Bitcoin - Consolidation Brings New Opportunities

Review

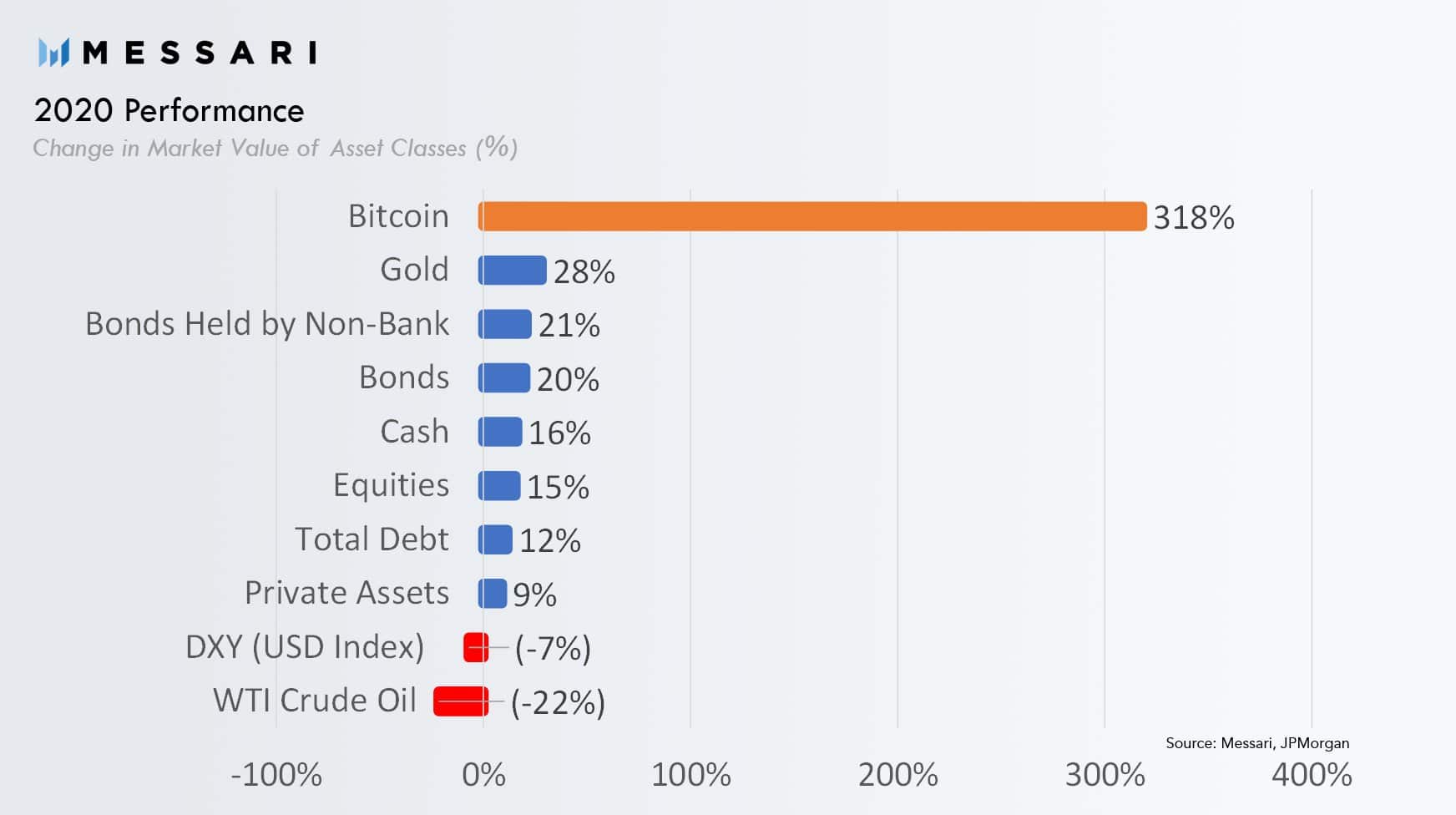

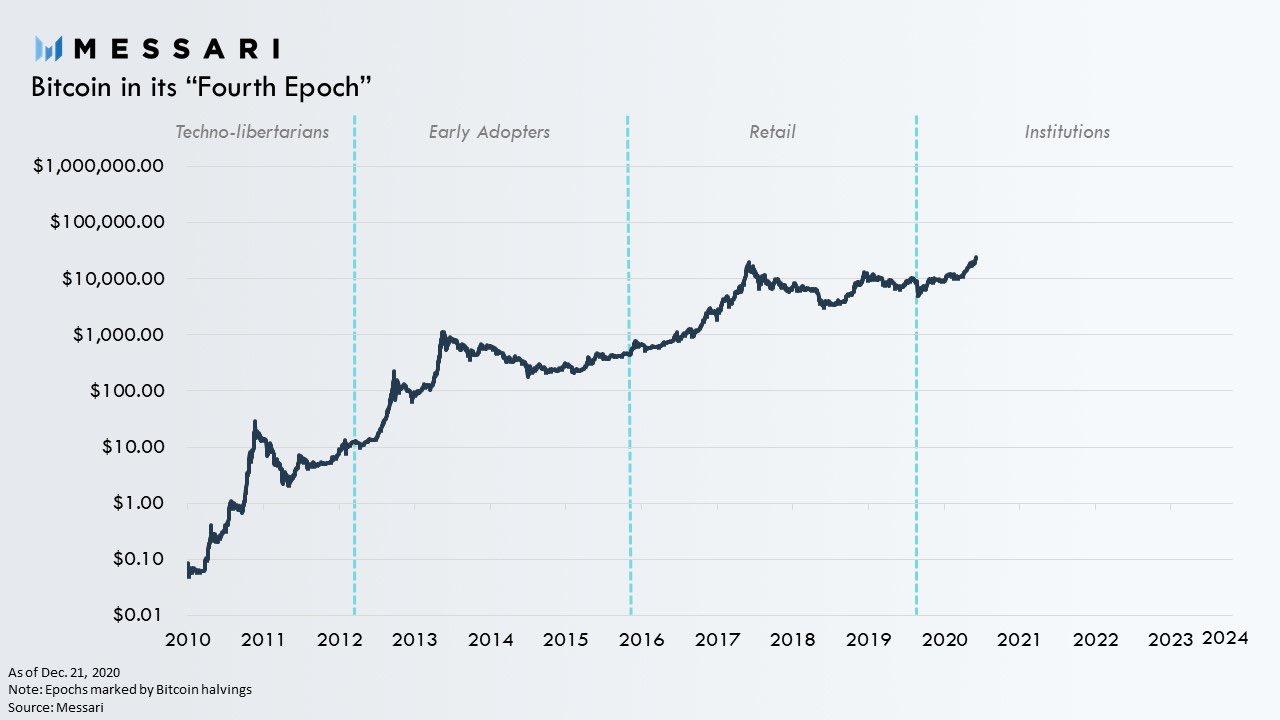

Source: Messari December 31st, 2020

After a massive rally from the beginning of October, Bitcoin (BITCOMP) almost reached prices around US$20,000 on December 1st. Despite a heavily overbought situation, the bulls only needed a two-week breather. The successful breakout immediately caused a further acceleration, so that bitcoin prices continued to explode until January 8th 2021 and were able to rise to almost US$42,000. Bitcoin had thus increased more than tenfold in less than 10 months since the Corona crash! Looking at 2020 as a whole, Bitcoin pretty much outperformed everything, gaining 318%.

Source: Dan Held on Twitter

Over the last three weeks, however, there was, not surprisingly, a wave of profit-taking hitting the bitcoin market. Hence, prices retraced all the way back down toward just under US$29,000. This rapid correction represented a drop of 31% in just 14 days. In the big picture, however, this is not unusual. Instead, bitcoin has seen countless corrective price moves like this over the past 10 years. In the last bull market between autumn 2015 and December 2017, there were a total of six sharp pullbacks, all of which amounted to sell offs between 29% and 38%.

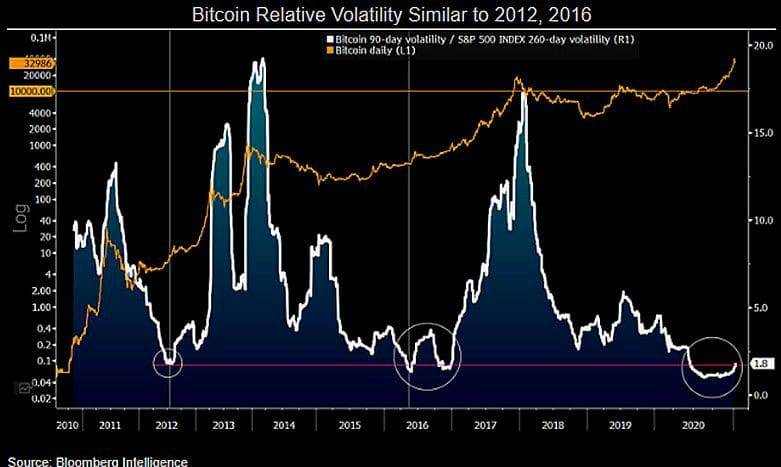

Source: Dan Tapiero on Twitter

In the bigger picture however, volatility is still relatively low. Rather, the relative volatility indicates that the range of fluctuation is only just slowly beginning to rise again and should spike towards the later stages during the course of this current bull market.

