Crude Eyeing OPEC+ Meeting – Where Is Oil Headed?

With the OPEC+ meeting on Thursday, oil looks to be in a corrective phase, as pressure is on for more crude. Are we looking at bearish winds ahead?

Photo by Timothy Newman on Unsplash

Crude oil prices have started their corrective wave, as we are approaching the monthly OPEC+ group meeting on Thursday, with some market participants now considering the eventuality of a larger-than-expected rise in production.

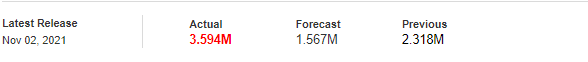

U.S. API Weekly Crude Oil Stock:

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via .com

Regarding the API figures published Tuesday, the increase in crude inventories (with 3.594 million barrels versus 1.567 million barrels expected) implies weaker demand and is normally bearish for crude prices.

Meanwhile, in the United States, the average price of fuel stabilized on Tuesday after several weeks of increase, according to data from the American Automobile Association (AAA), however, that’s 60% higher than a year ago.

(Click on image to enlarge)

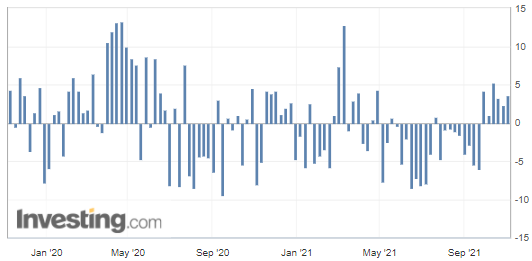

Chart – WTI Crude Oil (CLZ21) Futures (December contract, 4H chart)

In summary, we are now getting some context on how the oil market might develop in the forthcoming days, with some crucial events to monitor as they could have a strong impact on the energy markets, and particularly on the supply side.

Disclaimer: All essays, research and information found in this article represent the analyses and opinions of Sunshine Profits' associates only. As such, it may prove wrong and be ...

more