De-Dollarization And Re-Dollarization: Global Central Banks Gold Reserves

The Interest in Holding Gold

Central banks became net buyers of gold in 2010, just after the financial crisis, with gold remaining an attractive class of assets for central bank reserve managers. Amid the uncertainties associated with COVID-19, the yellow metal acts as a “safe heaven” that can be stored and sold in case of liquidity problems.

Image Source: Pixabay

With the increase in the prices of gold and in the context of the coronavirus crisis, gold has rarely appeared as attractive as it does today. Central bankers have reduced their policy interest rates and have aggressively expanded their asset purchasing programs at the heart of the pandemic. Of course, that has supported expansionist fiscal policies to ease the effects of population lockdown, but that has also contributed to the decrease in yields of sovereign bonds.

The reincrease of the U.S 10-year Treasury yield starting in August 2020 has followed, reinforced afterwards with the anticipated economic growth perspectives thanks to the arrival of vaccines against coronavirus, which have been presented as being very, very effective by their sources.

In August 2020, the central banks thus became net sellers of gold for the first time in about 18 months. Uzbekistan in particular has reduced their gold reserves by almost 32 tons that month, probably further to difficulties in financing to meet the health crisis. Countries having difficulties and gold-producing countries could in fact adopt this type of strategy. We should nevertheless underscore the fact that Uzbekistan has gold extraction activities and appears to be very favorable to the holding of precious metals by these citizens, because since November 2020 they have been issuing ingots sealed with a QR code.

Central banks have competing requirements on their investment strategies. Diversification appears to be the principal driving force of the interest of central banks in gold. Another important consideration for holding gold is the opportunity cost, which translates the benefits that an investor might have been able to receive from an alternative investment project. As a result of the crisis, the central banks have further relaxed their monetary policies and the budgetary policies of the governments have followed suit. In this context, the opportunity cost to hold gold rather decreased.

In real and nominal terms, the yellow metal has surpassed numerous other assets, in particular monetary assets (its fundamental function) since the end of the convertibility of the dollar into gold on 15 August 1971. Gold remains a strategic stake and there is little chance that the central banks will considerably reduce their holdings in precious metals in view of possible instability to come.

Central Eurasian Banks Against the Dollar

If we examine the structure of the reserves of the central banks on a worldwide scale, around 65% of them hold gold. It is interesting to observe that only 25% of them invest in stocks, despite their current yield.

