Data Shows Gold Is Undervalued In Many Currencies Since 2011

- Gold is undervalued, since 2011, because currency in circulation has risen much more than the gold price.

- The US dollar has failed to properly value gold in real terms. So have other world currencies.

- Expect a sharp upward correction in gold prices around the world during the next recession. This includes prices in US dollars.

- Gold’s natural limits on growth make it an ideal way to measure the value of various fiat (unlimited) currencies over time.

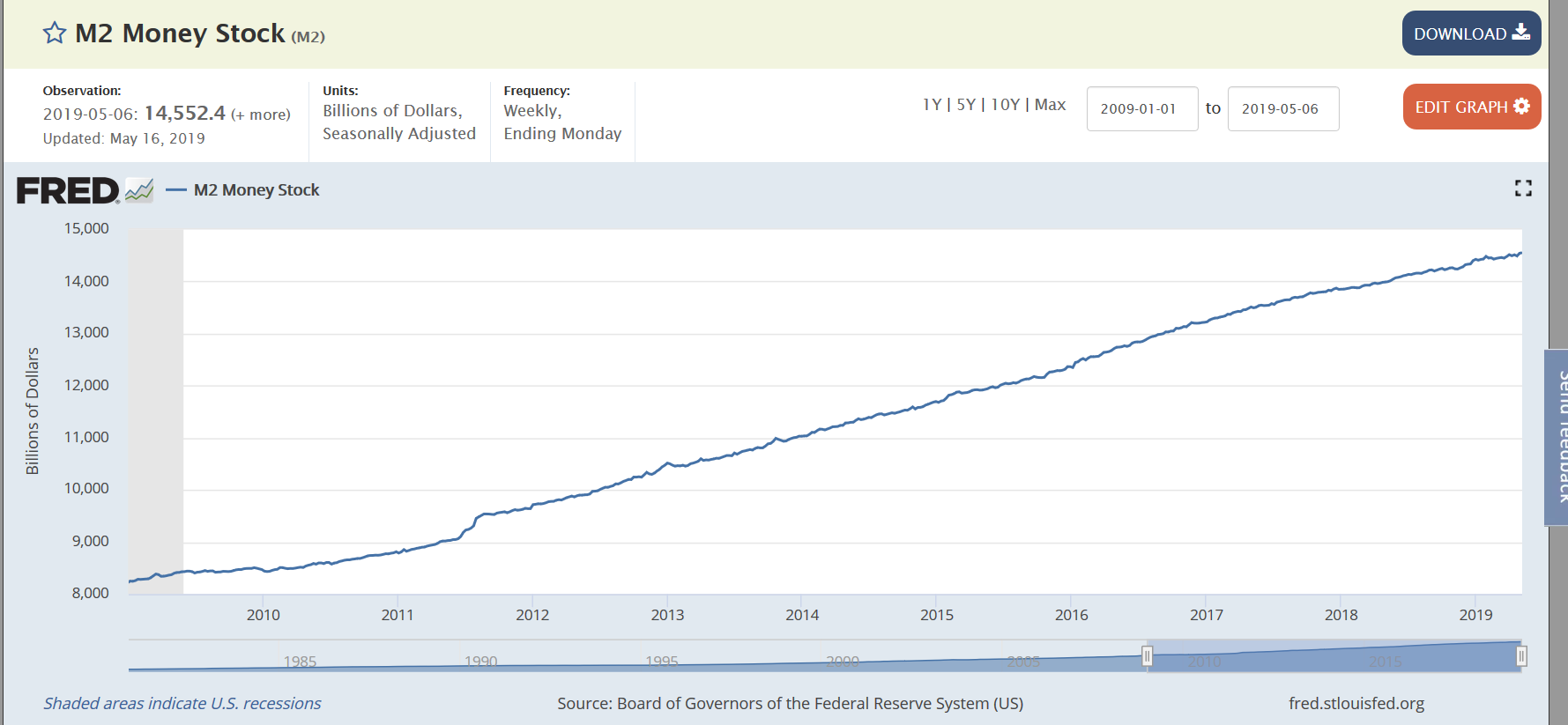

Since the last recession in 2008-9, gold’s price has fallen 45% in US dollar terms at the same time US M2 money supply has risen 70%. On its face, the relationship between the growth in aggregate money supply of dollars and the fall in corresponding dollar price of gold doesn’t make any sense.

