December USDA Report - Limited Stock Changes Ahead US/China Deadline & January Final Data

Market Analysis

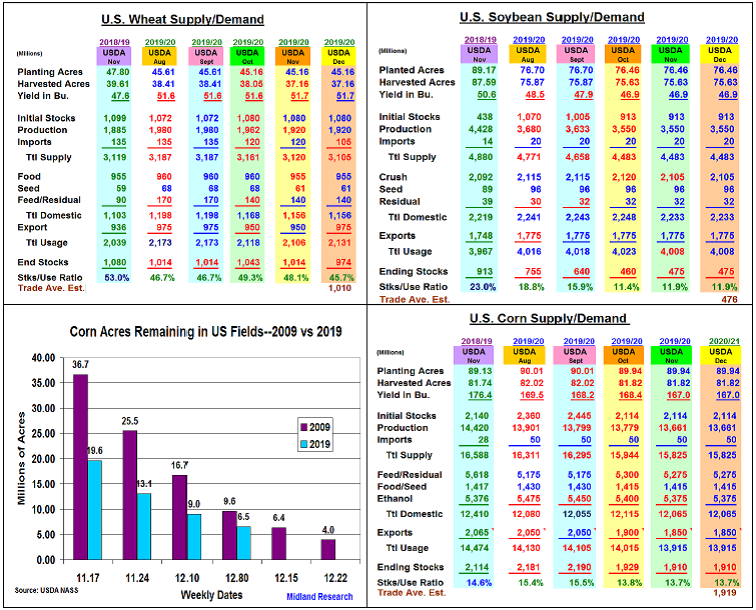

The USDA followed its more traditional approach in its December US supply/demand updates. As expected, the World Board left its US corn & soybean balance sheets unchanged ahead of the upcoming US December 15 tariff deadline and January’s final US production numbers. This wasn’t the case for wheat’s balance sheet. The USDA upped 2019/20’s exports & lowered imports. This update likely leaves the focus on the trade talks going forward.

In wheat, as expected reductions in Australian, Argentine and Canadian crops totaling 2.75 mmt were the likely reason for this month’s 25 million US export increase. The sur-prise change was the USDA’s 15 million bu. smaller im-ports. This drop helped slice 40 million from the US ending stocks to 974 million bu. S. Hemisphere weather remains important for wheat prices going forward.

Despite October’s record US soybean crush, the World Board left beans domestic demand unchanged this month at 2.105 billion bu. The committee also took a similar approach in their overseas demand outlook even with this year’s sales (66 million bu.) & shipments (115 million) higher than 2018’s 1st quarter pace. The uncertainty of the current US/China talks seems to be the factor for their conservative approach this month.

The USDA also didn’t change December’s 2019/20 US corn supply/demand table. After a slow initial pace, strong processing margins have returned US ethanol output to near last year’s levels keeping the USDA’s biofuel demand unchanged at 5.375 billion bu. Corn’s export demand has been hit hard by Brazilian competition cutting the USDA’s exports by 200 million bu. since September. The potential for a smaller US January final corn crop given the current 6.5 million acres (8%) still not harvested in the US fields this week along with S. American weather concerns (Argentine dryness) may have combined for no corn ending stock change this month.

(Click on image to enlarge)

What’s Ahead

China’s waving of their soybean and pork tariffs and rumors of soybean purchases could be a positive sign in the US/China trade talks ahead of the next US Dec 15 deadline. However, China’s desire for some tariff rollbacks remains a stumbling block. Given this uncertainty, producers should advance your soybean sales to 60% in January’s $9.00-$9.15 range. Hold corn & wheat for Mar $3.90 & $4.60 level sales.