Bakken Update: Tracking Oil E&Ps With The Lowest Breakeven Prices - Part 2

Reeves County continues to have one of the lowest breakeven oil prices in the US. There is upside to Reeves' producers as the play is relatively new. Operators are well positioned even with lower for longer oil prices.

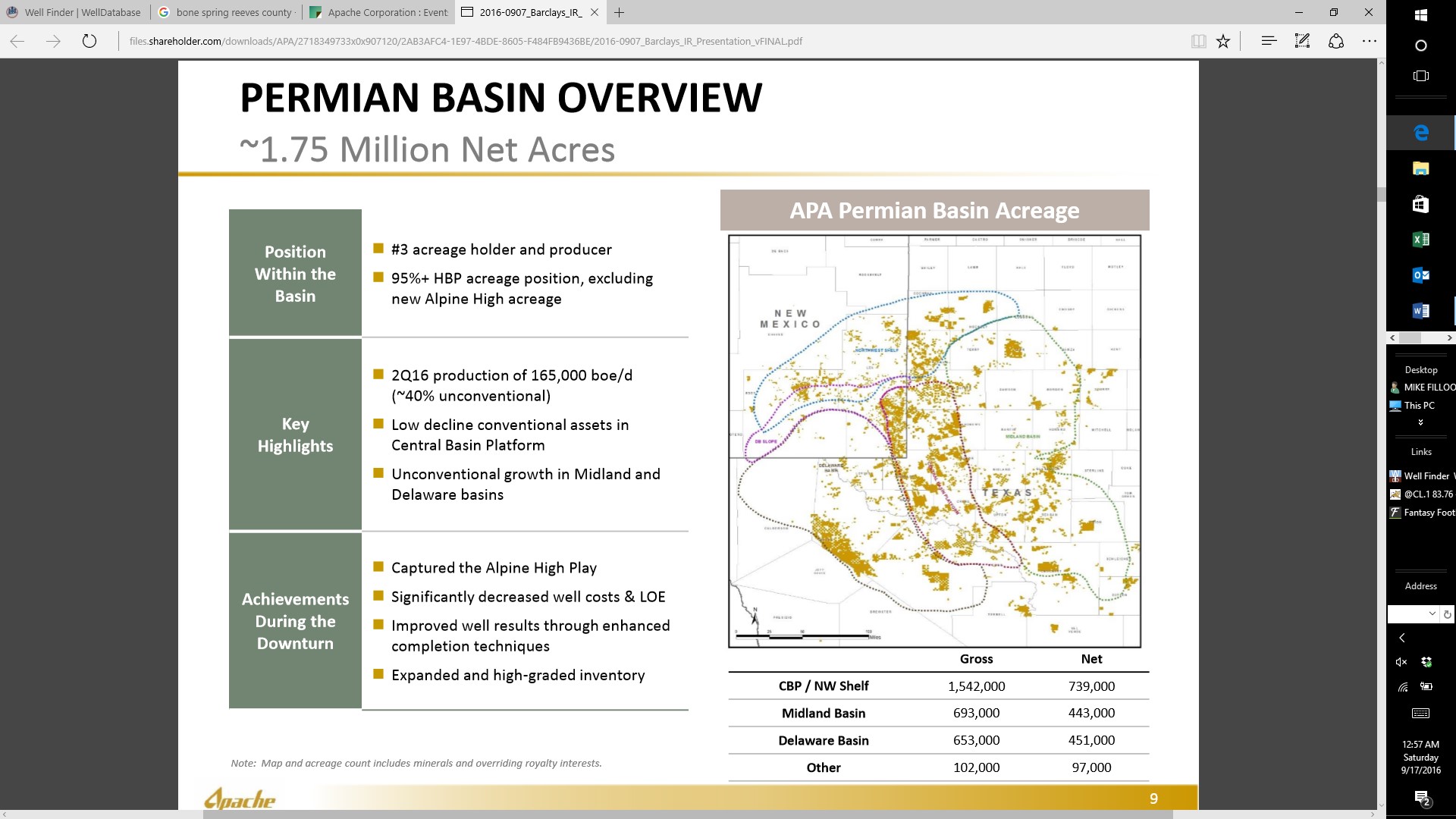

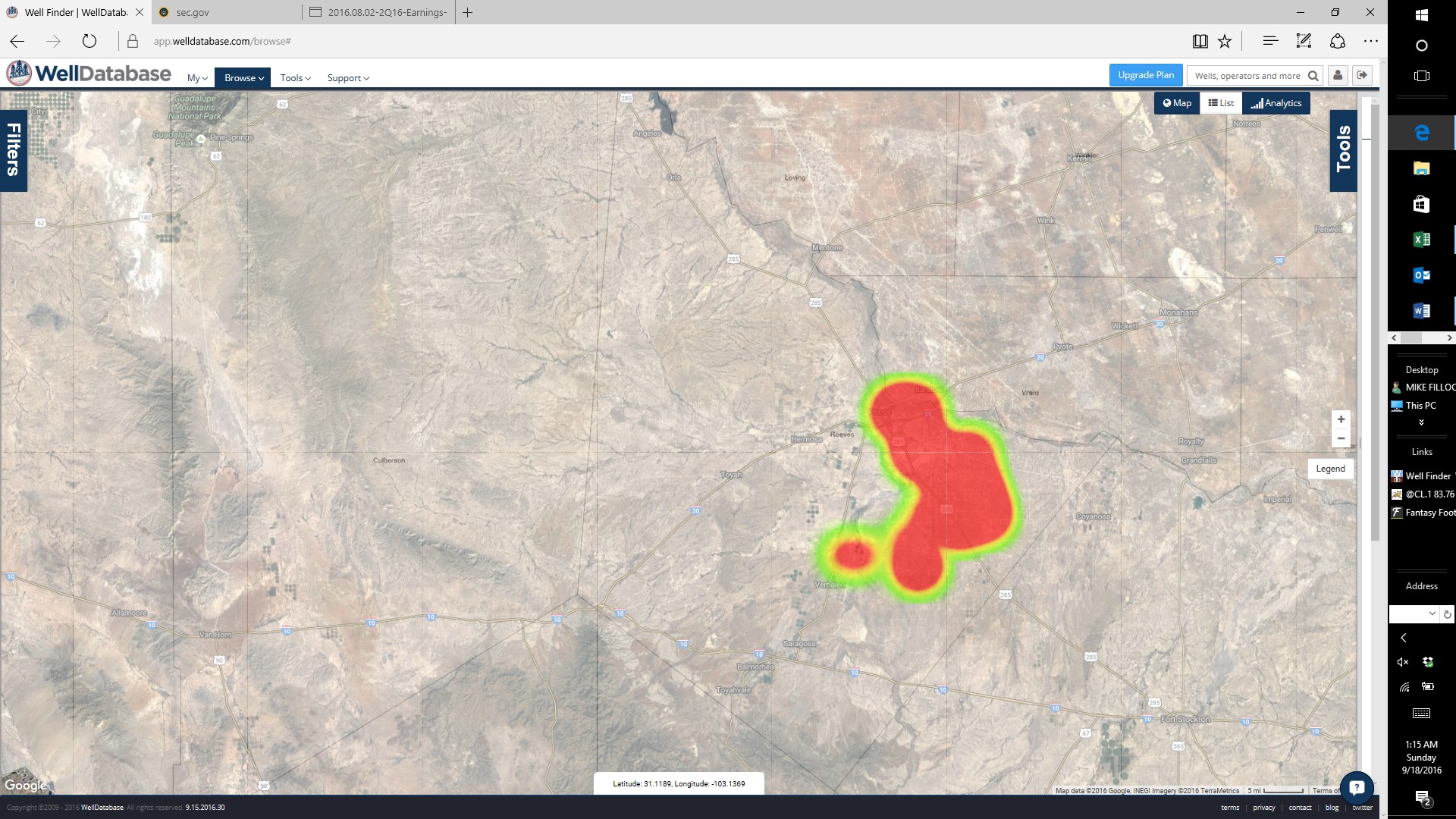

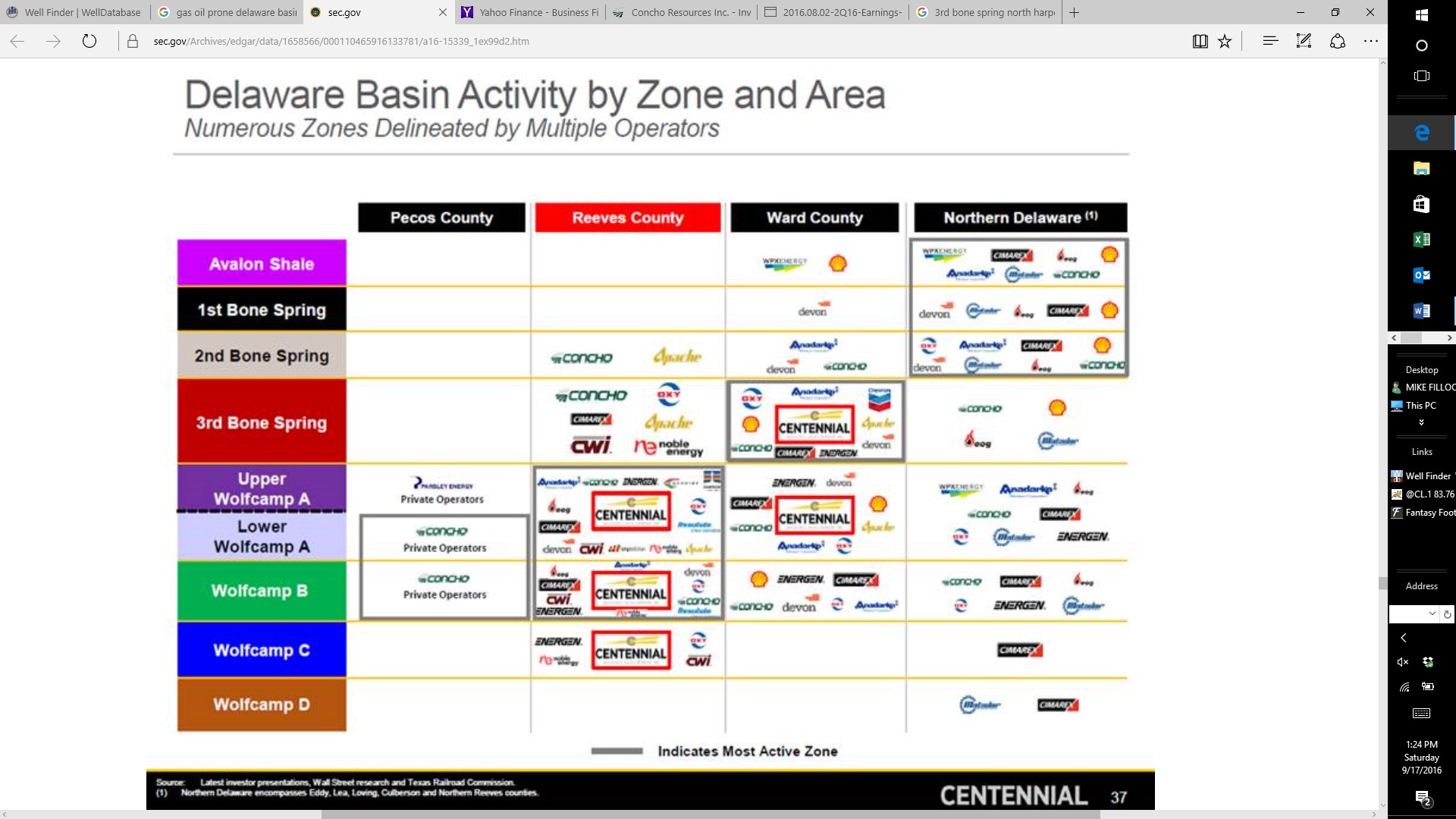

Occidental (OXY) has been the most active. It is followed by names like Concho (CXO), Anadarko (APC), Apache (APA), and EOG Resources (EOG). Concho is the top oil producer although it does not have the largest number of completions. Most of the activity has been to the northeast, but compared to the Midland Basin it is still a mystery. There are several intervals over many sections untested, and this is why an operator like Apache (APA) can make one of the biggest discoveries in years. The Permian Basin is its focus, with a very large and growing leasehold.