Overall, bitcoin has been in a new bull market since the Corona Crash in March 2020 and is likely to head for much higher price regions in the coming 10 to 24 months. Daily fluctuations of US$10,000 and more will then become increasingly common.

Technical Analysis For Bitcoin in US-Dollar

Bitcoin, Weekly Chart as of February 2nd, 2021. Source: Tradingview

With the breakout above the all-time high around US$20,000 on December 16th, 2020, the Bitcoin rally that had been underway since March 2020 already accelerated once again significantly. Although the market was already heavily overbought on all timeframes, bitcoin doubled within the following four weeks and reached a new all-time high at around US$42,000 on January 8th, 2021. After such a price explosion, it takes time to digest this strong rise. The pullback towards and slightly below US$29,000 is therefore perfectly normal and healthy.

From the perspective of the weekly chart, however, there are no clear signs for an end of that correction yet. Looking at the “old” support zones and the overbought stochastic oscillator, a return to the breakout level around US$20,000 would be quite conceivable. Beyond that, there are two long-term upward trend lines that could also act as possible targets on the downside.

Using the classic Fibonacci retracements from the low at US$3,850 to the recent high at US$42,000, the 38.2% retracement at US$27,425 would be the minimum correction target. If bitcoin can continue to hold above this retracement, this would be an extremely bullish sign of strength. A first retest of the recent lows at US$29,000 was also successful and thus far created a nice double low which might already have marked the turning point. However, prices below those lows would confirm a larger and deeper type of correction. Prices around US$27,500 and lower towards US$20,000 to US$22,000 would then become increasingly likely.

