Demand For Gold Is Expected To Grow Exponentially In 2021

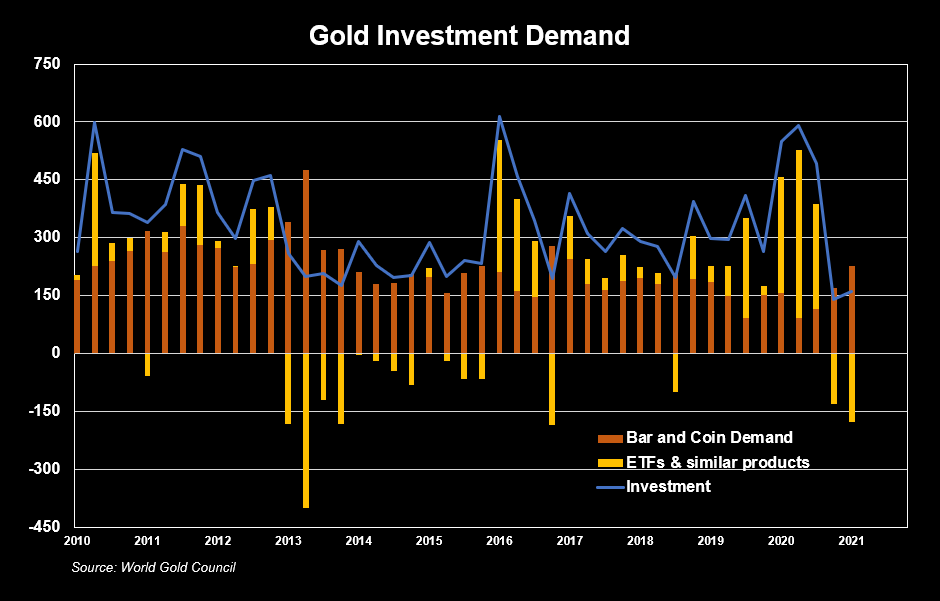

The difference between physical gold investing and ETF investing was stark in the first quarter 2021 according to the World Gold Council’s Gold Demand Trends data released last week.

Before focusing in on investment demand below a few notes on overall gold demand in the first quarter.

Total gold demand in the first quarter of 2021 was down 4%. However, because gold production and gold demand (jewellery, bar and coin etc.) are decentralized around the globe, and no one ever has a complete picture of all transactions. So the WGC adds up all the known supply and demand. If measured demand does not exactly match measured supply, then there is an X factor added to demand, because in the end demand should always equal supply. In the first quarter this balancing X factor increased by a whopping 247% over the first quarter 2020.

Gold jewellery demand increased 52%, technology demand (electronics, dental, other industrial) increased by 11%. Central bank demand decreased by 23% and investment demand decreased by 71%.

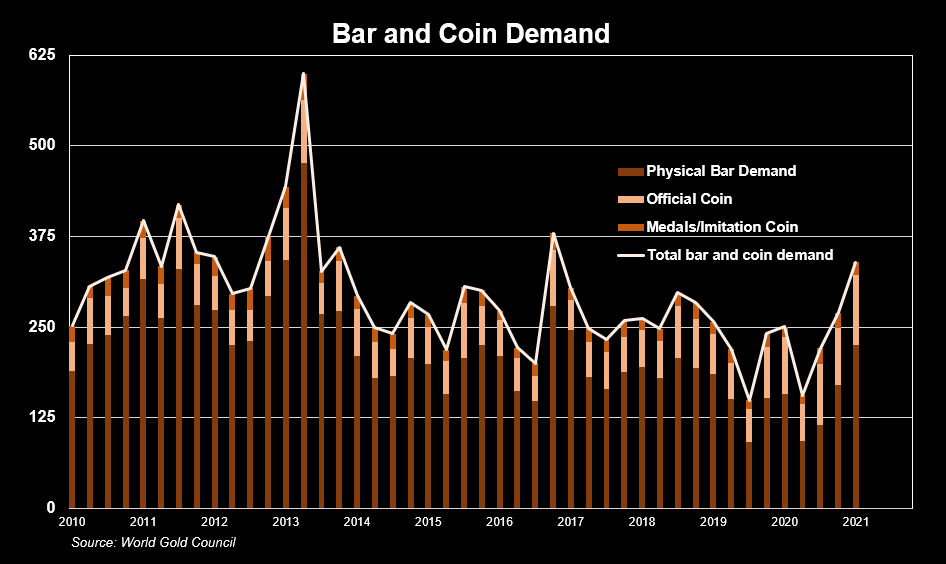

Taking a closer look at investment demand – physical gold demand (Total bar and coin demand) increased to 339.5 tonnes, while ETF sector had selling of 178 tonnes. The World Gold Council notes that both the total investment in bar and coins and ETF selling are the highest since 2016. So physical is hot while ETF is not.