(Source: Apache)

It has more than 1.7MM net acres in the Permian, and 420,000 in the Delaware Basin. It has the 3rd greatest Permian foothold, and is also the 3rd largest producer.

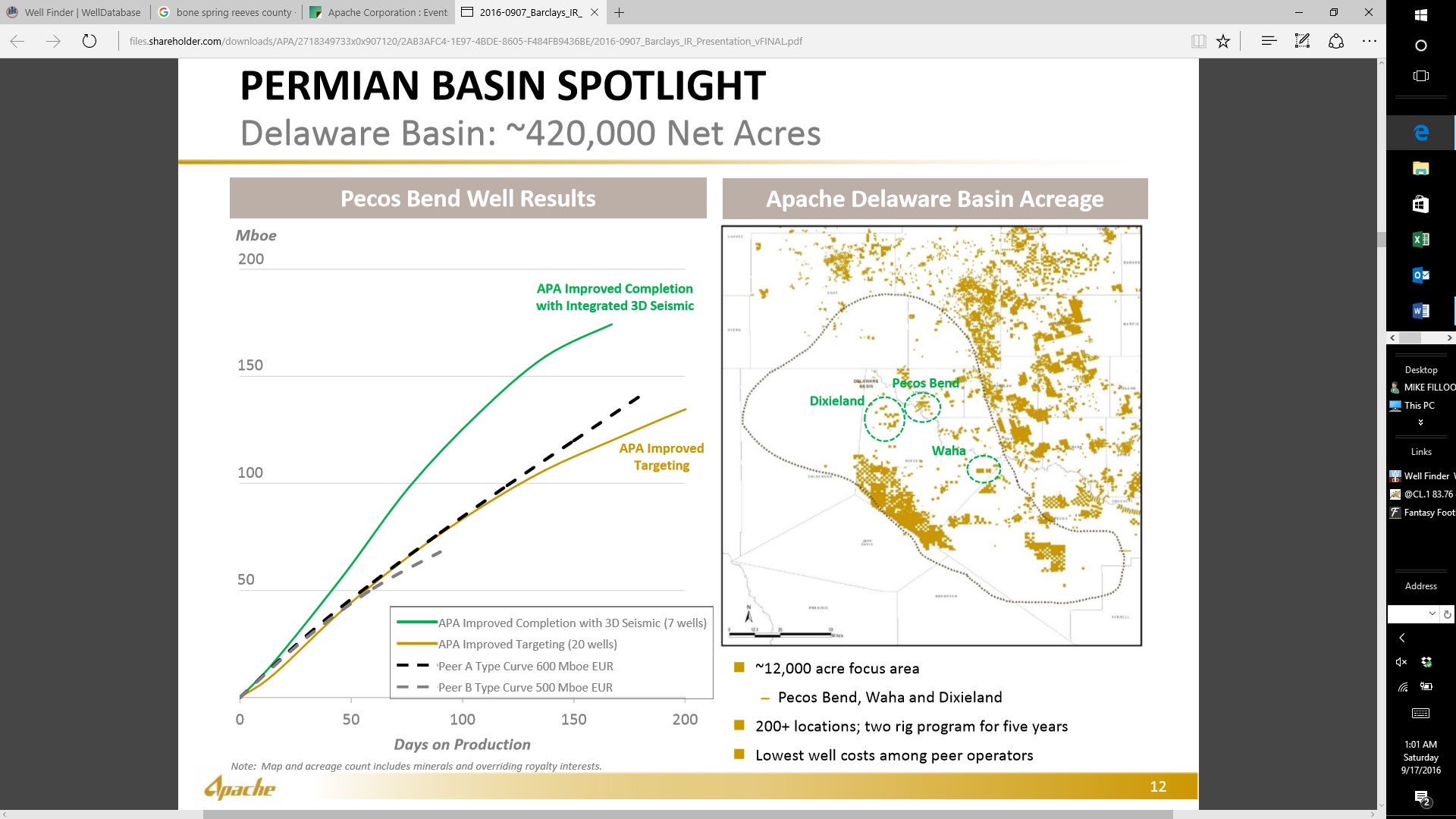

(Source: Apache)

