follows a similar upgrade from Goldman) to Overweight, making it the bank's top pick over Chevron:

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more