DUST: Gold Is Sensitive To Disappointment From The Fed

An increasingly dovish Fed has raised the probabilities of rate cuts ahead, which has weakened US Dollar. There is perceived to be a negative correlation between the USD and gold prices, as a weaker dollar makes dollar-denominated assets (such as gold) cheaper to buy internationally. Consequently, the weakening USD has allowed gold prices to rally lately. Higher gold prices, in turn, favor gold miners whose revenues are highly dependent on the precious metal’s price. Hence expectations of looser monetary policy conditions ahead has allowed the stock prices of gold miners to rally, which is unfavorable for the Direxion Daily Gold Miners Index Bear 3X Shares ETF (DUST), as it shorts gold miners (x3). The ETF is down -51.13% YTD. Nevertheless, the market’s expectations of the extent to which the Fed will ease monetary policy this year may have gone too far, and thus prices of asset classes such as gold may have become increasingly sensitive to disappointment from the Fed in the form of less dovish actions/ communication, which could result in short-term upward movements in the DUST ETF. Though the negative correlation between the US Dollar and gold may not be strong enough to support the case for shorting gold miners.

Prospectus Review

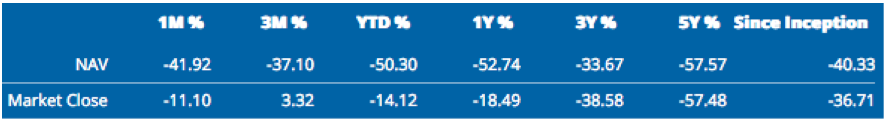

Before we assess the impact of the Fed on the DUST ETF, we must first evaluate the fund. The ETF aims to offer triple the inverse return on the NYSE Arca Gold Miners Index, in other words, it shorts (x3) its aforementioned underlying index. In order to deliver leverage (x3), the fund’s strategy incorporates the use of derivative products such as Swaps and Futures contracts. The use of such derivatives magnifies the fund’s risks as they incur greater volatility and liquidity risks. Below one can find the historical discrepancies between changes in the fund’s NAV and market price.

Source: iShares

It is interesting to note that the discrepancies in performance are actually in the investor’s favor.

Furthermore, it is extremely essential for anyone seeking to gain exposure to Gold miners through this leveraged ETF to understand the effects of compounding. Note that the fund’s objective is to deliver inverse (x3) the fund’s objective on a daily basis (no longer than a trading day). Over time, the daily returns will be compounded on top of the closing price of each previous trading day, resulting in the fund’s returns deviating away from the inverse (x3) objective over longer periods of time. However, this compounding actually works in the investor’s favor, in both directions. Having calculated the math behind it, the leverage ratio is greater than x3 when the underlying index is moving in a favorable direction for the investor. Conversely, the ratio is less than x3 when the underlying benchmark index is moving against the investor. Furthermore, the exact ratios in both directions depend on the holding period, whereby the longer the holding periods, the more favorable the ratio in both directions (i.e. greater during upside, lower during downside). Therefore, if investors are able to accurately gauge when the DUST ETF will witness a bullish uptrend due to favorable movements in the underlying index, they could end up generating a return even greater than the fund’s objective of ‘x3’. Conversely, if the investment does not work out in the investor’s favor, they will lose less than the fund’s stated objective of ‘x3’. Hence, the fund’s leverage compounding effect offers more upside potential than downside risk.

Market expectations of rate cuts

Slowing economic conditions have encouraged market participants to bet that the Fed will cut the federal funds rate in their upcoming meeting on Jul.31, 2019. Yes, given that Powell has stated that the Fed will “act as appropriate to sustain the expansion” does give reason to believe the Fed will cut rates this year. However, the belief that the Fed will cut rates three or four times this year is a stretch. In fact, in the press conference following the June FOMC meeting, Powell claimed that he did not see any risk of waiting too long before cutting rates, implying that the Fed does not feel inclined to cut rates as soon as possible to avoid worsening economic conditions. Furthermore, he also explained how the Fed prefers to assess the 3-month and 6-month averages for jobs growth, and thus one or two weak jobs reports is unlikely to persuade the Fed to begin easing aggressively through multiple rate cuts.

Though there is a good reason to anticipate the Fed cutting rates soon, either in July or the following meetings, given the number of Fed members that expressed willingness to cut rates following the June meeting. Though once the Fed cuts rates, they are unlikely to signal to markets the will cut more times later on in the year. The Fed will likely want to save its bullets (rate cuts and other monetary policy tools) for when the economy really needs it. Hence in order to avoid disappointing markets later on in the year, it would be rational to expect the Fed to adjust its communication style to tame market’s expectations of rate cuts. Hence, the Fed is likely to portray a ‘wait and see’ approach after the first-rate cut. Given that asset classes such as equities and gold have already priced in multiple rate cuts, this could make them vulnerable to ‘less dovish’ communication from the Fed.