However, since bitcoin is undoubtedly in an established bull market and in an overarching uptrend, the surprises are generally happening to the upside. Therefore, the only thing to note here is that new prices above US$40,000 would probably signal a continuation of the steep rally. In this case, prices around the next psychological level at US$50,000 should follow quickly.

To summarize the weekly chart remains bullish above US$20,000. At the same time, there are still no signals for an end to the recently started pullback. In view of the relatively fresh stochastic sell signal, there is a distinct possibility that the correction of the last four weeks could extend significantly. However, if the bulls can keep the prices above US$29,000, the rally can continue at any time.

Bitcoin, Daily Chart as of February 2nd, 2021. Source: Tradingview

On the daily chart, the correction of the last three weeks had created a pretty oversold situation and thus a low-risk entry opportunity. Now that bitcoin quickly recovered from those lows around US$29,000, the good low-risk set up is certainly gone. Especially since a third attack pullback US$29,000 would now have to be interpreted as weakness.

But although the 200-day moving average (US$16,738) as well as the established support zone at US$20,000 are far away from current pricing around US$34,000, the setup looks promising. Based on the principle that a trend in motion is more likely to continue than to suddenly turn around, it is important to look for entry opportunities on the long side only (“buy the dip”). Bitcoin now has to surpass its recent high above US$38,600 to establish a short-term series of higher lows and higher highs. This would shift the daily chart clearly back into bullish territory.

Overall, the daily chart is coming out of an oversold setup recovering quickly, but somehow is still stuck in a downtrend short-term. However, bitcoin has now been trading around and above USD 30,000 for more than four weeks already. This means that a base is being formed from which the rally should continue rather sooner than later.

Sentiment Bitcoin – Consolidation brings new opportunities

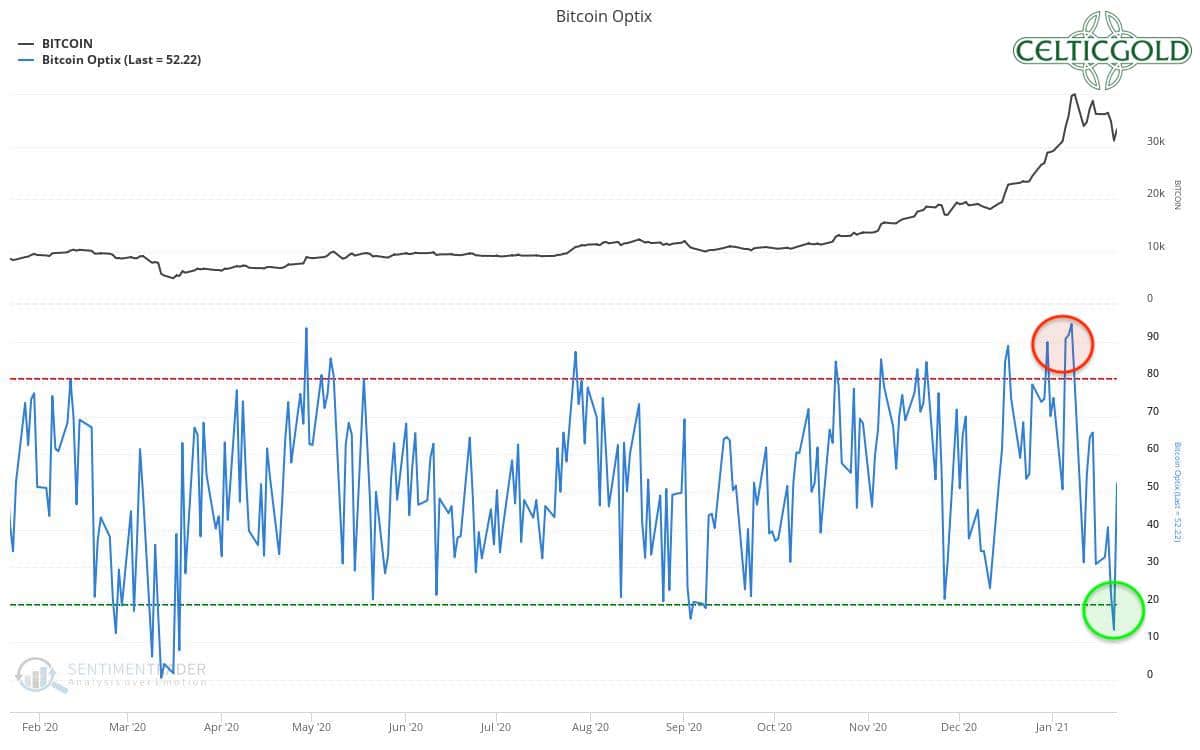

Bitcoin Optix as of January 24th, 2021. Source: Sentimentrader

The quantitative sentiment indicator “Bitcoin Optix” signaled a short-term exaggeration at the end of December and then especially at the beginning of January. However, the sharp pullback in the order of 31% completely cooled down any excessive optimism and even created a small panic among the weak hands in the short term.