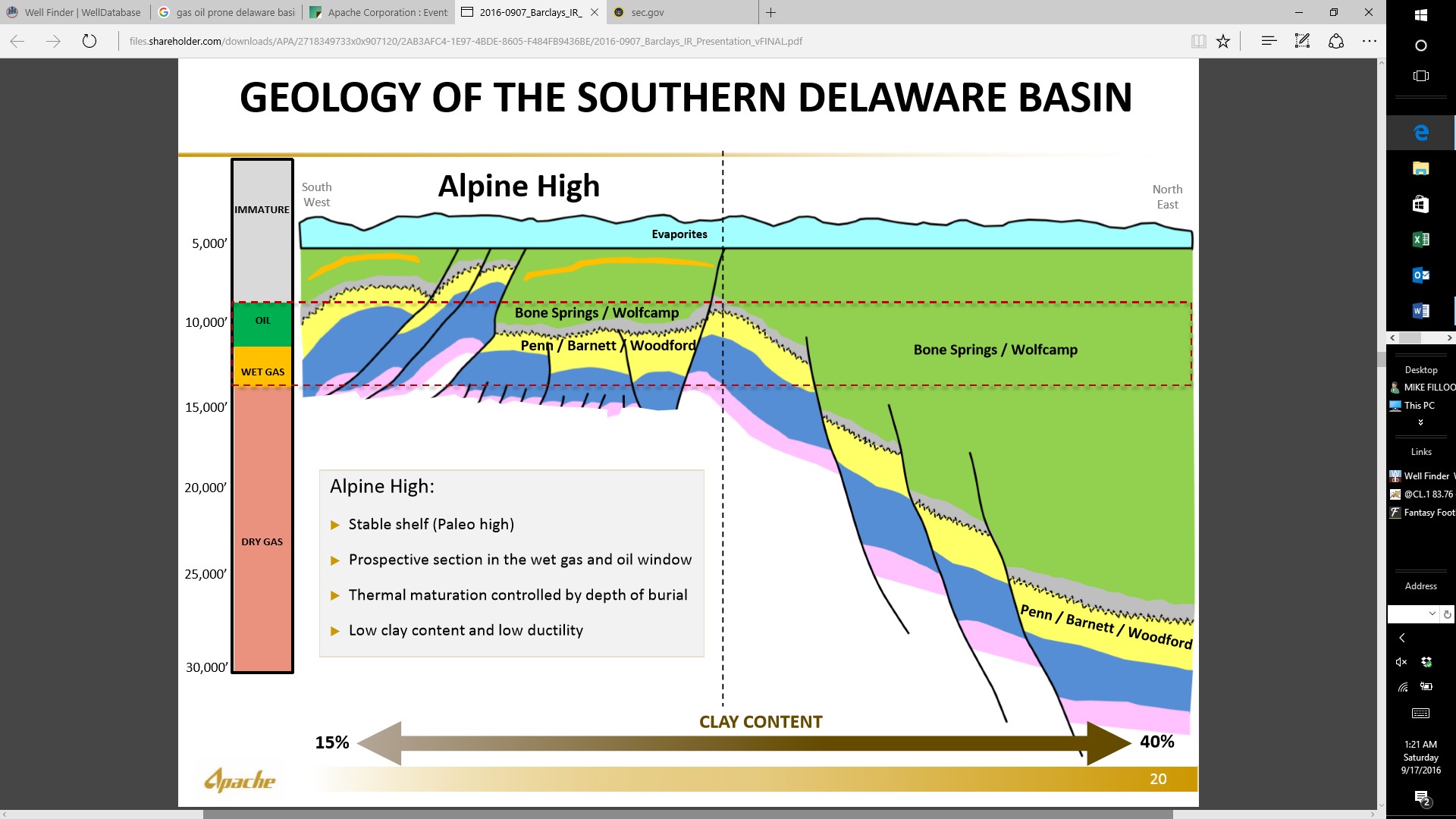

Almost all of its acreage is in the Alpine High. This is the large contiguous position in the southwest. It was once thought the Alpine couldn’t support unconventional development. We now know the shelf is stable, and this high pressure Barnett/Woodford target is not all natural gas. This source rock produces very little water, which makes the play as prolific as any other in the country. It contains an estimated 75 Tcf of natural gas and 3 billion bbls of oil. Only 19 locations have been completed by Apache, so we are unsure how far the play advances to the northeast.It is possible operators like Silver Run (SRAQ) (SRAQU), Concho (CXO), and Clayton Williams (CWEI) could have Alpine leasehold but it will take time to tell.

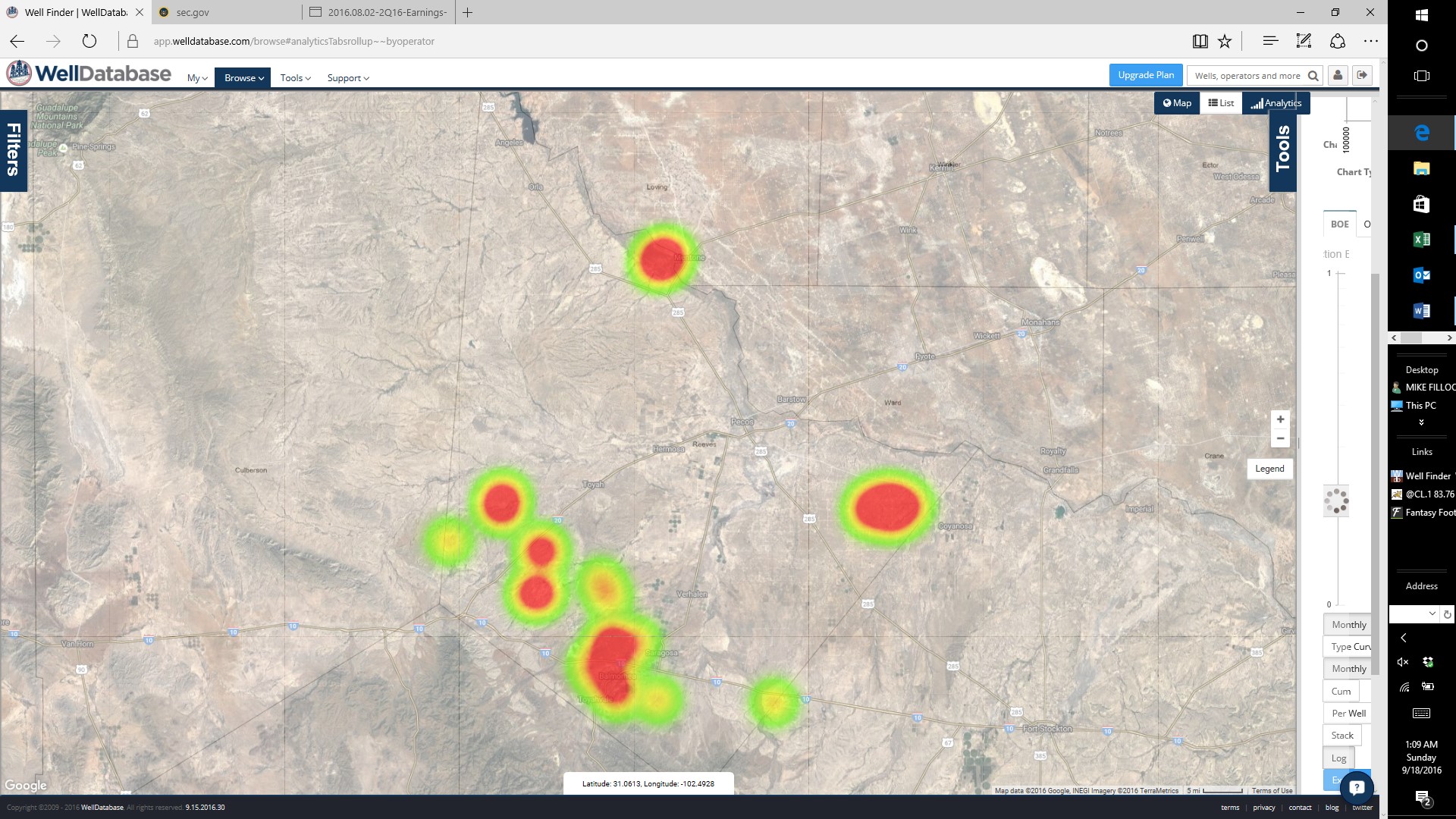

(Source: Welldatabase.com)

