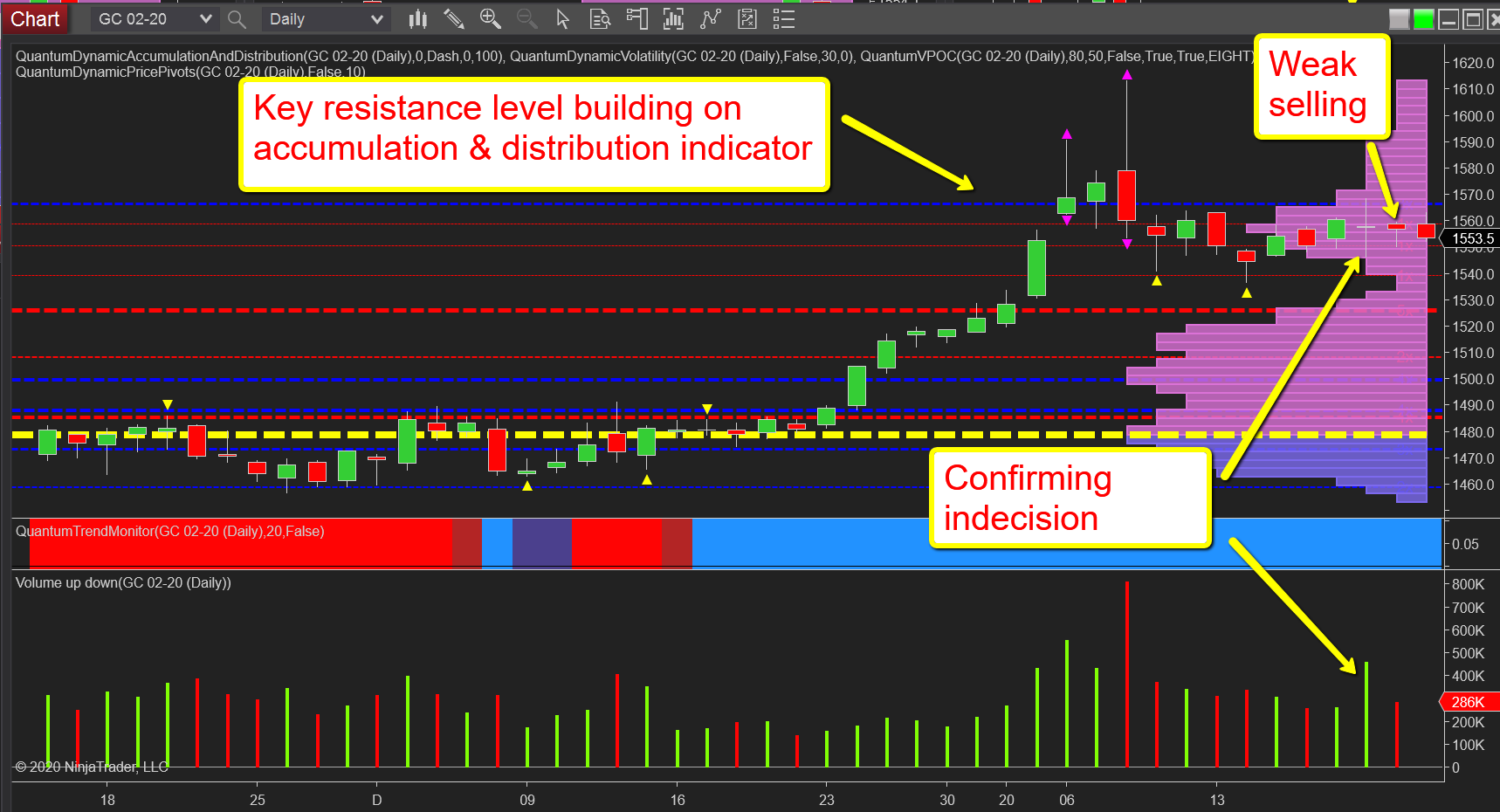

Cause And Effect For Gold As Congestion Continues

An interesting technical picture for gold on the daily chart as the precious metal continues to trade in a narrow range, and as always with congestion phases, Wyckoff’s second law of cause and effect applies. In other words, the longer a market remains in congestion (cause) then the more pronounced will be the trend (effect) which develops thereafter. The key level for gold at present is the technical resistance overhead at $1565 per ounce which is capping any attempt to advance, and even the current concerns over the Chinese coronavirus appear to be having little impact in terms of safe-haven flows. The longer-term outlook remains broadly bullish for the metal, with only muted selling volume yesterday confirming the current picture, and indeed much of this was absorbed during the session with the metal regaining intraday losses. This followed the previous high volume day which closed with a well-formed doji candle and confirming the current indecision.

(Click on image to enlarge)

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more