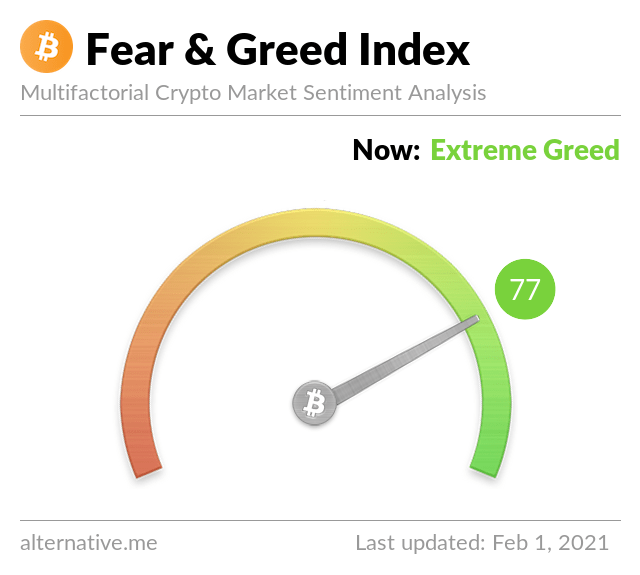

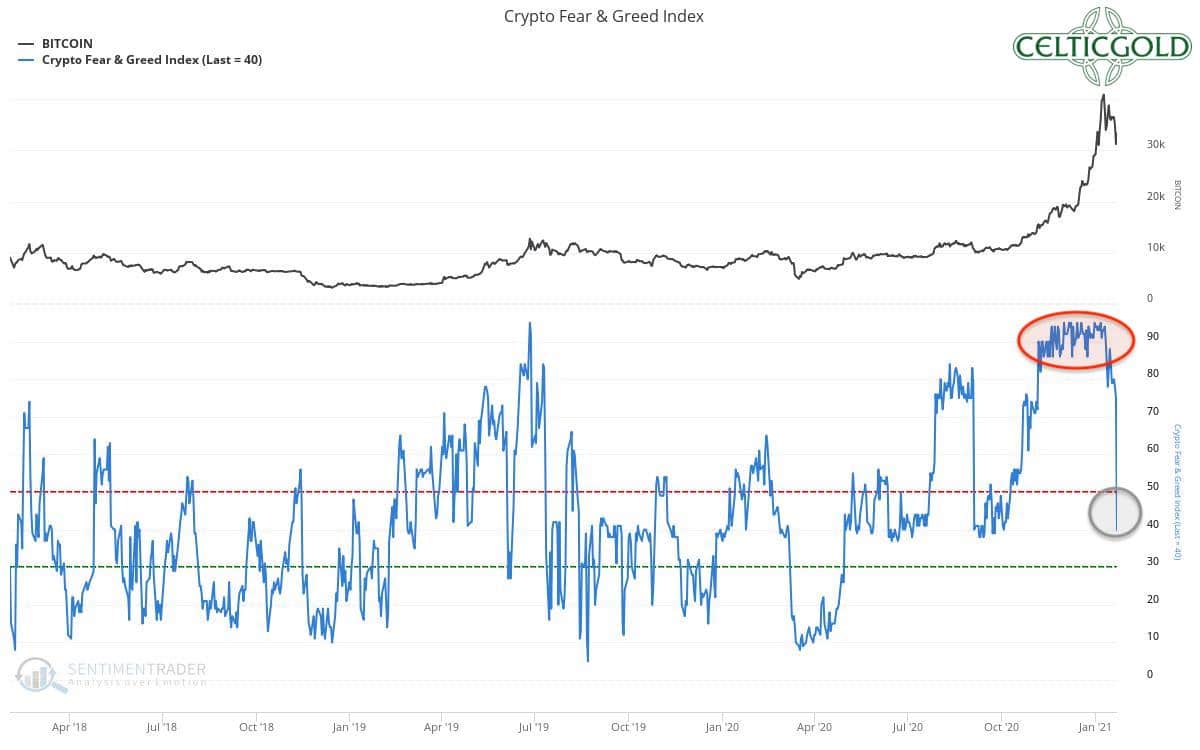

Crypto Fear & Greed Index as of February 1st, 2021. Source: Crypto Fear & Greed Index

The much more complex Crypto Fear & Greed Index, on the other hand, continues to measure an increased level of greed in the entire crypto sector. However, such conditions did persist for many months in the past.

Crypto Fear & Greed Index as of January 24th, 2021. Source: Sentimentrader

In a long-term comparison, however, the Crypto Fear & Greed Index has also declined significantly and currently reflects a rather balanced sentiment picture.

Overall, the overly optimistic sentiment has been cleared up surprisingly quickly due to the price decline from US$42,000 down to US$29,000. Hence, nothing stands in the way of a continuation of the rally from a sentiment perspective.

Seasonality Bitcoin – Consolidation brings new opportunities –

Bitcoin seasonality. Source: Seasonax

From a seasonal perspective, bitcoin has been most often moving sideways from mid o January until mid-April. Accordingly, the recently started correction could well drag on for at least a few more weeks.

Bitcoin seasonality in bull market years. Source: Seasonax

However, if we only use the price development in bull market years, the data set shrinks to the years 2010, 2012, 2013, 2016 and 2017. But at the same time, it becomes clear that in these years bitcoin always found an important low between mid-January and mid-February.

Overall, one would be well advised not to expect any exaggerated price explosions in the coming weeks. Statistically, these tend to occur in the months of April to June and October to December. However, the seasonal outlook for the next one to two months is not really unfavorable either.