The map above provides a more exact location of Apache production. It provides its northern, eastern and Alpine High prospects. It has acreage all around Reeves County, and the north has several productive intervals including the Bone Spring. It is on the border of the gas and oil prone areas.

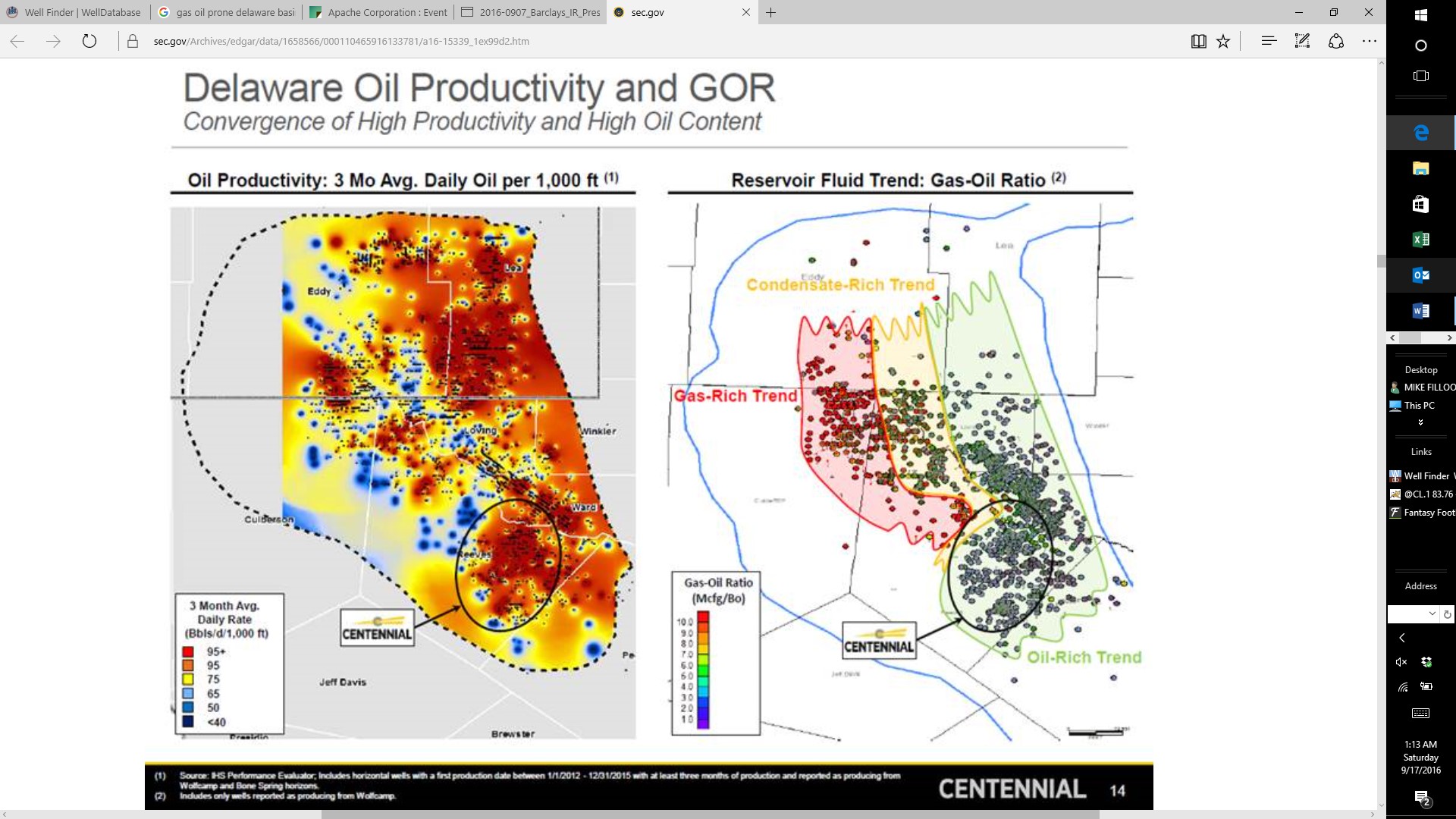

(Source: Silver Run)

Silver Run provides an excellent look into the basin. Locations with a higher percentage of oil are to the east and south. The percentage of gas increases to the west. Currently the best IP rates are coming from southwest Lea, western Ward and eastern Reeves counties. The oily side of the play close to the gas and condensate trend borders are best. The increased well pressures from higher gas and condensate percentages help to push oil up and out of the wellbore quicker. The map also shows some sporadic locations of very good wells in northern Reeves, but that has been developed slower than to the east.

The Alpine High has also had successful tests of both the Bone Springs and Wolfcamp. This is important, as the initial thought was the entire play was non-productive.

(Source: Apache)

Once past the Alpine, the Barnett/Woodford increases in depth and become uneconomic due to costs. The play may push out further to the northeast as these intervals dive at an angle, but may still be drillable.