Source: FRED

Gold’s Valuation Relative to Fiat

It is reasonable to assume that the increase in fiat dollars, created easily through a printing press and computer, would increase the prices of all real goods requiring labor and time to create. However while the general prices of goods in the US economy have risen, albeit not in line with the same growth in US M2, the price of precious metals such as gold and silver have not steadily risen, and have instead fallen substantially against the dollar.

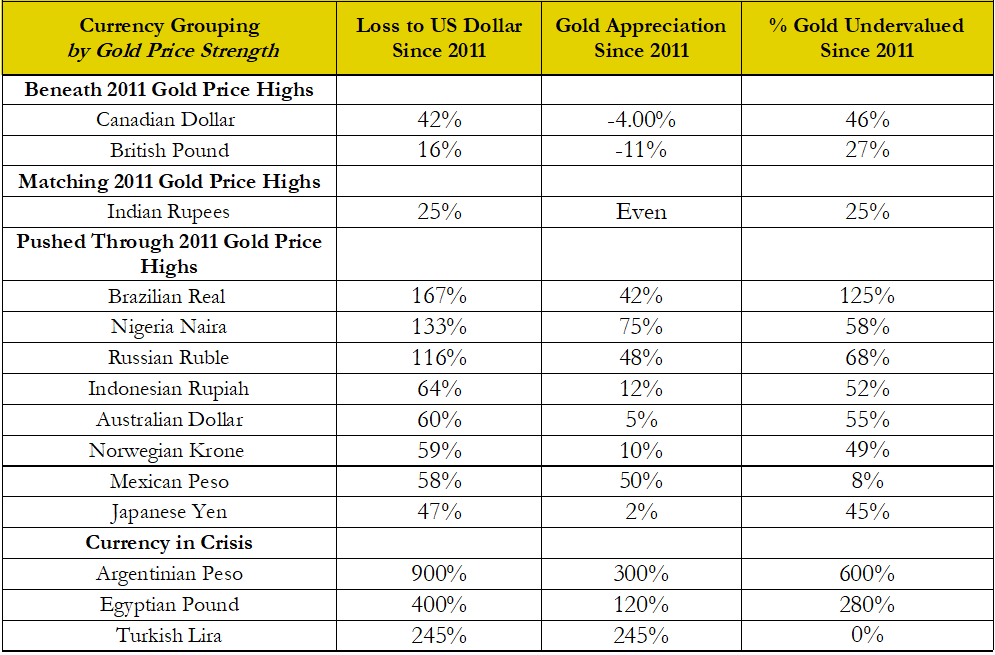

The price of gold has risen in the value of many other world currencies. The following chart illustrates how much gold has risen, grouped by comparative difference to gold’s price peak in 2011. I will refer to this information throughout the rest of the article.

Data Sources: Goldprice.org, XE Corporation

A reasonable person may presume that for those currencies in which gold prices have risen substantially, the value of the dollar against those currencies also rose by a similar amount. In other words, dollar strength versus the field of other currencies would explain why gold’s price is rising in the other currencies, assuming all other factors are constant.