Sound-money: Bitcoin vs. Gold

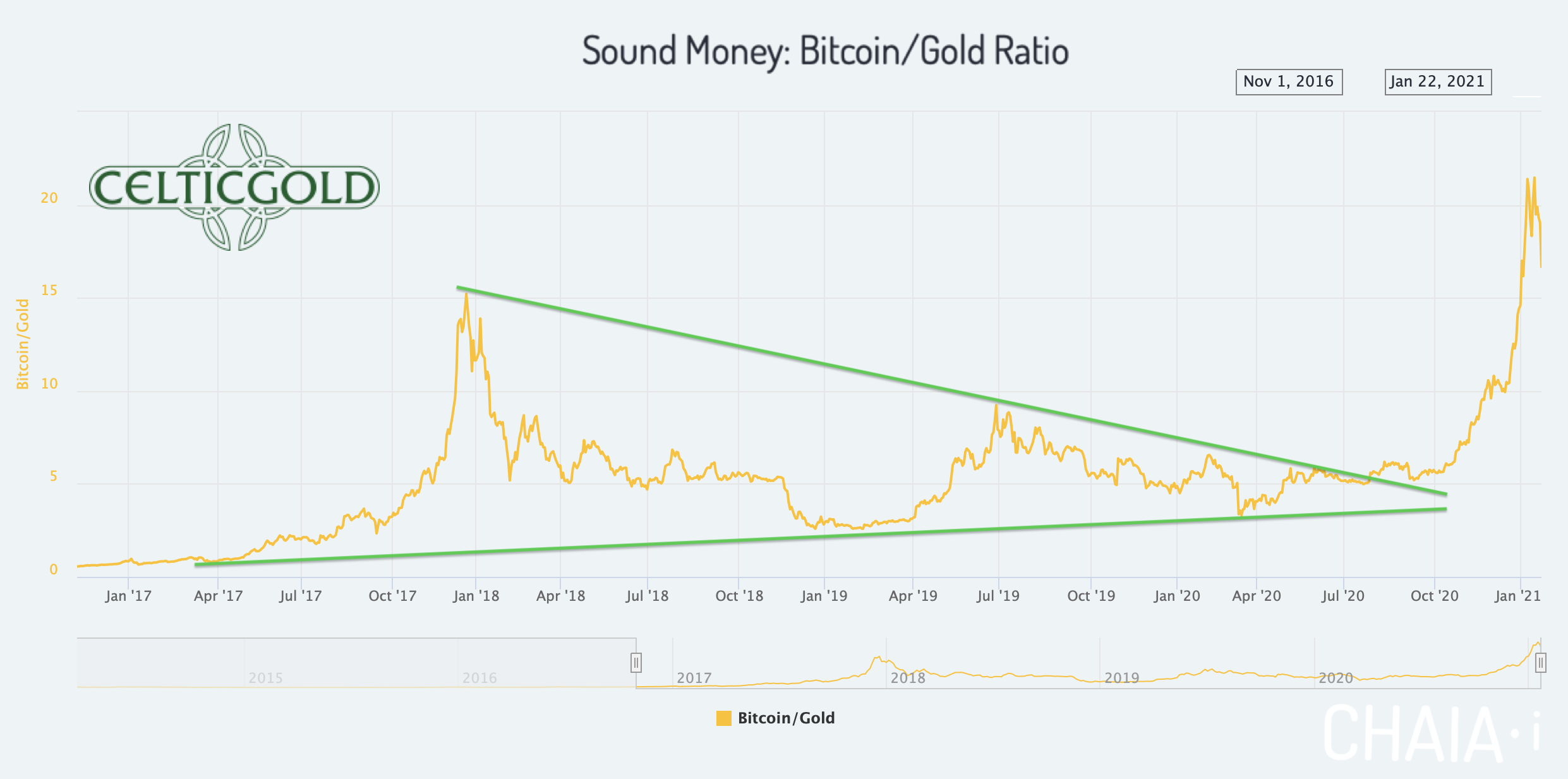

Sound Money Bitcoin/Gold-Ratio as of January 25th, 2021. Source: Chaia

With current prices of US$33,650 for one bitcoin and US$1,864 for one troy ounce of gold (GLD), the bitcoin/gold ratio is currently around 18.05, i.e., you currently have to pay more than 18 ounces of gold for one bitcoin. In other words, one troy ounce of gold currently costs only 0.055 bitcoin.

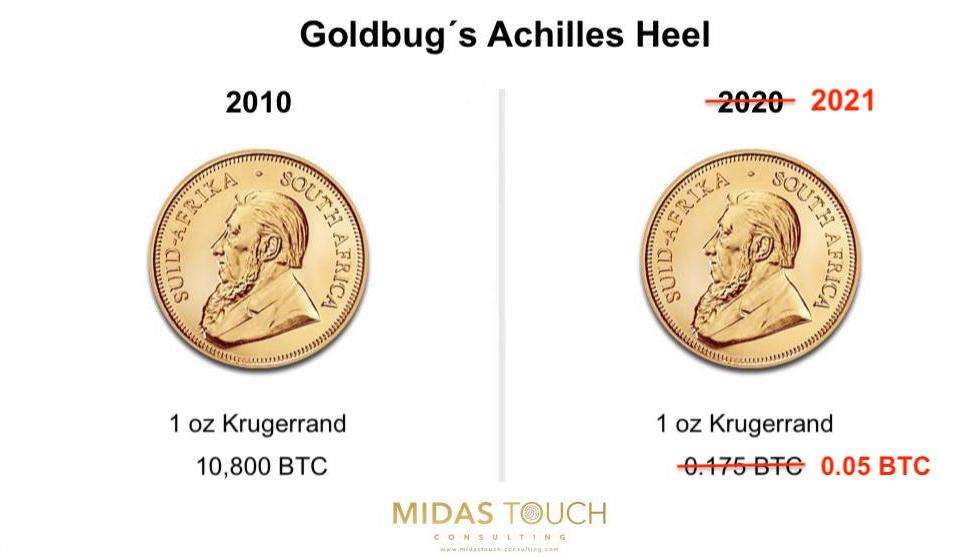

Goldbug´s Achilles Heel, Source Midas Touch Consulting January 25th, 2021.