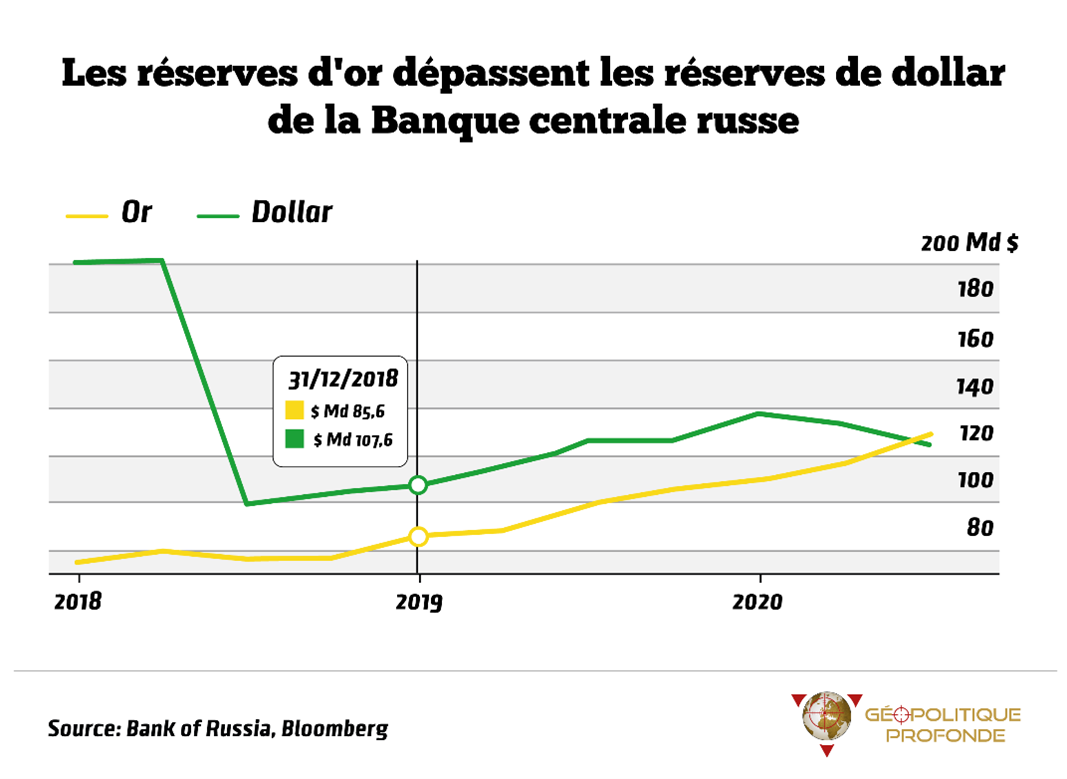

Apart from the traditional reason for holding gold reserves and optimizing portfolios, today it is also a matter of having an asset that makes it possible to escape the dollar. For example, in Russia, holding gold has become superior to holding dollars in mid-2020: they reduced their holdings in this currency by 96%.

This idea of de-dollarization has been supported by gold analysts for a long time now. Tensions between the United States and China have probably contributed to the increase in gold assets in China and other countries with a difficult bilateral relationship with Washington, like Russia or even Turkey.

A small group of central banks - Russia, China and Turkey primarily - have been effectively leading gold purchases for some years now. Is this so that they can reduce their exposure to the U.S dollar and the effectiveness of American sanctions against their economies? This is highly probable, and we have already discussed it in a previous article.

Another especially pertinent point: gold is also a liquid asset in U.S dollars. In fact, we are still living in a worldwide monetary system that is dominated by the dollar and this currency remains essential as a liquidity reserve for each country, in particular for international trade. The reduction of U.S. Treasury assets (in other words dollars in reserve) reduces the immediate exposure of a central bank to the macroeconomic and geopolitical positions of the United States. However, since gold is quoted primarily in dollars, it always assures the possibility of recovering greenbacks quickly on the market by reselling, if needed, the yellow metal against currencies.

This double dimension of de-dollarization and re-dollarization of yellow metal is exactly the thesis brought forth in Geopolitics of Gold more than a year ago. Whether we are de-dollarizing or re-dollarizing, gold will remain a very pertinent asset in the next few years, no matter whether the world of tomorrow is dominated by the United States or by Eurasia.

The Position of the Central Bank of Hungary

According to Róbert Rékási, head of Foreign Echange Reserves Management at the Central Bank of Hungary since 2013, gold is a strategic asset that could take on even more importance in the exchange reserves. The volatility of the price of the metal is real, but low: it is only one of several factors to take into consideration. His interview in the report of Central Banking 2020 is enlightening on this subject.

For the past few years, the banks of central Europe, in particular Poland, Austria or even Hungary, have been making movements similar to their alter ego in the East. The Hungarian National Bank (MNB) has greatly increased their holdings in gold during the past decade to over 31.5 tons, in other words at greater than 5% of the value of their portfolio in June 2020.

Increasing the size of gold assets is a strategic decision of long-term national and economic policy, according to Róbert Rékási. The Hungarian decision was especially driven by stability objectives; there were no investment considerations behind holding new gold reserves.

The MNB has also decided to repatriate their gold reserves stored abroad. Holding of precious metals within a country reinforces financial stability and contributes to the solidification of the confidence of financial markets in the Hungarian economy. In my opinion, this is a major national sovereignty independence movement; think of Charles de Gaulle who repatriated the gold deposited at the Federal Reserve in New York starting in 1958 in order to reconstitute France’s reserves. This process has taken years to materialize, and the emergence of May 68 is perhaps no stranger to the General’s deep patriotic wishful thinking.

An alternative to holding gold on national soil is to transfer part of the funds to the main centers for financing and negotiating gold, such as London, New York, or Switzerland. This is also useful in terms of liquidity because these movements make it possible to make gold exchanges more flexible on the markets and to lend it through swap agreements in exchange for U.S dollars. For more information, I refer you back to the previous analysis about the gold reserves of central banks.

External transfers can also serve to improve yields, depending on the specific goals of each central bank. This will occur to the detriment of the sovereignty of their gold, but as is often the case, everything is a question of weighting. Most central banks have it both ways so that they have both security and yield on their family jewels. Since gold has no yield, it is interesting for a central bank to use a portion of their assets in precious metals, especially if it has a certain quantity of it, to produce yield.

Let’s not forget that, under normal circumstances, the characteristic of confidence and the stabilizing role of gold are rather sterile. The yellow metal is less pertinent there than in a period of structural changes in the international financial system, or during profound geopolitical crises. In those cases, it can act as a line of defense in extreme market conditions.

It will come as no surprise to you when I say that we are in the full swing of this last process.

Disclosure: GoldBroker.com, all rights reserved