(Source: Apache)

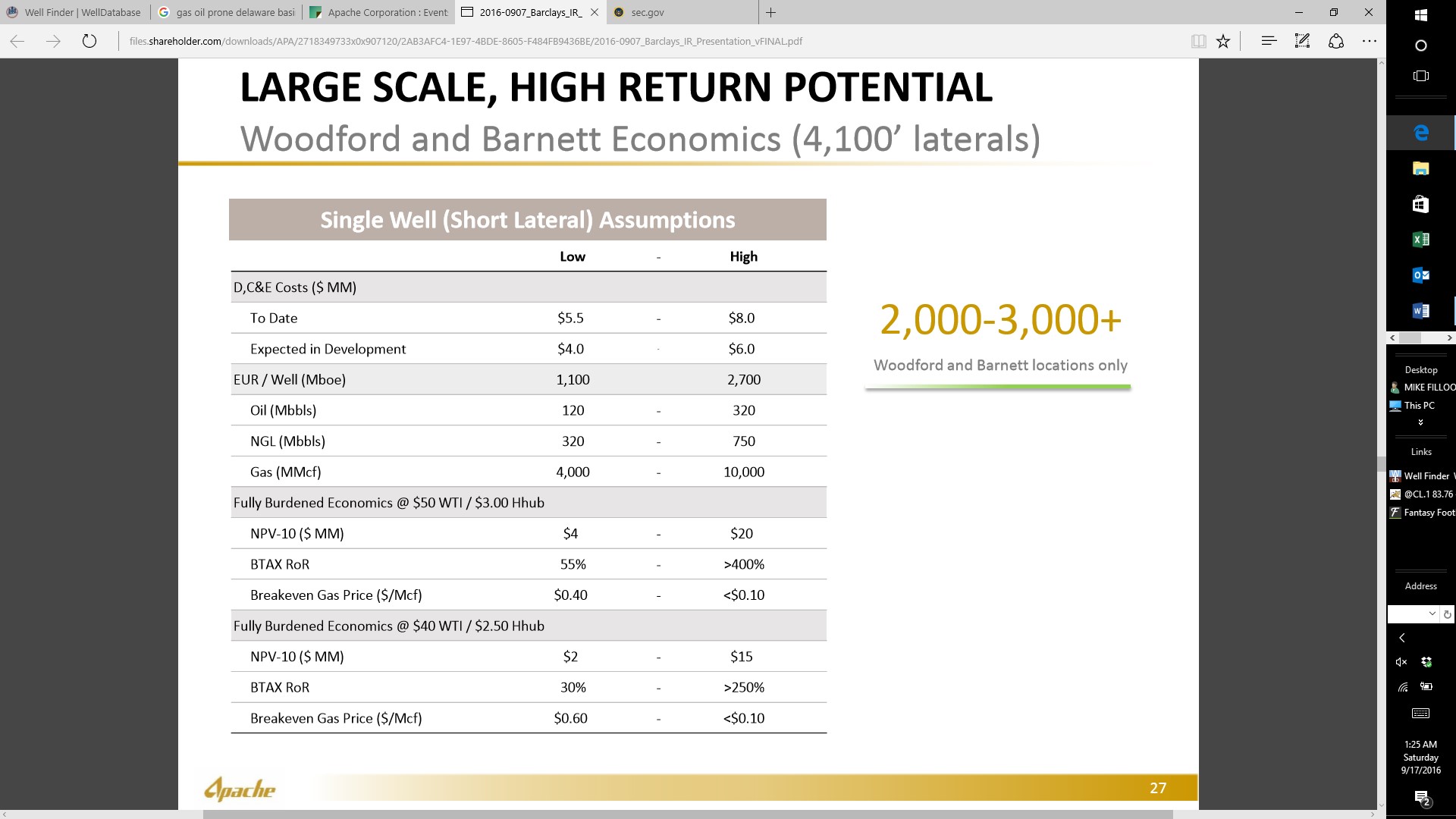

The high pressured part of the Barnett/Woodford reaches breakeven at a 10 cent per Mcf gas price. At $40/bbl WTI and $2.50/Mcf the wells have a NPV-10 of $15MM. At $50/bbl and $3.00/Mcf, the NPV-10 increases to $20MM. Estimates are for 320M bbls of crude, 750M bbls of NGLs, and 10,000 MMcf. Crazy good results from a play no operator tried to develop. There were a few natural gas locations that are dry holes.