Disappointment from the Fed would strengthen the US Dollar and hence cause the inversely correlated gold price to decline, which would allow the bearish DUST ETF to rally higher. Furthermore, if the Fed fails to meet the markets’ dovish expectations at the same time as other global central banks begin aggressive easing to accommodate their domestic economies, the greenback will then inevitably strengthen even more against global currencies, further pressuring gold prices lower, benefiting DUST ETF investors.

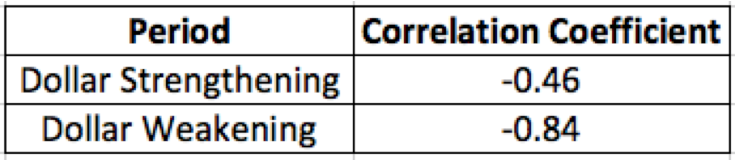

To gain a deeper understanding of the correlation between the US Dollar and Gold prices, the correlation coefficients between the two asset classes have been calculated for two separate time periods, the most recent period during which the Dollar was strengthening since beginning 2018, and the period during which the dollar has been weakening since April 2019. The US Dollar/USDX-Index-Cash (DX-Y.NYB) will be used as a proxy for the price of the US Dollar, and the Gold Bullion price will be sourced from the Federal Reserve Economic Data (FRED). The exact time periods used to represent the Dollar strengthening period will be from Feb. 27, 2018 (marking the first time Powell testified before Congress and issued hawkish statements) through Apr. 25, 2019 (marking the most recent peak of the Dollar). Consequently, the Dollar weakening period will be reflected by the time period from Apr. 25, 2019 till now. The results can be found in the table below.

Note: the differences in length of both time periods used could also affect the correlation coefficients.

During periods of dollar strengthening, the negative correlation between Dollar and gold was much weaker, at -0.46, implying that even when the dollar was strengthening, there were still days that gold was able to rise. This makes sense given that Fed’s persistent hawkishness in the second half of last year, coupled with the ongoing trade war, was raising economic uncertainty, pushing gold prices higher even amid a strengthening Dollar.

On the other hand, the correlation between the USD and gold is much stronger during periods of Dollar weakening. This also makes sense given that the reasoning behind the Fed having to turn dovish (which weakens the USD) is due to rising economic uncertainty, which is also supportive for gold. The main reasons cited by the Fed for needing to adopt a more dovish approach include a slowing economy (plus outlook uncertainty) and rising trade tensions, which on their own are already supportive for gold, regardless of whether the Fed turns dovish/ weakens the USD or not. Hence the simultaneous combination of rising economic uncertainty and expectations of looser monetary policy conditions explains the strong negative correlation between a weakening Dollar and gold prices.

Thus, from our correlation findings, we can infer that if the Fed indeed were to disappointment markets by not being as dovish as anticipated, then the resulting strengthening Dollar against global currencies may not necessarily induce strong sell-offs in gold. The negative correlation is likely to remain weak, the rationale behind this being that the economic outlook could worsen amid a Fed refusing to appease to market’s dovish expectations, and coupled with ongoing trade tensions, this could further raise economic uncertainty, supporting gold prices higher even amid a strengthening US Dollar. As a result, even though disappointment from the Fed could put some downward pressure on gold, the likely weak negative correlation between the two asset classes undermines the case to take bearish positions on gold miners through the DUST ETF. Moreover, the domestic economic slowdown is not likely to fade away any time soon, given a simultaneously weakening global economy, ongoing trade tensions, and worrisome signals from the bond market. Therefore, even if the Fed does not turn as dovish as anticipated in the near-term, the central bank will eventually need to engage in more effective monetary policy easing to support the economy, which will weaken the USD and support gold prices higher. Hence, this further undermines the case for risking bearish positions on gold miners through the DUST ETF.

Bottom Line

Markets’ expectations regarding the level of easing from the Fed are currently elevated, which sets investors up for potential disappointment. This could potentially induce a short-term pullback in gold prices, consequently supporting the bearish DUST ETF higher. However, the negative correlation between the US Dollar and gold prices has been weak (-0.46) for the most recent period of Dollar strengthening, and thus undermines the rationale behind shorting gold miners through the DUST ETF. Furthermore, even if the Fed fails to meet markets’ dovish expectations over the coming months, over the longer-term they will inevitably need to ease monetary policy conditions more effectively to accommodate the weakening economy, which will weaken the USD and support gold prices higher, consequently pushing the DUST ETF lower. Therefore, while the DUST ETF could witness some short-term support from Fed disappointment, over the longer-term it could face downward pressure amid a persistently slowing economy. A more ideal time to take bearish positions on gold miners would be when the Fed begins another rate-hiking cycle amid an improving economy at some point in the future.

Note that while this article is mainly focused on the impact of the US Dollar on gold prices/miners through central bank policies, other factors such as supply/demand dynamics also affect gold prices, and investors should incorporate such attributes into investment decisions as well.