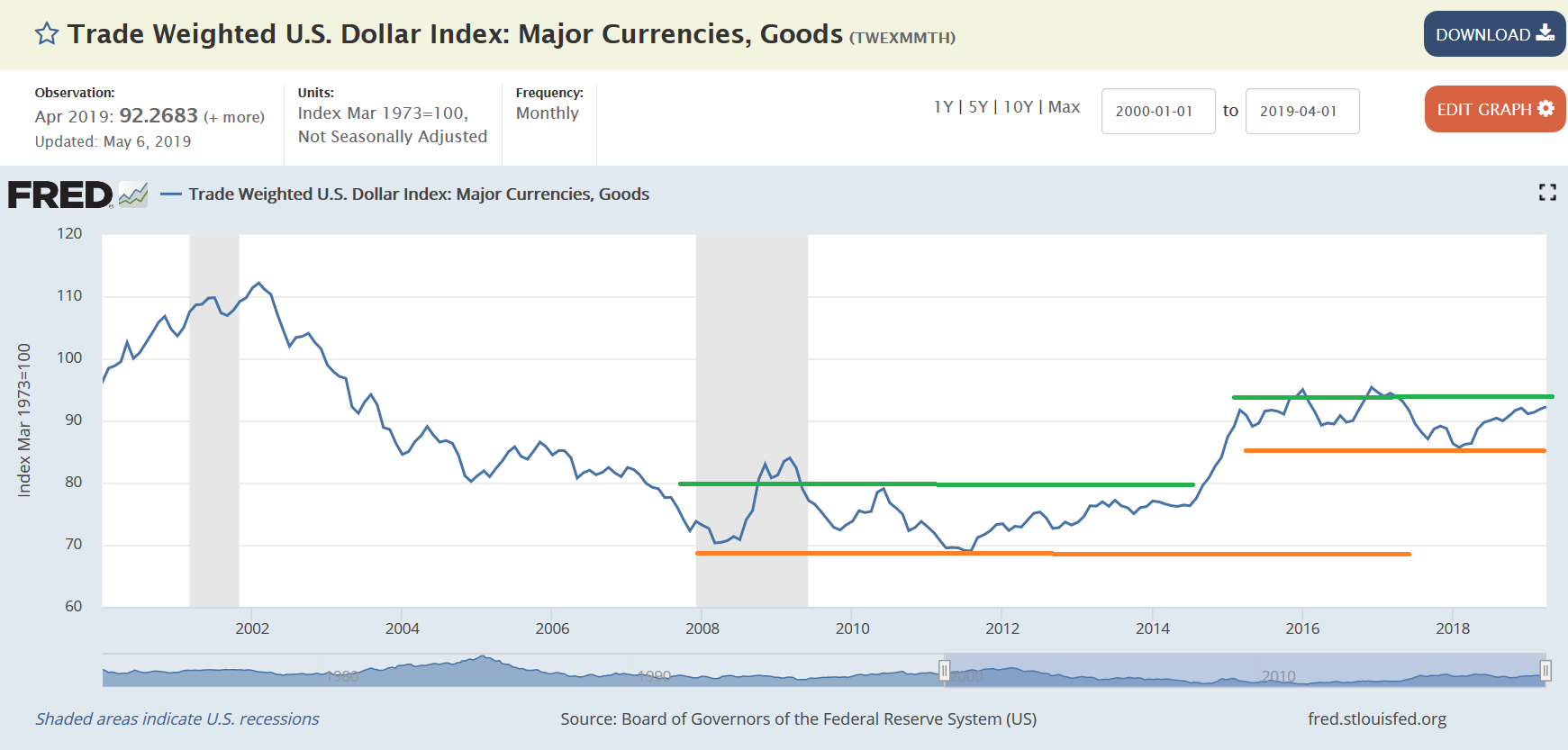

Source: FRED

In many cases, the price of gold in other currencies has risen. However, the dollar rose by a much higher amount than gold did. Several examples stick out:

- While gold has risen modestly in the Australian dollar, the AUD has lost 12 times as much value relative to the US dollar.

- While gold has risen in Brazilian Real terms, the Real has lost 4 times as much value relative to the US dollar.

- The same situation exists with the Norwegian Krone, but at a ratio of 5 to 1.

- 11 out of 14 currencies in the chart above have seen higher devaluations against the US dollar than gold has risen by a corresponding amount in local currency terms.