This means that bitcoin´s outperformance against gold has clearly intensified in the past two months. An end to this major trend is not in sight. Quite the contrary, despite possible short-term fluctuations and countertrend moves, gold and silver are more likely to lose further against bitcoin.

You want to own Bitcoin and gold!

Generally, buying and selling Bitcoin against gold only makes sense to the extent that one balances the allocation in those two asset classes! At least 10% but better 25% of one’s total assets should be invested in precious metals physically, while in cryptos and especially in Bitcoin one should hold at least between 1% and of 5%. If you are very familiar with cryptocurrencies and Bitcoin, you can certainly allocate much higher percentages to Bitcoin on an individual basis. For the average investor, who is normally also invested in equities and real estate, more than 5% in the still highly speculative and highly volatile Bitcoin is already a lot!

Opposites compliment. In our dualistic world of Yin and Yang, body and mind, up and down, warm and cold, we are bound by the necessary attraction of opposites. In this sense you can view gold and bitcoin as such a pair of strength. With the physical component of gold and the digital aspect of bitcoin you have a complimentary unit of a true safe haven for the 21st century. You want to own both! – Florian Grummes

Macro Outlook

Source: Investing.com

With the inauguration of Joe Biden, the political circumstances in the USA have shifted significantly, but the loose monetary policy of the last twenty years is likely to continue and intensify significantly. The prices for gold and silver, as well as for bitcoin, will therefore continue to be driven upwards in the medium term by the constant expansion of the money supply.

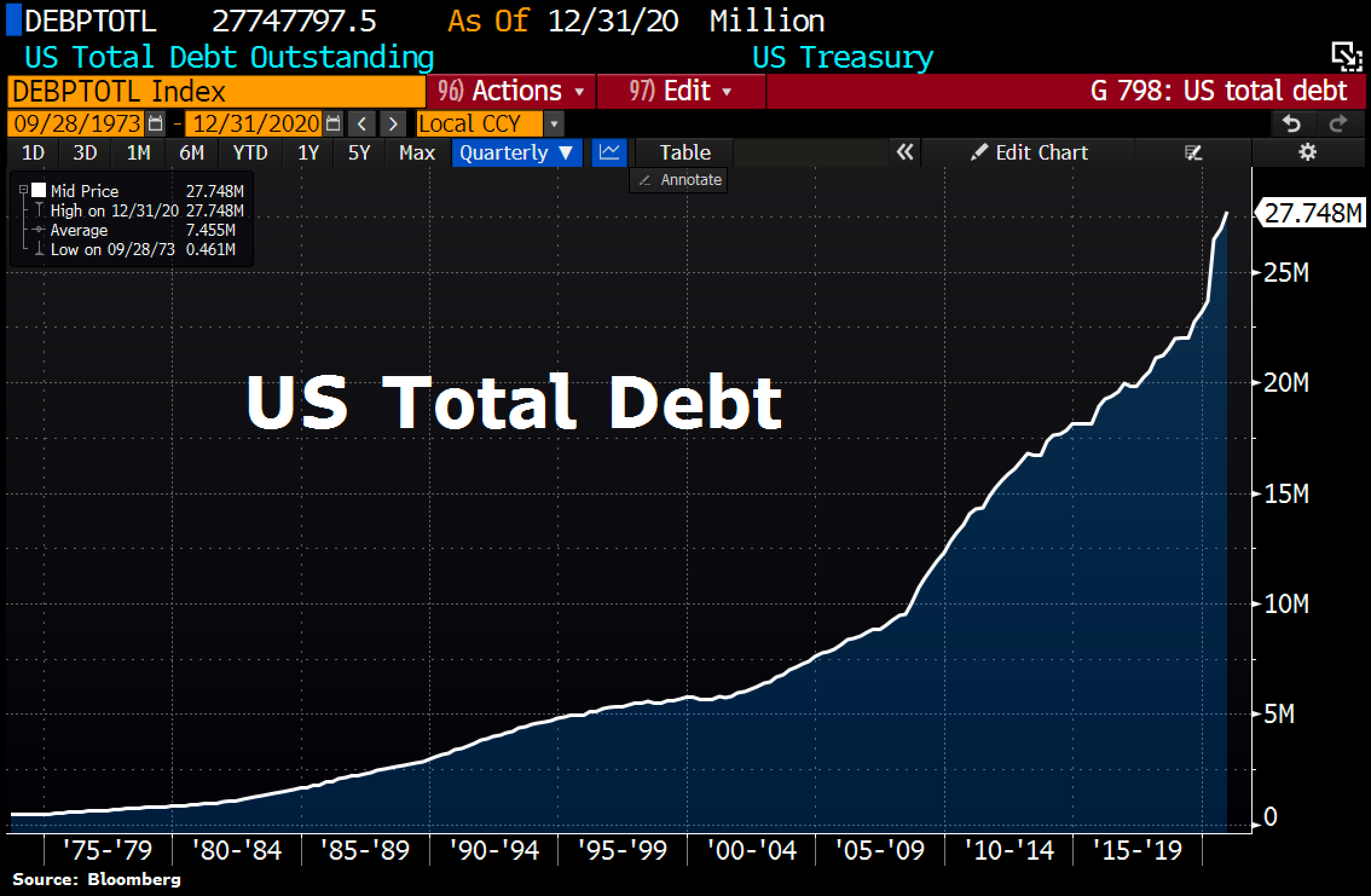

US Total Debt, © Holger Zschaepitz. Source Twitter @Schuldensuehner, 20. Januar 2021

The monetary policy, backed by nothing but the blind trust of the citizens, had already led to an unprecedented debt orgy in the USA since the end of the gold standard in 1971. The record-high US national debt was further exacerbated by the Corona crisis in 2020 and is now rising parabolically. The same applies to pretty much all other countries and currency zones on our planet.

