Bakken Update: Continental's (CLR) Mega Fracs Significantly Increases Oil Production

Improving well designs have increased US production and decreased breakevens. Estimates vary on improvements and we double check well results in hopes of pinpointing areas with upside.

CLR was late to move back to plug and perf. Its average production per foot was lower than many North Dakota operators, and we believe this could create great growth in 2017. CLR's large acreage position in the STACK/SCOOP is one of the best areas in the country and provides an area to develop until oil prices recover. We think oil is headed to $60 in the short term, and by the peak of driving season we could be pushing $74 as long as OPEC cuts production. The Dakota Access Pipeline (DAPL) will provide some differential relief. While CLR has a very large acreage in ND, it has much of it held by production, and does not need to push into marginal areas. CLR seems well placed in 2017.

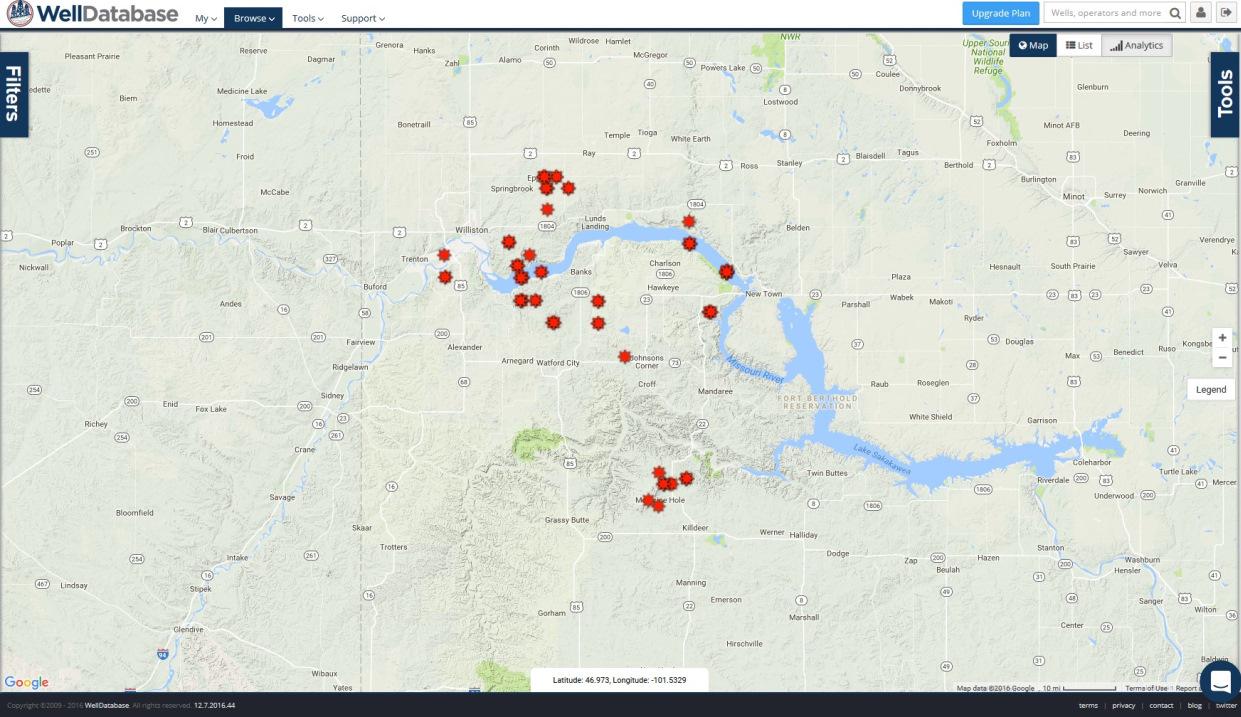

I pulled well results from 4/15 to 9/15 in North Dakota. Changes to well design provided improvements have improved production. During this time it has also cut costs. I included all of CLRs horizontal wells in North Dakota and did not exclude any poor performers. The Welldatabase.com map below, provides the locations of production data.

(Source: Welldatabase.com)

Only a few are core Bakken wells, but only a couple would be on the fringe. The average production was 152,020 BO over 17 months.

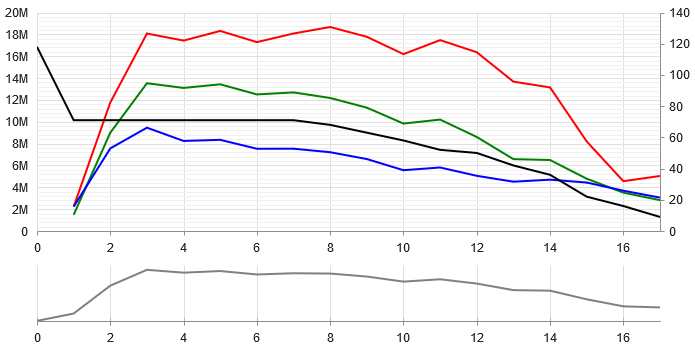

(Source: Welldatabase.com)

The graph above provides the natural gas (red), crude (green), water (blue), BOE (grey) and number of locations (black) curve for the 71 locations. I have calculated the payback time below. I had to model the final 6 months based on a modified exponential decline.

|

Volumetrics |

||

|

Months: 24 |

EUR: 167,067 |

|

|

Months: 18 |

Recovered: 152,016 |

|

|

Months: 6 |

Remaining: 15,051 |

|

|

Working Interest: 80% |

||

|

Selling Price: $53/Bbl. |

||

|

Initial Capital Expense: |

$6,000,000 |

|

|

Lease Operating Cost (monthly): |

($1,802,640) |

|

|

Total |

Working Interest |

|

|

Total: |

$8,854,542 |

$7,083,634 |

|

Recovered: |

$8,056,861 |

$6,445,489 |

|

Remaining: |

$797,682 |

$638,146 |

|

Total |

Working Interest |

|

|

Total: |

($7,802,640) |

($7,802,640) |

|

Recovered: |

($7,351,980) |

($7,351,980) |

|

Remaining: |

($450,660) |

($450,660) |

|

Total |

Working Interest |

|

|

Total: |

$1,051,902.88 |

($719,006) |

|

Recovered: |

$704,880.99 |

($906,491) |

|

Remaining: |

$347,021.89 |

$187,486 |

(Source: Welldatabase.com)

The average payback was 24 months. I also modeled natural gas revenues. It added $705,568 to offset the $719,006 deficit. Differentials are the largest issue in the Bakken. The DAPL will decrease CLR's differentials by approximately $4/bbl. This would be a 50% reduction. Currently a $61/bbl wellhead price is needed to reach payback in 24 months. A $57/bbl price would be needed post-DAPL. We estimate its North Dakota acreage will improve production 20% to 25% on a per well basis. This increase would add another $1.5 million net per well.

This isn't the main reason to like CLR, as its STACK/SCOOP leasehold is the most important. While it is one of the biggest players in North Dakota, its future rests on results in Oklahoma. CLR is a name we own and think has upside into 2Q17. We would lighten the load if oil prices above the mid-$60s. When trading oil and gas names in 2017, it is very important to remember the $50/$55/$60/$65 strategy. Permian production spikes at $50/bbl. The Eagle Ford core sees a major boost at $55. The Bakken core at $60. At $65, we begin to see some better marginal production come on line. As we lever up into each step individual plays will start to add rigs. This will be what pushes prices down naturally. Producer hedging will remain a concern, as it will put a ceiling on prices. This could lead to another glut in 2018, but we will have to wait and see if that is the case.

Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access to additional ...

more