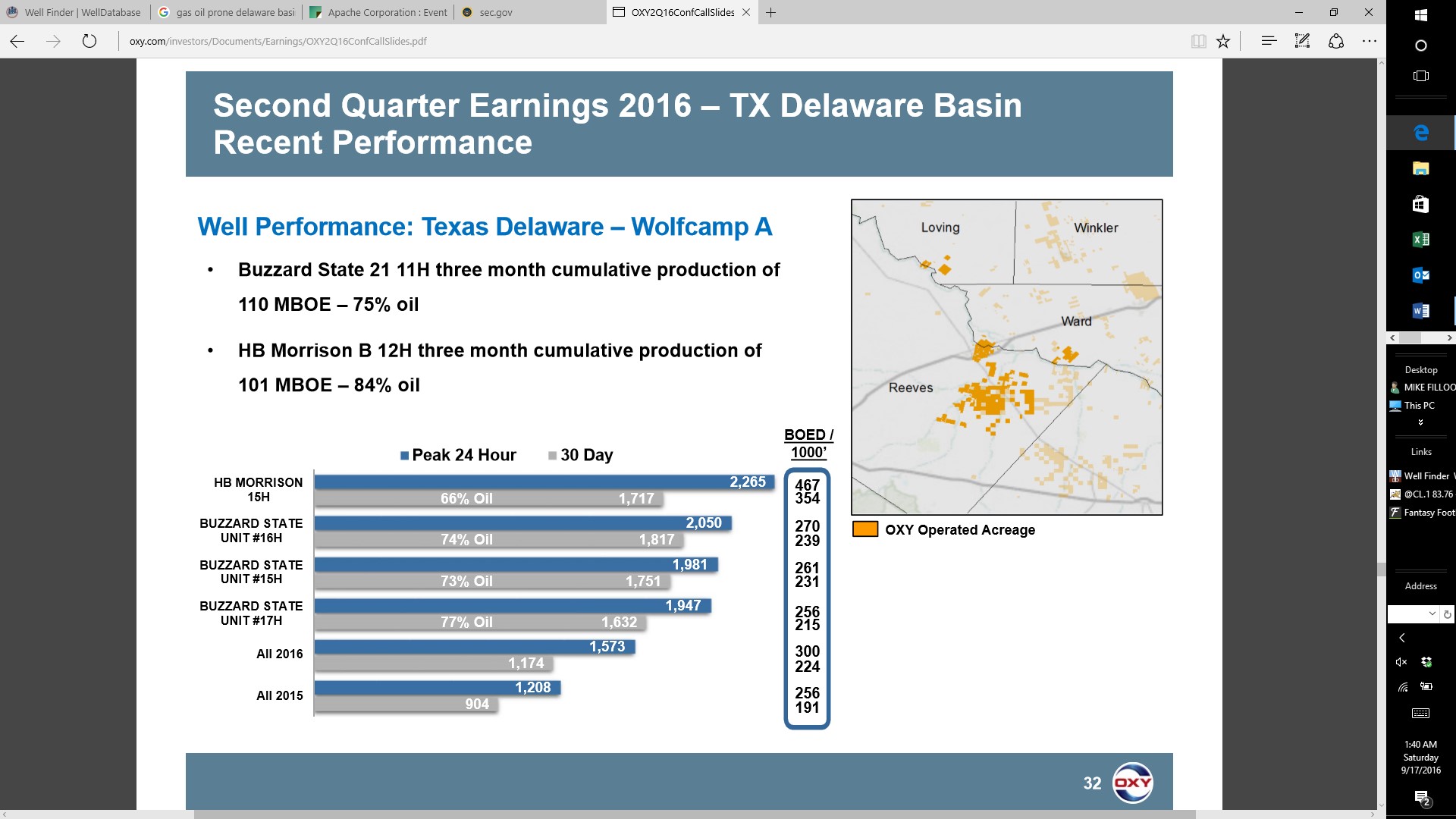

Occidental (OXY) also has a very large leasehold in the Permian. It operates acreage in western Reeves.

(Source: Occidental)

Its most recent completions have IP30 of 1,600 to 1,800 Boe/d. Wolfcamp A wells are producing 66% to 77% oil. In just 30 days, these locations are producing over 50MBoe. In 90 days, in improves to over 100MBoe.

(Source: Welldatabase.com)

Occidental is focused on eastern Reeves. This has turned out to be a very good area. The Wolfcamp has been very good as has the Bone Spring. It is located on the edge of oil and condensate windows. This has provided some very good well pressures.

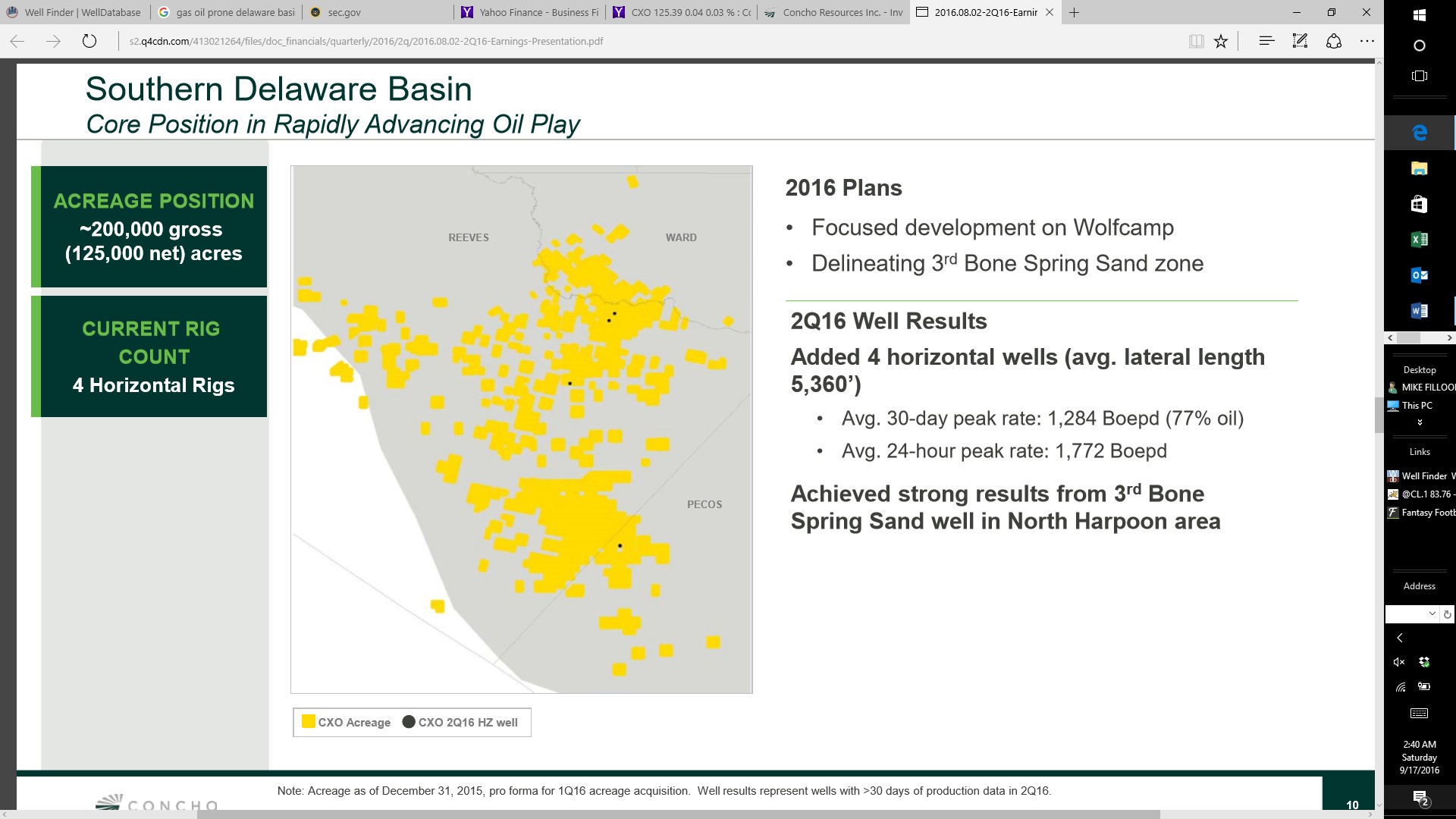

Concho (CXO) is another big player in the Delaware. It has 250M net acres in the north and another 125M in the south. It has a very large Reeves County leasehold and is one of the most active players with respect to de-risking. In all, it has over 1MM gross acres in the Delaware and Midland basins.