Global Stock Market Cap, © Holger Zschaepitz.. Source Twitter @Schuldensuehner, 24. Januar 2021

Driven by the constant currency creation, the market capitalization of global stock markets therefore continues to rise. It is important to realize that the stock markets no longer reflect the real economy as they used to. The only thing that matters is the constant expansion of liquidity via central bank balance sheets.

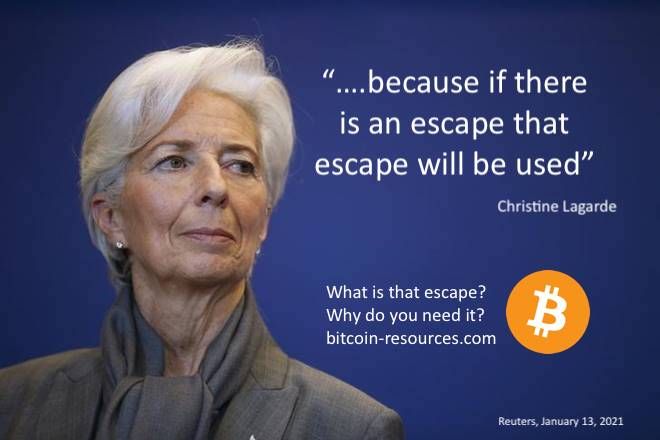

Source: Bitcoin Resources

The unregulated and decentralized Bitcoin is therefore increasingly a thorn in the side of central bankers and politicians. After all, the irresponsible central bank policy can be recognized quite easily here. One can even say that in view of Bitcoin prices above US$30,000, the hyper-inflationary tendencies of fiat currencies are already becoming visible here. Whereas in the gold market one can always intervene in a depressing way on prices via so-called paper gold, the short-selling attacks on the Bitcoin markets are collapsing like a soufflé due to the digital scarcity. The decentralized structure of bitcoin is also a phenomenon that the technocrats will not be able to deal with, even with a ban.

However, we have to assume that in the coming months or years there will be a concentrated attack on bitcoin by central bankers and politicians. However, the more institutional capital is invested in Bitcoin, the more difficult this undertaking will be.

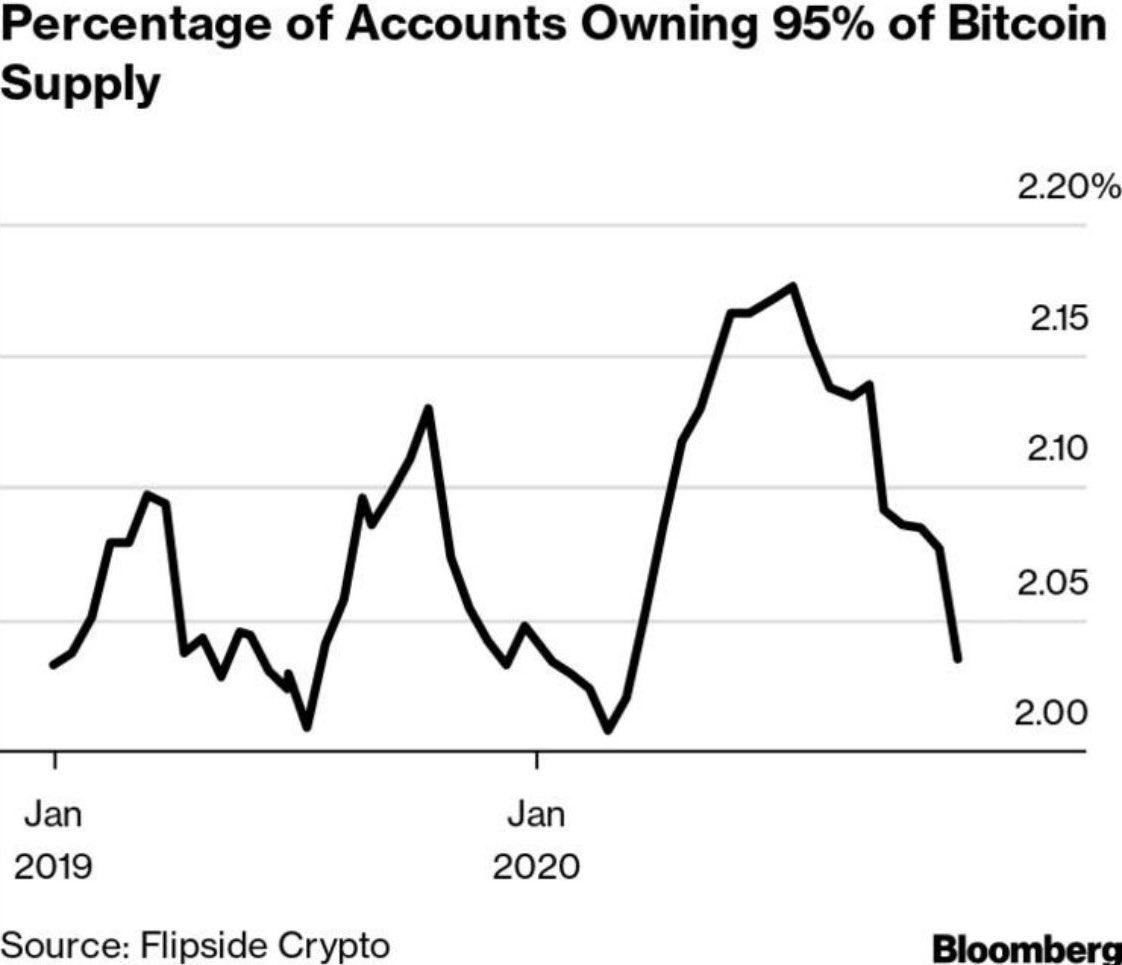

Source: Flipside Crypto

A real point of criticism, on the other hand, is the extremely unbalanced distribution of the Bitcoins mined so far. Slightly more than 2% of the wallets hold 95% of the Bitcoins. This threatens to create a new power structure that can manipulate Bitcoin prices in its favor at will.

