Don’t Go Bottom Fishing For These 4 Cheap Stocks

Many people may have already bought into these cheap stocks trading at ultra-low valuations hoping to catch a bounce, but these four stocks are not done falling yet. If you own any of these stocks you must sell now.

Crude oil recently traded below $30 a barrel and now the prospects of it hitting $20 a barrel is becoming increasingly likely. Demand from emerging markets is slowing as their economies falter and the US Energy Information Administration has cut its forecast for oil, saying the oil market would be out of balance until at least 2017.

Whether you want to admit it or not, you must at least consider the possibility of oil hitting $20 a barrel this year. And with the threat of oil hitting $20 a barrel, there are few places to hide out in the energy space. In the least, there’s a handful of stocks that you should be dumping today.

Think about this – Saudi Aramco, the government-owned Saudi oil company, is considering an IPO. Why is that? One explanation is that they are looking to get what they can before oil heads lower.

A listing of Saudi Aramco, which could be worth 20 times ExxonMobil (NYSE: XOM), comes as the Saudis are looking to profit while they can – before oil hits $20 a barrel. And the cries for $20 oil are getting louder. Goldman Sachs thinks there’s a 50% chance oil hits $20 given the fact that storage capacity is in rapid decline. Meaning more oil to hit the market with no place to store it.

Morgan Stanley thinks that oil will drop down to $20 given the fact that 2016 could be a strong year for the dollar. They expect a 10% to 25% fall in oil prices if the U.S. dollar gains 5%.

$20 oil brings with it a whole new barrel of problems, including putting pressure on companies with hefty debt loads and making it even harder for them to pay down debts. Then there’s the issue of seemingly solid companies not being able to raise new capital to continue funding operations.

With all that in mind, here are the top four oil stocks to sell today:

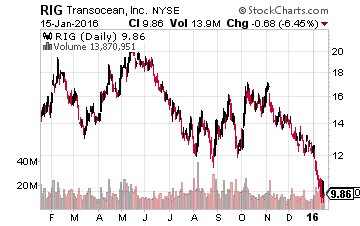

Oil Stock to Sell Today No. 1: Transocean (NYSE: RIG)

Transocean, the offshore oil driller, is already down 35% over the last year, but it won’t be spared if oil goes lower. In fact, the offshore drilling space will likely be hit the hardest.

The market for offshore drilling rigs is still oversupplied and Transocean has said as much. They have taken rigs down, but they can only do so much, so fast. And in the case that oil does rebound quickly, they’re disadvantaged, because cold staking means rigs are off the market for years.

The offshore rig market will see profitability challenges for years as existing rig contracts expire without renewals and the new contracts coming in are at lower prices. The rise of fracking and efficiency of onshore oil drilling means that offshore drilling likely won’t recover to past levels anytime soon.

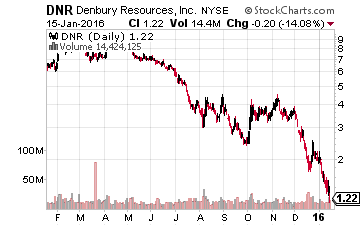

Oil Stock To Sell Today No. 2: Denbury Resources (NYSE: DNR)

Denbury is an explorer and producer of oil and gas. The thing working against this company is that it’s running out of CO2 reserves, which it will have to replace with more expensive man-made suppliers.

The other issue with Denbury is that it’s a long-lead business, where many of its projects are front-loaded – requiring several years of cash outflows before seeing any production. There are a lot of things working against this company.

With a hefty debt load and no earnings, $20 oil means a lot more pain for Denbury, which is already down 80% over the last year.

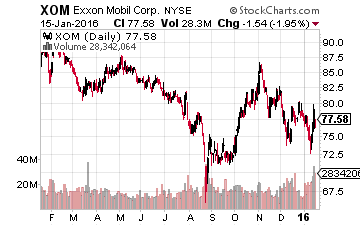

Oil Stock To Sell Today No. 3: ExxonMobil (NYSE: XOM)

ExxonMobil needs no introduction as one of the biggest companies in the world. However, it’s grossly disadvantaged when it comes to finding new reserves. This has left it more reliant on higher cost projects.

And with $20 oil, Exxon would have to consider increasing its debt in order to keep growing its dividend and buying back shares. Trading at 21 times next year’s earnings, Exxon is also still very expensive for a company that could be facing $20 oil.

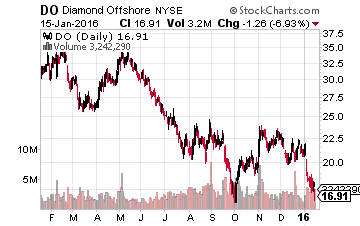

Oil Stock To Sell Today No. 4: Diamond Offshore Drilling (NYSE: DO)

Continuing with the theme that offshore drillers are in store for a lot more pain, there’s also Diamond Offshore Drilling. This company is trading at 35 times earnings and down 40% over the last year.

The big thing working against Diamond Offshore is it has the industry’s oldest fleets. Meaning its maintenance expenditures are higher. $20 oil will likely mean a cut to its dividend. It’s already paying out almost all its earnings via dividends.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more