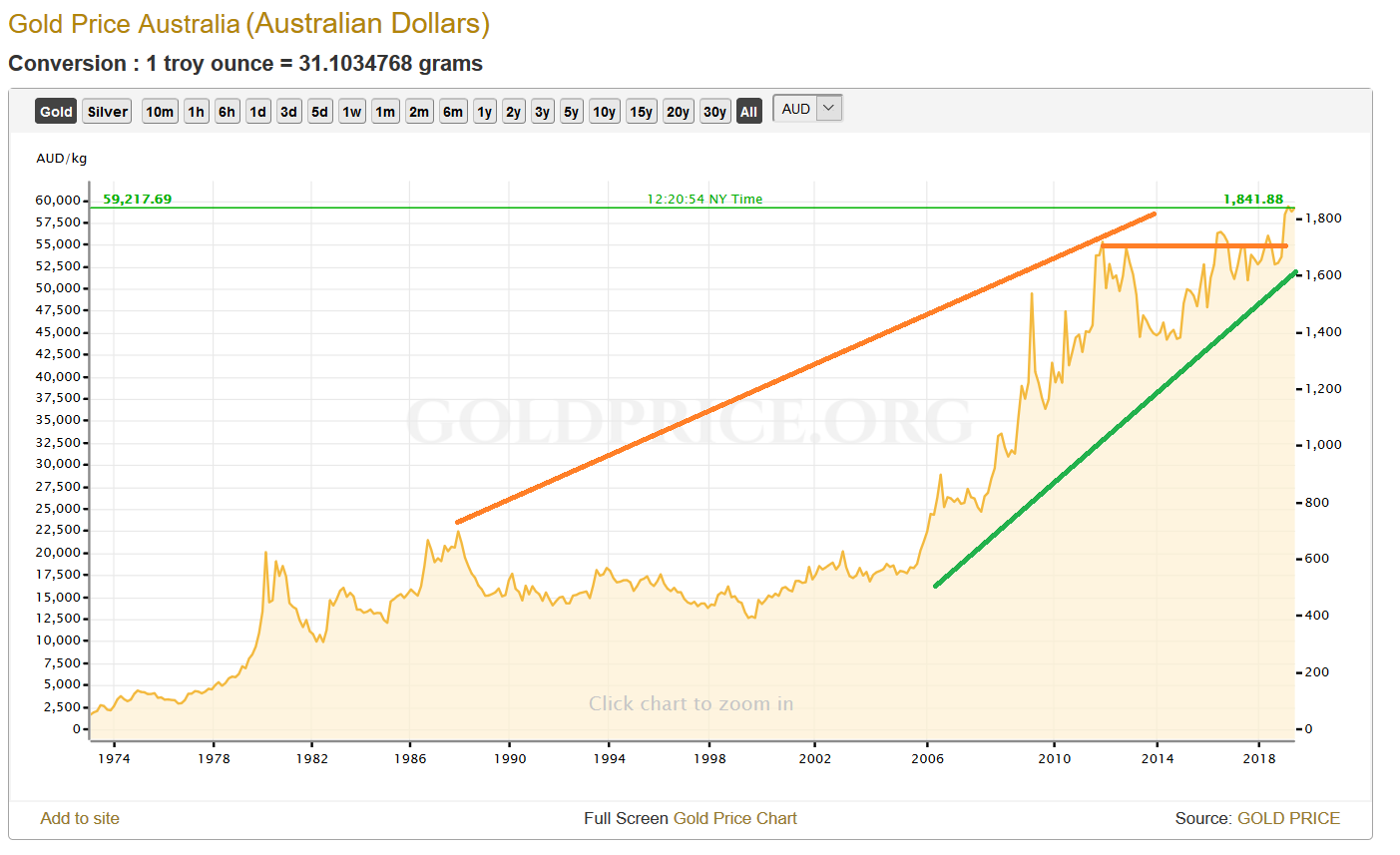

Source: Goldprice.org

Gold Growth Relative to Aggregate M2 Increases

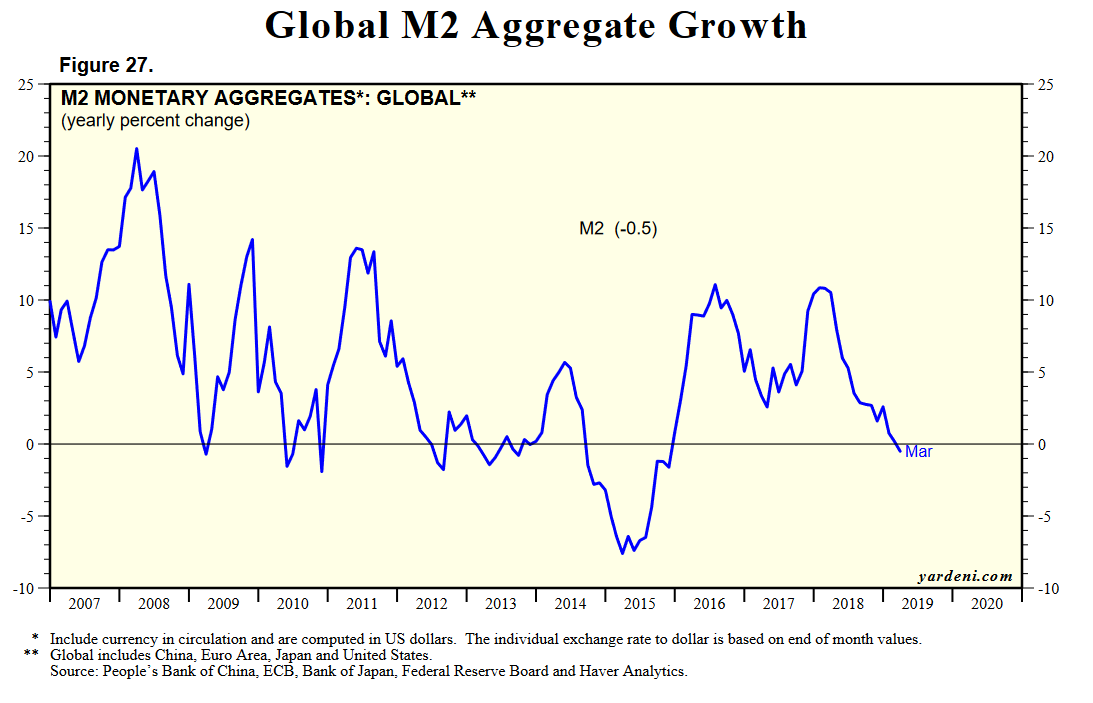

The next question one might ask is whether, given aggregate gains in M2 of the world’s currencies including the dollar, that gold’s price grew by a corresponding amount to the M2 aggregate increase. This chart shows that world currency aggregate has expanded by about an average of between 5 and 10% per year.

Source: Yardeni

The global money supply increased 20% right before the financial crisis, and seems to have very gradually slowed its acceleration from that level. Notwithstanding 2015 when world M2 aggregate decreased by about 5%, central banks around the world kept up the spigot of easy cash flowing at a substantial pace the last decade.

Gold’s price in the major world currencies, in contrast, has not kept the pace of the average annual M2 inflation during the same time frame.

