Bearish For Natural Gas Prices, Soybeans Deeper Into March

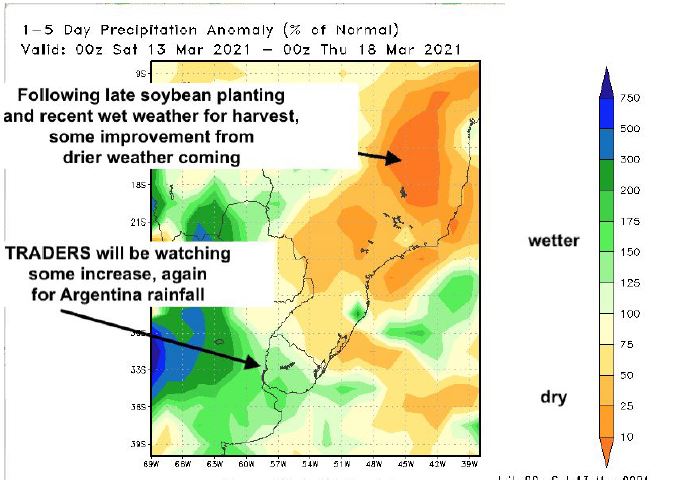

The wild swings in soybean prices are due to the very tight old crop stocks, reduced Argentina crop from dry weather, harvest delays to the Brazil crop and near record high Palm Oil and China soybean prices.

It is hard to gauge from one day to the next, which outside fundamental factors will influence soybeans. If the Brazil harvest improves a bit with drier weather in the north with some rains in the south, it may create a sell-off in May and July soybeans again. Though again, this market is difficult to trade, short term right now.

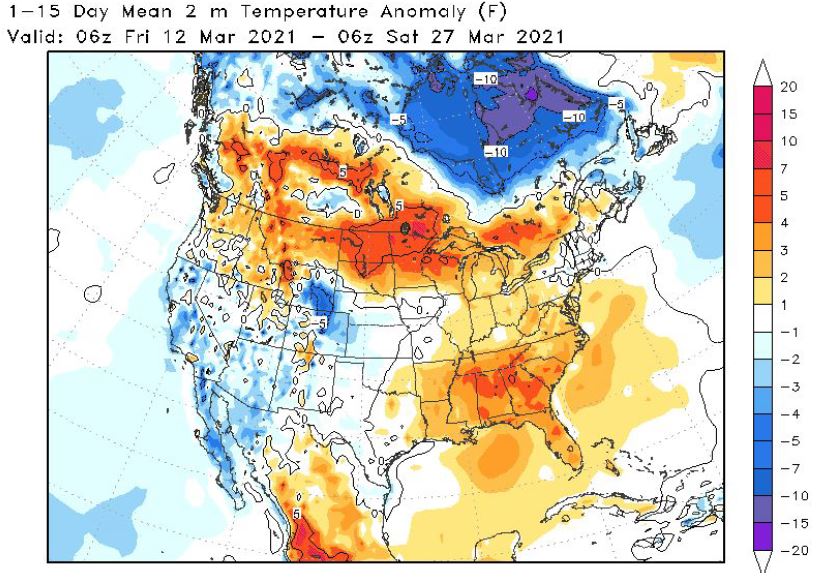

Shoulder month and no extreme cold still leans bearish for natural gas prices

I was lucky enough to catch the move up in natural gas on the Arctic Pig and massive February cold spell but became bearish around $3.00 calling quite early the “big mid-late winter” warm-up.

This being a “shoulder month” for the natural gas market, without any extreme cold weather is still potentially bearish heading into April.

Renewable energy stocks soar after my buy recommendation

I am constantly doing research about new technologies around the world, with respect to a warming planet, environmental hazards brought on by CO2, etc., etc. My thoughts about certain stocks that I favor are shared with premium members of our service. They have partaken in a massive 20-40% rally last week.

These companies have been “under my microscope” as the world goes into more of a “green economy” for investment decisions. Not only do I list my preferences (which stocks to consider the most), but I also suggest specific trade strategies for both the aggressive and the conservative investor.

Calling the bear market in wheat. What about corn?

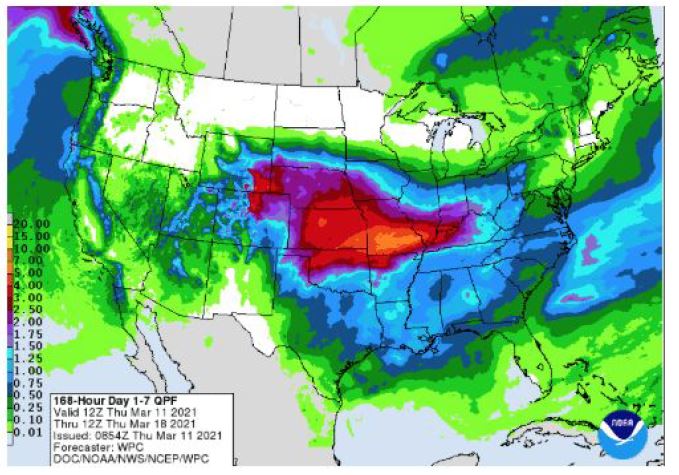

The map above shows rainfall across the Plains and Midwest from late last week through much of this week. Areas in red are more than 2-3″. I began predicting this quite early, about 7-10 days ago, and suggested adjusting our portfolio accordingly as per my more bearish outlook in wheat.

Drought to east next 2 weeks in midwest corn belt and wheat areas with Colorado seeing feet more snow

The drought above is easing and a key reason for my bearish attitude in wheat. This may also keep new crop corn in check until we get through the March 31st planting intentions report. Right now, the drought easing is potentially more “psychologically bearish December” corn than anything else. There is still a chance for planting delays from wet weather this spring and a hot, dry summer, but in the short term, the weather may be looked as a bit bearish new crop.

2021 Cocoa crop should be huge with improving weather

Farmers across the country, the world’s top cocoa producer, told Reuters on Monday that medium and large-sized pods were ripening on the trees and that harvesting would start soon. Rain in early March, when the dry season ends, would ensure a large and healthy harvest in the early months of the mid-crop, which runs from April to September.

An increase in rainfall as the maps show below will abate any short-term concern about dry weather in West Africa. Overall, the 2020-21 crop should be large and a bearish aspect to the market. What will happen to deepen into summer? Stay tuned.

After four winning cocoa trades in 2020 on the spread-sheet, weather is net bearish cocoa, but the end of the pandemic and possibly great demand, plus this seasonal below showing that cocoa usually rallies into April and May means I will not advise.

(Click on image to enlarge)

The table above shows entering into a long position in cocoa in mid-March has worked 13 of the last 15 years until early May. However, with improving West African weather, we see no reason to buy, other than on outside market factors and seasonal tendencies in cocoa.

Brazil Coffee: the crop keeps coming down

The coffee market has been caught between large nearby stocks and the weaker Brazil Real (bearish), vs the lower Brazil crop from dry weather last year.

The coffee market bottomed last week as the Brazil Real rallied. I still think that come spring or summer, prices in the $1.40-$1.50 range is a possibility once the harvest comes on and supplies are less burdensome, later.

This is an excerpt from James Roemer's premium subscription newsletter. Try a free trial subscription by clicking here.