(Source: Concho)

It is very important for Concho to de-risk the 3rd Bone Spring in southern Reeves. It has a sizeable position currently outside what is considered a Bone Spring economic zone. Acreage valuations can increase significantly as intervals are proved.If this occurs there will be significant appreciation to the market caps of players in that area.

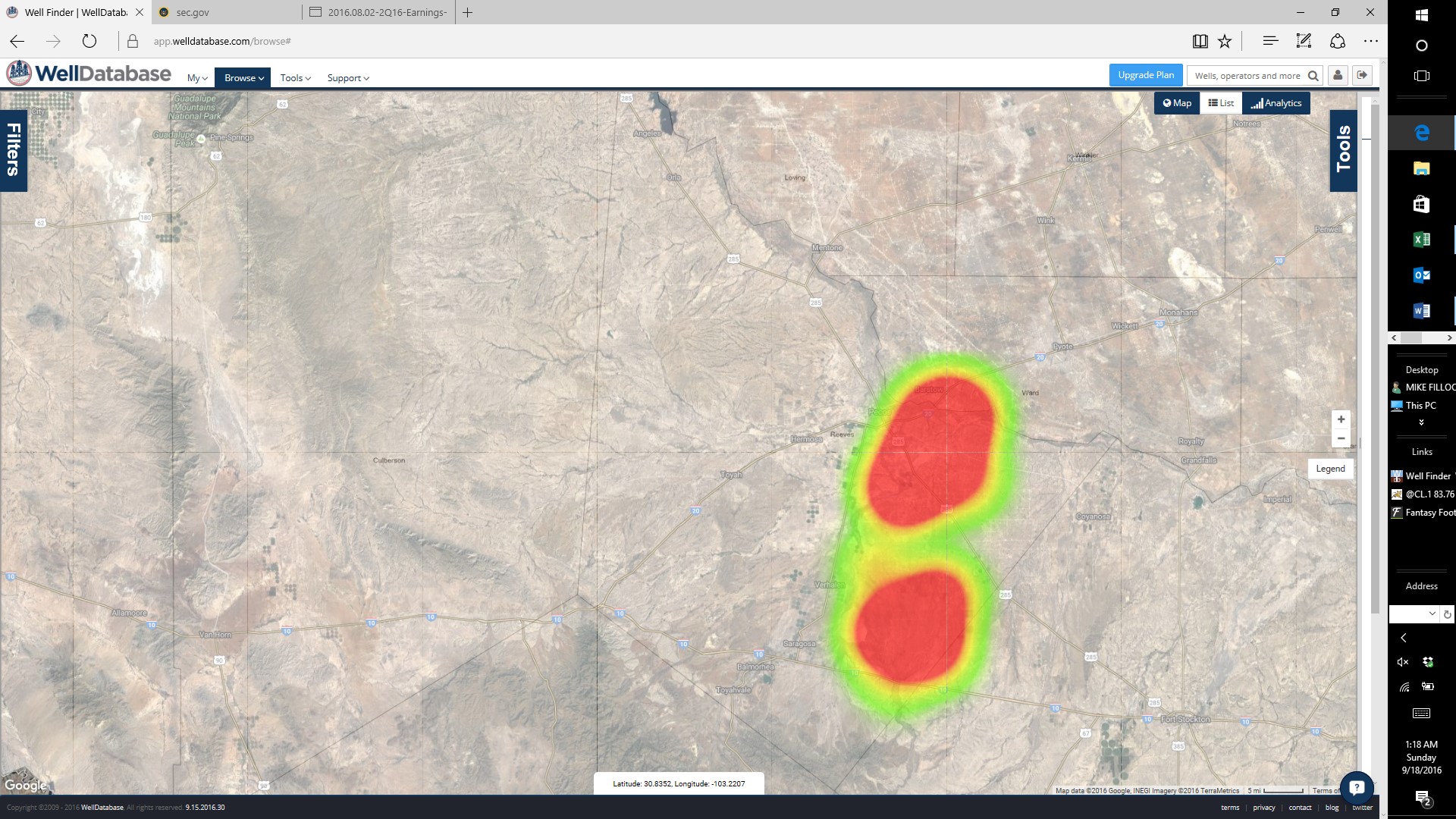

(Source: Welldatabase.com)

Concho’s production provides the tale of two prospects. The more northern acreage has seen more development. The southeastern part of the play may have more upside. It really needs a good Bone Spring well which would increase valuations, and benefit anyone there. There is a possibility this acreage is only prospective the Wolfcamp. If so, it is still a good area, just not as good as we hoped.

(Source: Silver Run)

Reeves County has seen completions across 6 intervals to date. To the north and east, there have been 2nd and 3rd Bone Spring plus the Wolfcamp source rock. The south and southeastern Reeves has seen little by the way of the Bone Spring. The de-risking of the Bone Spring has been slowed by low oil prices as operators focus on pad completions in intervals with better economics.

The number of operators in Reeves are well positioned.We like its low breakeven prices, and shallow decline curve. There is still more upside to this county than Midland in our opinion. It is a newer play and still could have upside through other untested intervals. The productive intervals are some of the best in the country, so activity will outpace other areas. Operators like Concho (CXO), Silver Run (SRAQ), and Apache (APA) will continue to produce better results. Breakeven prices should continue lower as operators get more comfortable with the geology.

Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access to additional ...

more