Gold Price Building Strong Technical Base

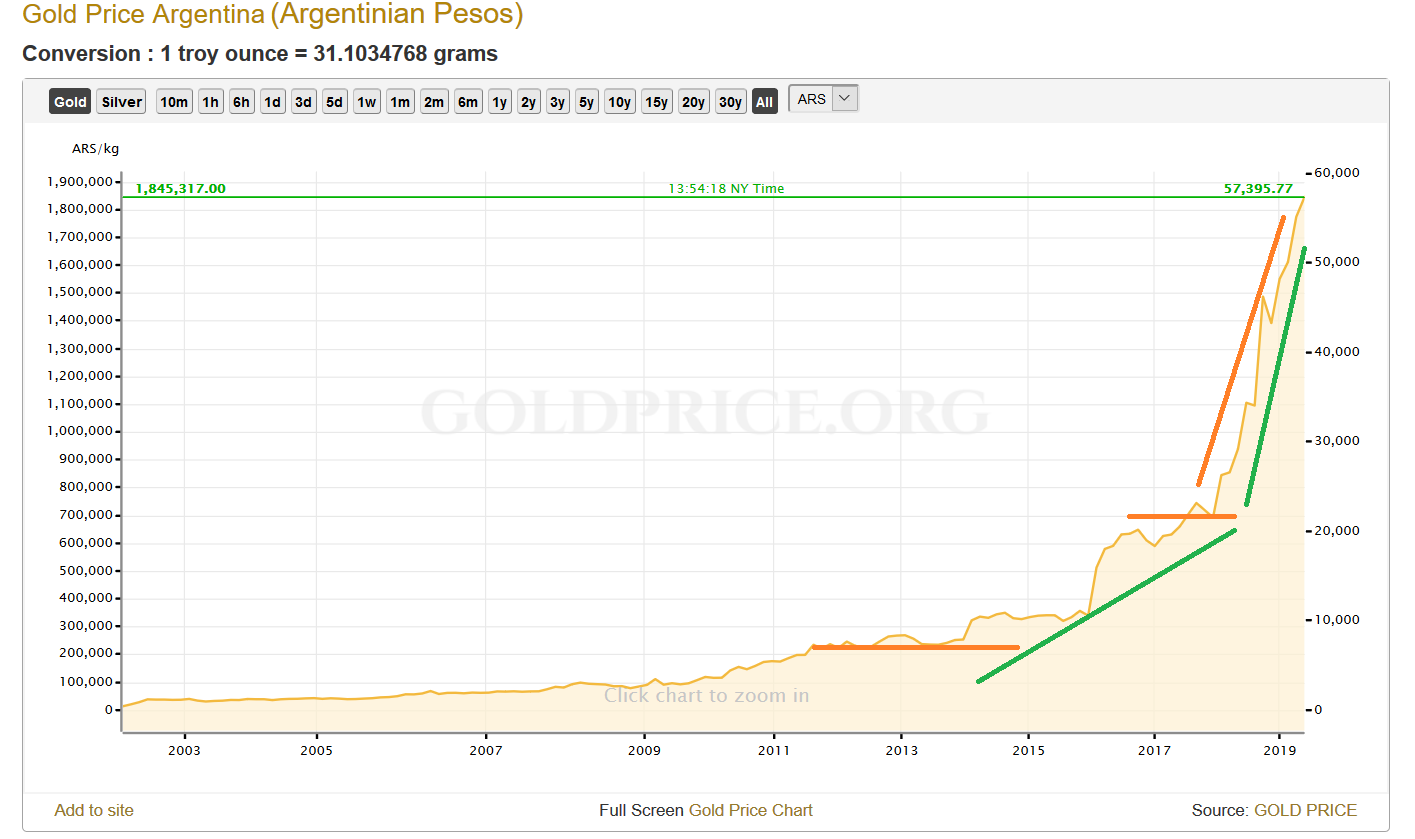

There are a few standout countries that we should examine in which the gold price has increased quite a bit. These countries experienced the sharpest gold price gains (amounts approximate):

- Argentinian Peso – 300%

- Turkish Lira – 245%

- Egyptian Pound – 120%

- Nigerian Naira – 75%

- Mexican Peso – 50%

- Russian Ruble – 48%

The only major currency from this list in which gold’s price kept pace with the local currency weakness to the US dollar is Turkey. The Lira suffered severe damage amid political conflict, and gold accurately reflects the currency downside that the country has suffered.

This is what one would expect to occur, given the history of gold as a monetary base asset and real store of wealth. In all other cases presented in this study, it is clear that the price of gold has not been appropriately valued relative to the local currency debasements.