Bitcoin – Consolidation brings new opportunities

Source: Messari December 28th, 2020

Bitcoin is undoubtedly in the middle of a new bull market. The final top has not yet been reached by a long shot. Prices around US$100,000 and possibly even above US$300,000 are quite conceivable in the next 10 to 24 months. The main drivers will be an institutional buying spree, as these institutional investors will come under an increasing pressure due to rising prices.

Of course, there will be some brutal pullbacks on the way to higher prices. To be able to profit from this bull market, you need to be patient. And you really need to have internalized the so-called “Hodl” strategy.

In summary, bitcoin is consolidating at high level trying to build a new base. This consolidation may well last a few more weeks and could also bring lower prices. More likely, however, is a continuation of the rally towards US$50,000 in the near future already.

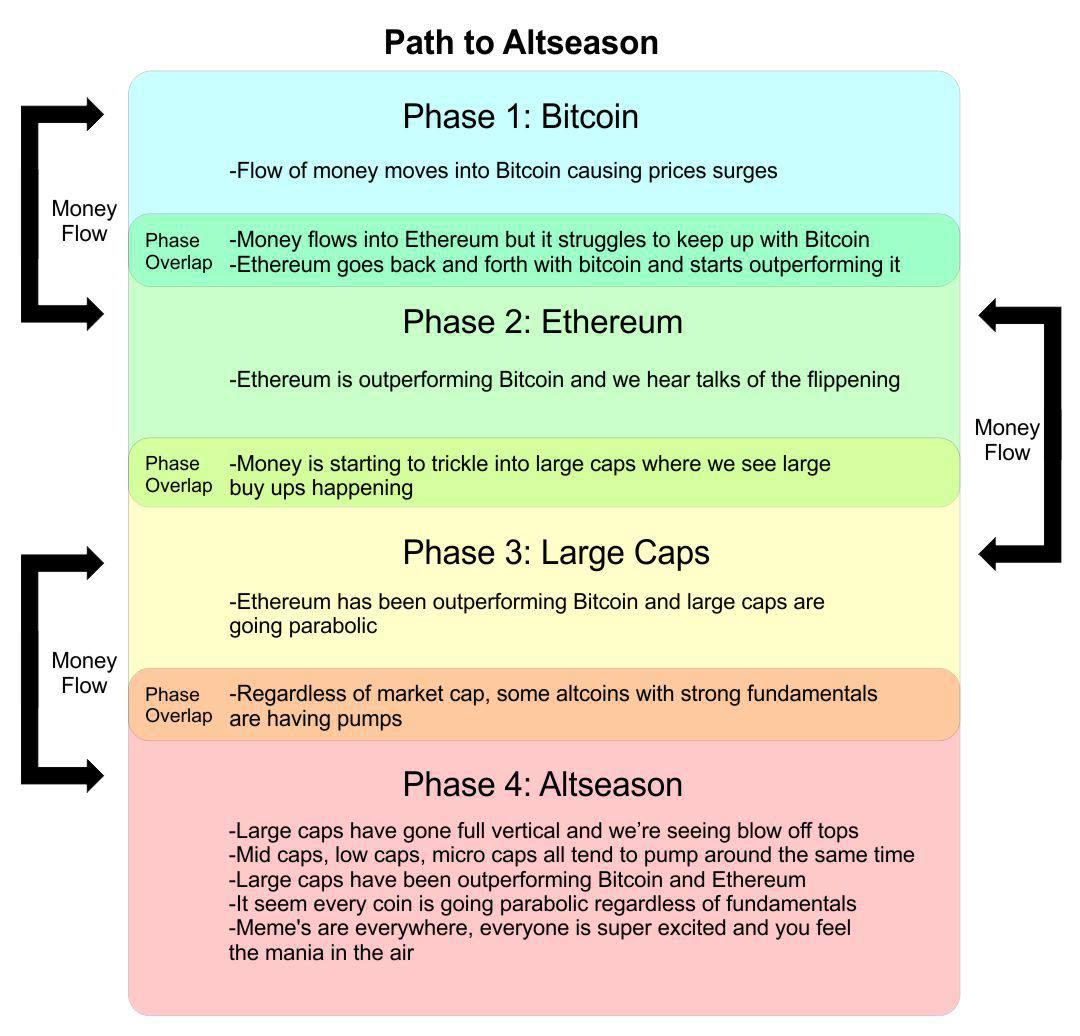

Source: Regard News

Also, it more an more smells like “altcoin season”. Bitcoin prices have already doubled from the old all-time high. Then, in the last four weeks, Ethereum also reached its December 2017 high around US$1,400. In the next phase, Ethereum (ETH-X) should outperform Bitcoin. Afterwards, the smaller altcoins will explode. This time, the highflyers are likely to be in the booming DeFi sector. However, anyone who wants to play along here has to practice tough risk management and take profits regularly and quickly.

Disclaimer: All published information represents the opinion and analysis of Mr Florian Grummes & his partners, based on data available to him, at the time of writing. Mr. Grummes’s ...

more