An Alternative to Fiat Currencies?

Investment sentiment in exchange traded products faded on a rising US dollar, interest rates, and bitcoin. Analysis shows approximately 4.3% of the 10.4% decline in the gold price in the first quarter. This was due to rising US real interest rates, another 3.6% due to the rising US dollar, and 2.5% was due to the rise in bitcoin.

The negative correlation between gold and the US dollar and real interest rates is widely discussed among analysts. But the relationship between bitcoin and gold is now being closely analysed. As many investors have said that they see bitcoin and gold both as alternatives to fiat currencies. The gold price reached a new all-time high in August 2020. After which the sentiment started to change towards other asset classes, namely cryptocurrencies.

Retail demand in bar and coins on the other hand saw sharp increases in the fourth quarter of 2020 and the first quarter of this year. The World Gold Council notes: A third successive quarter of growth in bar and coin investment saw it reach 339.5t – the highest since Q4 2016. The Q1 total was 36% higher y-o-y and 37% above the five-year quarterly average of 248.5t … Fear over rising inflationary pressures was an added driver. As economies around the world responded to the massive fiscal and monetary stimulus introduced to combat the worst impacts of the pandemic. All three sub-categories of bar and coin demand saw strong y-o-y improvement.

The last time there was this same stark contrast between gold ETF investment demand and gold physical demand was 2016 when the Fed started raising interest rates after 7-years.

The difference between then and now is that although inflation expectations are rising. Fed Chair Powell stated in his press conference last week that it is not even time to start thinking about even starting to talk about tapering its US$120 billion a month in asset purchases. The Fed has stated that it will start to taper its asset purchases before raising rates. Unlike in 2016, the Fed is not going to raise interest rates on inflation expectations this time. But instead, the Fed is going to wait until data shows that permanently sustainable inflation near the 2% target has taken hold.

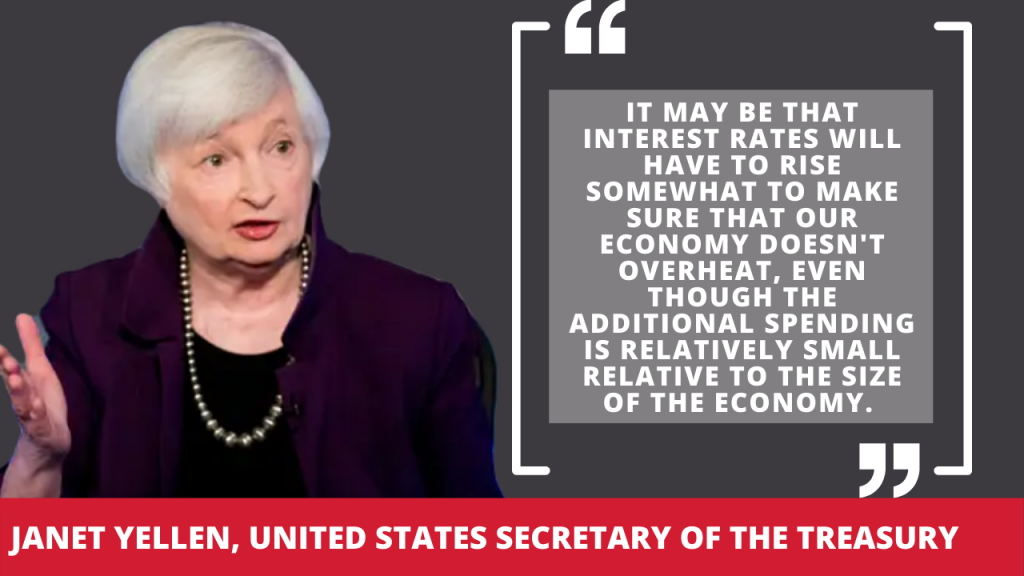

Markets declined on Tuesday after US Treasury Secretary Janet Yellen stated a different view in a webinar Tuesday:

However, later in the day Yellen scrambled to clarify that she isn’t predicting rates to increase because of the Biden Administration proposed US $6 trillion in additional spending in its first 100 days!

Disclosure: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation ...

more