Coffee Heats Up

Coffee more expensive? As Jeremy Irons' character in "Margin Call" says, "I'll have to pay".

Coffee Heats Up

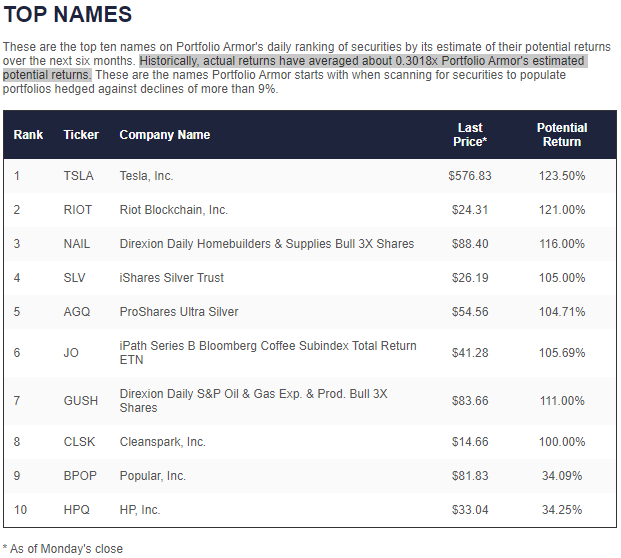

Two months ago (Too Much Crypto, Not Enough Stuff), we wrote about coffee shortages and noted that the leading coffee exchange traded note was one of our top names:

In a nice bit of synergy, Bloomberg licenses its commodity indexes to the sponsors of exchange traded products. So not only does it report on rising commodity prices, but it also profits from them. Coincidentally, one of those exchange traded products, the iPath Series B Bloomberg Coffee Subindex Total Return ETN (JO) was one of our system's top ten names on Monday.

Screen capture via Portfolio Armor on May 17th, 2021.

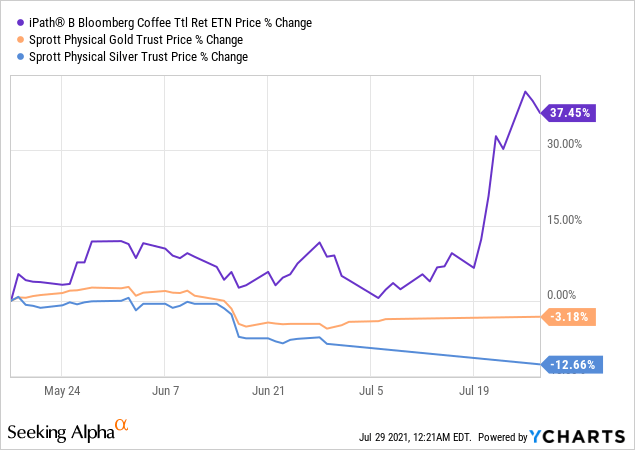

Since then, JO has been on a tear. Illustrating the theme of consumable commodities outpacing precious metals during the reflation trade, both the Sprott Physical Gold Trust (PHYS) and the Sprott Physical Silver Trust (PSLV) are in the red over the same time period.

Still Bullish On JO

Earlier this week, ZeroHedge reported that weather prices could drive coffee prices even higher.

"Another Explosive Week" - Coffee Futures Hit 7-Year High Ahead Of Next Cold Snap https://t.co/JZlDMy71nb

— zerohedge (@zerohedge) July 27, 2021

JO was again one of our top ten names on Wednesday. It's possible that the options market participants whose sentiment our system gauges in its daily ranking have been watching the weather reports in coffee-growing regions.

It's also possible they're overshooting this time. One issue with our security selection method this year is that has caught picked up some names such as Tesla (TSLA) near their record highs. Then again, given Tesla's impressive earnings this week, it may go on to hit new highs over the next few months. So the best bet with JO here may be to buy and hedge. We show a couple of ways of doing so below.

Hedging Your Bets On JO

Here are two ways of limiting your downside risk if you're long JO now or are considering buying it.

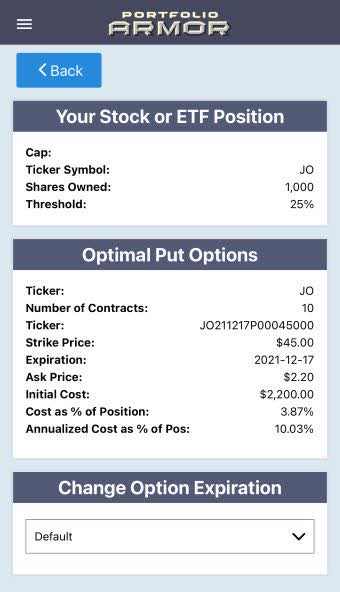

Uncapped Upside, Positive Cost

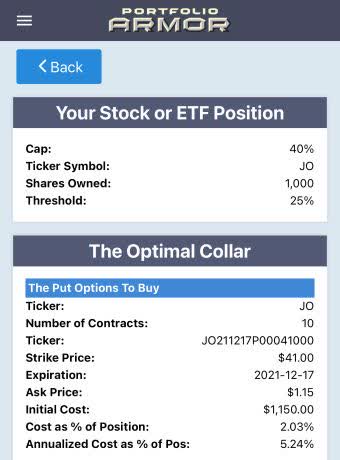

These were the optimal puts, as of Wednesday's close, to hedge 1,000 shares of JO against a greater-than-25% drop by December 17th.

This, and subsequent screen capture via the Portfolio Armor iPhone app.

The cost there was $2,200, or 3.87% of position value, calculated conservatively, at the ask price of the puts (in practice, you can often buy and sell options at some price between the bid and ask).

Capped Upside, Negative Cost

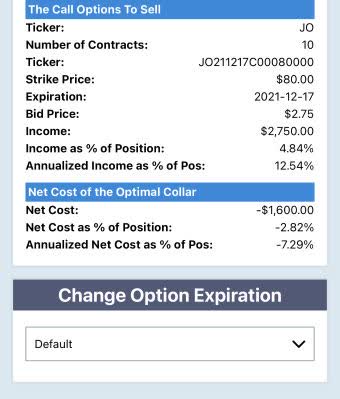

If you were willing to cap your possible upside at 40% by December 17th, this was the optimal collar to protect against a >25% decline over the same time frame.

This time, the net cost was negative, meaning you would have collected a net credit of $1,600, or 2.82% of position value when opening that optimal collar, assuming (again, to be conservative) that you placed both trades at the worst ends of their respective spreads (buying the puts at the ask and selling the calls at the bid).

Something to consider while the coffee's still hot.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more