Crude Oil Price Forecast: Traders Set Sights Above $70 With Uptrend Intact

Crude oil trades tantalizingly close to the $70 mark for the first time since October 2018 as strong economic data helps drive continued price gains for the commodity. With little to suggest a reversal lower is imminent, bulls will look to keep the uptrend intact for the foreseeable future and a confident break above the $70 mark would serve as an encouraging first step on the road to further gains. That said, seasonal headwinds could make a convincing break hard to come by.

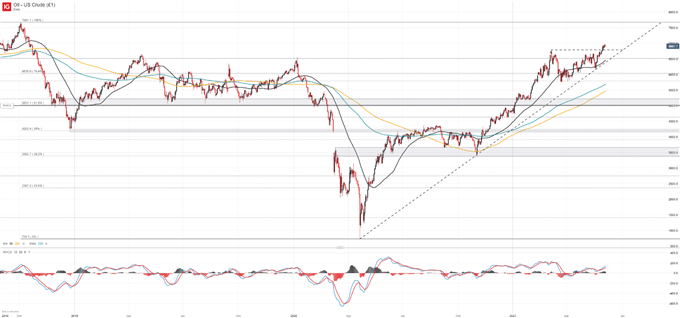

CRUDE OIL PRICE CHART: DAILY TIME FRAME (OCTOBER 2018 – JUNE 2021)

To that end, market participants have already begun to experience lower trading volumes as summer approaches and a lack of conviction could leave early attempts above $70 vulnerable to brief pullbacks. Thankfully for bulls, crude oil enjoys a collection of support nearby. Initial buoyancy may be found from the commodity’s swing high in early March, around $68, with subsequent support around the $65 area.

In the current market environment, the $65 zone may serve as the “line in the sand” level that could see losses accelerate if pierced. The area roughly coincides with the 50-day simple moving average, a longstanding Fibonacci level and a crucial trendline from the April 2020 lows.

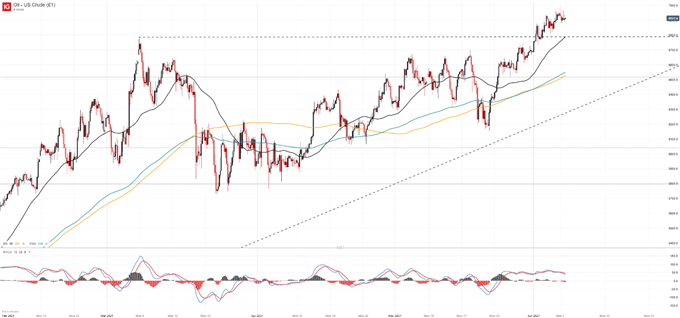

CRUDE OIL PRICE CHART: 4 - HOUR TIME FRAME (FEBRUARY 2021 – JUNE 2021)

A break beneath the area and, perhaps more importantly the April uptrend, could seriously undermine the commodity’s longer-term technical outlook. For the time being, however, crude looks well positioned to continue higher given the fundamental and technical landscapes.

Disclosure: See the full disclosure for DailyFX here.