Crude Oil Prices In Focus Amid Fears Of Falling Demand

Oil Price Forecast:

- US Crude Oil inventories fall by 3.2 million barrels

- Price action stalls amid fresh lockdown restrictions, sparking concerns around future demand

- CCI harbors on overbought territory

Global lockdown restrictions continue to weigh on crude oil as a surge in Covid-19 cases have resulted in fresh lockdown measures throughout Europe and China, placing pressure on the demand for Oil and other commodities.

Meanwhile, according to this week’s EIA (Energy Information Administration) report, US crude inventories fell by 3.2 million barrels in the week ending 8 Jan 2020, concluding the fifth consecutive week of drawdowns in stockpiles. Despite the negative correlation between oil supply and prices, the future of the oil market remains opaque, as the battle between supply and demand rages on.

TECHNICAL ANALYSIS

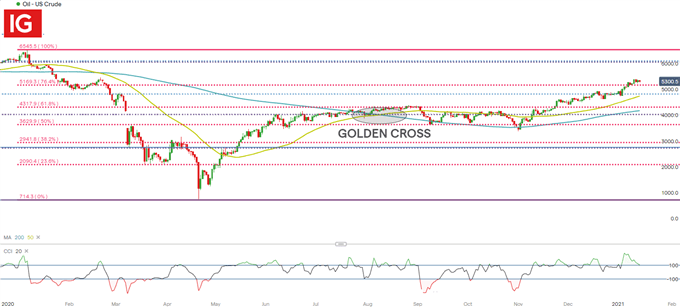

Technically, WTI prices remain confined by the key Fibonacci levels that have provided support and resistance for the major commodity since recovering from April 2020 lows, where Oil prices breached negative territory for the first time in history. Currently price action remains above support, formed by the 76.4% Fibonacci retracement level of the short-term move at 5169.3, but remains below the 50-period Moving Average (MA), which continues to form an additional layer of resistance at 5344.6

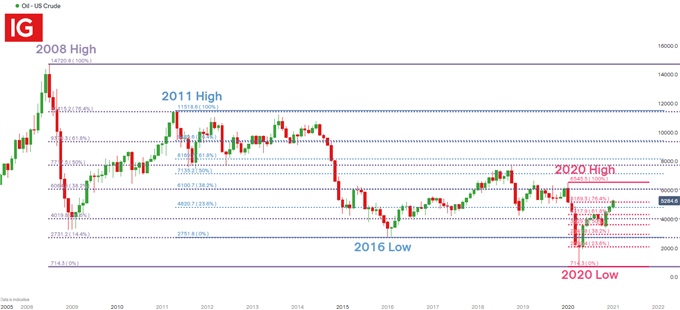

WTI – US Crude Oil Monthly Chart

Chart prepared by Tammy Da Costa, IG

Focusing on a more imminent move, the short-term trend has recently favored bulls, with price action trading above both the 50 and 200-Day Moving Average (MA) on the daily chart. Prices have continued to cling to Fibonacci support while testing the upper bounds of the Commodity Channel Index (CCI), which harbors on overbought territory.

WTI – US Crude Oil Daily Chart

Chart prepared by Tammy Da Costa, IG

For bullish continuation themes buyers are going to need to push through current resistance, holding at 5344.6, with the next resistance level forming at the key psychological level of 5400.

On the contrary, if bears push below the Fibonacci support of 5169.3, downward pressure may see prices testing the 38.2% Fibonacci retracement of the 2011 – 2016 move.

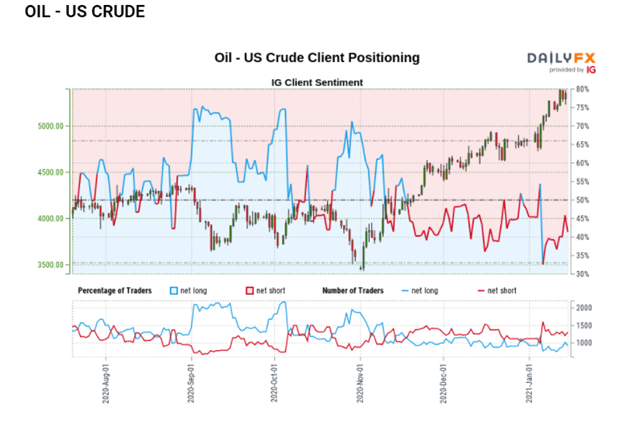

CLIENT SENTIMENT

Oil - US Crude: Retail trader data shows 44.28% of traders are net-long with the ratio of traders short to long at 1.26 to 1. The number of traders net-long is 9.65% lower than yesterday and 10.72% higher from last week, while the number of traders net-short is 5.79% higher than yesterday and 10.50% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Oil - US Crude prices may continue to rise.

Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed Oil - US Crude trading bias

Disclosure: Visit the DailyFX Educational Center to discover why news events are Key to Forex Fundamental ...

more