Copper And Oil Walked Out On The Last Puppet Show

Where have you gone, green shoots? The Fed turned dovish, a bunch of transitory factors, and, above all, so much Chinese stimulus. That’s what got everyone through the winter. Markets were truly harsh to end 2018, a sharp slap in the face after all year the unemployment rate.

One of the big ones that seemed evidence for green shoots was copper. Once the Fed “pause” was finalized in whispers, this one commodity price began its resurgence. And it wasn’t alone, either. Copper was joined by oil, the two biggest stars of the physical marketplace. The bellwethers had turned back positive.

In many ways, both HG1 and WTI are a referendum on dovishness. Rate cuts were still a few bps of inversion, some distant concern not yet the gaping hole in every prominent curve. The commodities were moving toward one side while the bond market stayed mostly to the other.

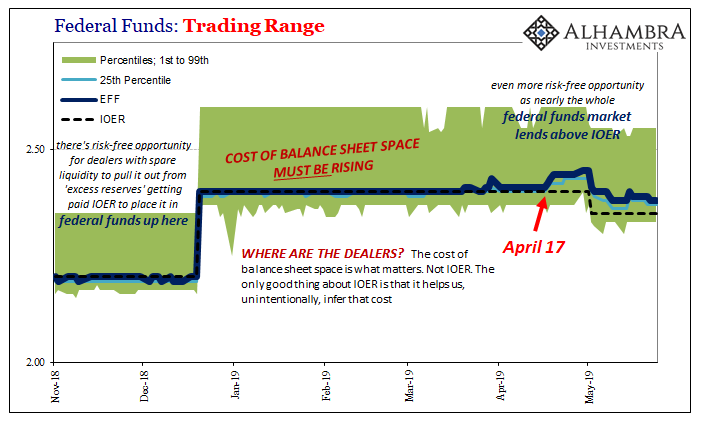

Then, federal funds in mid-April. People talked about tax refunds and money market funds to try and explain why an irrelevant liquidity indicator was suddenly so interestingly disobedient. The effective federal funds rate suddenly blew out as if the whole liquidity space had been emptied.

In the aftermath of that ironically poignant symbol, much less disagreement about where all this is heading. The bond market continued its plunge, even accelerated the curve collapse, while both copper and oil decided it was time for them to join back in.

As of this writing, copper is trading down nearly $0.05 at $2.626. It is threatening to take out the January low and maybe match last August. This would be a big one on its own given how important Chinese economic perceptions are to the metal’s price.

If RRR cuts and whatever else has been chalked up to the PBOC’s “powerful” toolkit haven’t ignited China’s expected rebound, testing and surpassing those lows in copper would be a pretty definitive signal about global risks.

To that end, China’s Caixin reported some troubling weakness in that country’s service sector:

“Overall, China’s economic growth showed some signs of slowing in May. Employment and business confidence in particular merit policymakers’ attention,” said Zhengsheng Zhong, Director of macroeconomic analysis at CEBM Group, in a statement accompanying the data release.

The broad survey results and a run of recent data from China suggest Beijing might need to roll out more stimulus to stave off a sharper economic deceleration.

That’s the message out of the oil patch in WTI, if somewhat less China-centric. Peaking last on April 23, a week after EFF, over the last two weeks crude prices have plunged. In wild trading today, the front futures price at the intraday low was just barely outside the $40s again. That puts oil in range of returning to its alarming December trading area.

It also places copper and oil into the same column strongly together. The one that adds up to the first rate cut coming sooner than you think, followed closely by a series of them. Anyone think Jay Powell brought up QE, ZIRP, NIRP, and more moneyless experimentation this week on a whim? He can’t say that he’s worried, so he says instead they have all this presumed ammunition just in case.

China’s RRR and the Fed’s pause didn’t do the trick. While we watch the global economy deteriorate we can at least look forward to the entertainment of finding out what’s next for the puppet show.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more