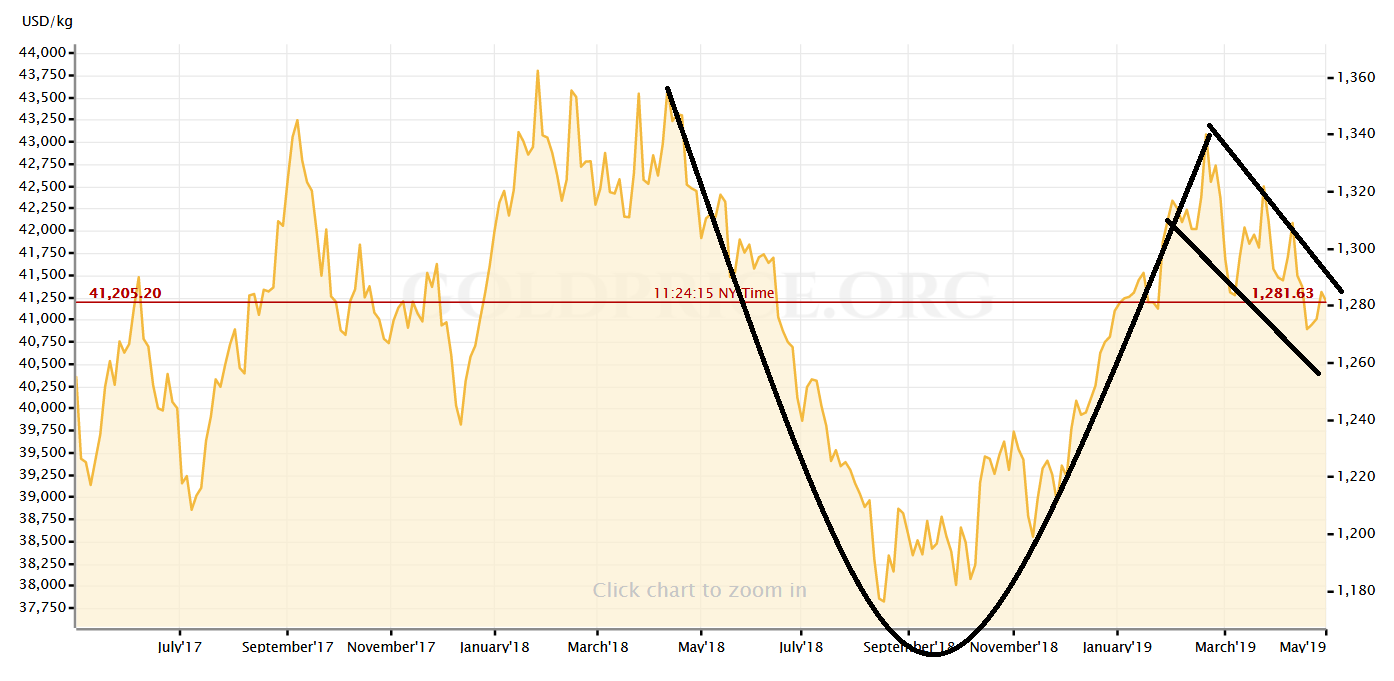

This includes the US dollar which serves as the world’s reserve currency. As if on cue, technical analysis is signaling a building base for future US dollar gold price appreciation as shown below.

Source: Previous Article

Quoting my statement from a previous article:

You know the pattern is bullish when a full cup forms, as we see in the picture. As well, the handle portion on the right of the cup needs to be downward sloping, as it is with the current gold price. Further, the pattern we see in gold fits in with the typical time frame in which cup and handle patterns result in strong upward price movements.

Currency Indexes Do Not Measure Fiat Value in Real Terms

This highlights the problem with using the US dollar index as a measure of strength. Relative to other world currencies, the dollar has indeed gained strength in the last 10 years. But, this is only a nominal measure of fiat strength among the major paper currencies.

Gold cannot be created from thin air, and supply has grown over time relatively consistently with global population. Gold is not in oversupply and therefore is not at risk of an acute devaluation. That is why central bankers have declared it a Tier 1, risk-free asset.

The strength of gold is therefore not measured by fiat currencies, but the other way around. And where the majority of the major world currencies have maintained price strength relative to gold, we can confidently reason that gold is undervalued in all of those currencies. The currency market’s undervaluing of gold will be resolved during the next recession when the bloated world M2 currency complex comes under pressure.

Gold Valuation in a Currency Crisis

In the extreme case of Argentina, which is suffering a currency crisis brought on by excessive government debt, the price of gold in Pesos has only risen by about 1/3 of the amount the US dollar has to the Peso. Even so, ask Argentinians now whether they would rather hold gold or their local paper currency. The choice should be easy.

Source: Goldprice.org

I recently interviewed a survivor of the last Argentinian currency crisis in 2000, and you can listen to that interview here. His comments about the demand for the Peso, US dollars, and gold during currency crisis are quite enlightening.

Summary

One thing is certain – gold is undervalued almost across the board in the various world currencies. An astute investor should see opportunity in the relatively low gold prices, especially against the specter of an oncoming world recession. Given the average length between recessions, the same astute investor should also expect to capitalize on this opportunity of cheaply priced gold in a relatively short period of time as well.