Crude Oil Prices May Extend Gains As Investors Eye OPEC JMMC Meeting

CRUDE OIL FUNDAMENTAL FORECAST: BULLISH

- Positive vaccine developments and a more moderate than expected easing of OPEC+ output cuts may continue to propel crude oil prices higher.

- OPEC’s Oil Market Report and Joint Ministerial Monitoring Meeting may dictate near-term price action.

VACCINE PROGRESS TO UNDERPIN OIL PRICES

Crude oil prices have stormed higher since falling to multi-month lows at the start of November, climbing over 40% in the last 6 weeks on the back of positive Covid-19 vaccine progress and the decision by OPEC+ to ease output cuts more moderately than expected.

With an independent panel of government advisers recommending that the benefits of Pfizer’s coronavirus vaccine outweighs any potential risks, it’s expected that the US Food and Drug Administration (FDA) will authorize the immunization in the coming days.

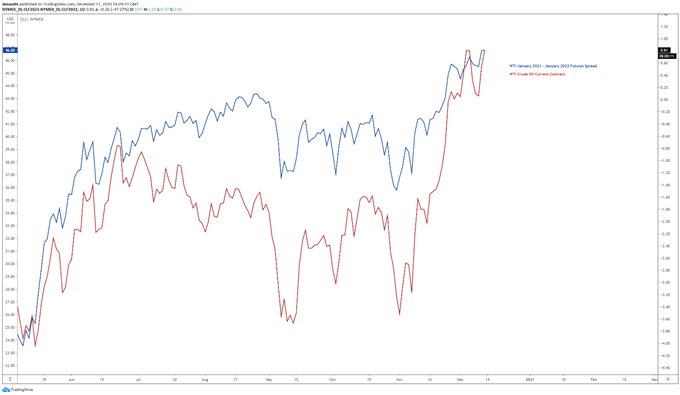

Crude oil futures comparison chart created using Tradingview

This will likely act as a tailwind for crude as investors begin to price in a progressive return to normalcy in 2021. Indeed, WTI futures backwardation hints at strong near-term demand, with the spread between the January 2021 and 2022 contracts rising to its highest level since late February.

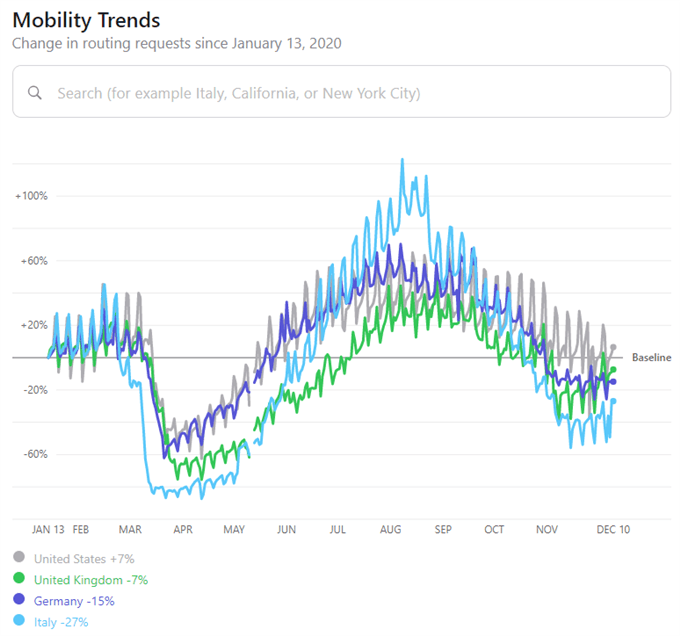

Moreover, the notable stabilization in high-frequency data suggests that the tightening of restrictions in several European nations, and a cluster of US states, isn’t having as adverse an impact on overall mobility.

These positive factors could foster further gains for oil prices and open the door for crude to retest levels not seen since before the coronavirus crash in March.

Source – Apple Mobility Data

OPEC JMMC MEETING AND OIL MARKET REPORT KEENLY EYED

Looking ahead, the release of OPEC’s Oil Market Report on Monday, followed by the cartel’s monthly Joint Ministerial Monitoring Meeting on Thursday, will be keenly eyed.

Investors will be scrutinizing comments from several key alliance members to gauge what the full ministerial meeting in early January could entail, after the cartel approved a 500,000 barrel-per-day increase in output next year.

Additional easing of output cuts could limit the potential upside for crude oil prices in the near term. However, the gradual pickup in demand may offset the negative impact of additional supply and allow crude to extend its climb higher.

Disclosure: See the full disclosure for DailyFX here.