Are Pipelines Still Cheap?

Investors have endured several body blows this year. Inflation was already rising due to the strong rebound from Covid exacerbated by last year’s $1.9TN Covid relief spending. The long heralded and late removal of excessive monetary accommodation is about to start.

More recently, Russia’s invasion of Ukraine has abruptly upended decades of western engagement, ushering in sanctions, European rearmament, and urgent diversification of energy supplies. As if this isn’t enough, China placed the 17.5 million residents of Shenzhen into lockdown after new virus cases doubled nationwide to almost 3,400. The rest of the world has resigned itself to living with Covid – China’s lone insistence on complete suppression seems futile but not yet abandoned.

There’s no shortage of articles, some quite thoughtful, on Russia’s invasion and its consequences. The Weakness of the Despot is an interview with historian Stephen Korkin who has written two volumes on Stalin (he’s working on a third). Korkin argues that Russia’s history repeatedly shows “its capabilities have never matched its aspirations” as a great power. In Possible Outcomes of the Russo-Ukrainian War and China’s Choice a Chinese academic argues that once it becomes clear Russia has blundered, Chinese interests will draw them back towards economically successful western nations, cooling relations with Russia.

Tempting as it is to become an expert on wars and geopolitics, the more useful insight we can offer is that Russia’s estrangement from most of the world is going to last years if not decades. We can be more confident in this forecast than the conflict itself or China’s next moves because the fact and manner of Russia’s invasion can’t be undone.

For example, Christopher Smart, chief global strategist and head of the Barings Investment Institute, said “Until you have a new leader in Russia, one who apologizes for invading Ukraine and who writes a check for reparations, these sanctions are going to remain in place. And I don’t see any of the three things I just described happening.”

Some predict that Russia’s economy will be set back thirty years. The global oil giants were only the first in a long line of western companies to announce the exit or abandonment of their Russian operations. So far more than 300 of the world’s best-known brands have announced plans to leave. The port of Hamburg reports that container traffic with Russia is “approaching zero,” compared with “hundreds of thousands annually” before the invasion.

CNBC noted that “none of the experts who spoke to CNBC for this story believe that any of the current sanctions against Russia or Belarus are going to be eased or lifted for at least the next three years.”

As upwards of 300 companies deal with messy exits and the inevitable write-downs, corporate memories will be scarred.

The change in trade flows as much of the world turns away from imports of Russian oil, gas, and wheat represent as significant a change as we can recall to the world economy. The recent drop in crude oil was caused by the Chinese reminder that Covid remains with us, even if they’re alone in still trying to wipe it out. The rest of the world has moved on. “Remask between bites and sips,” the offensive demand on US commercial airlines to constantly adjust face gear while eating and drinking, is redundant and virtually the only restriction left while the CDC takes yet another month to review its policy for the public transport. Bites and sips. Ugh.

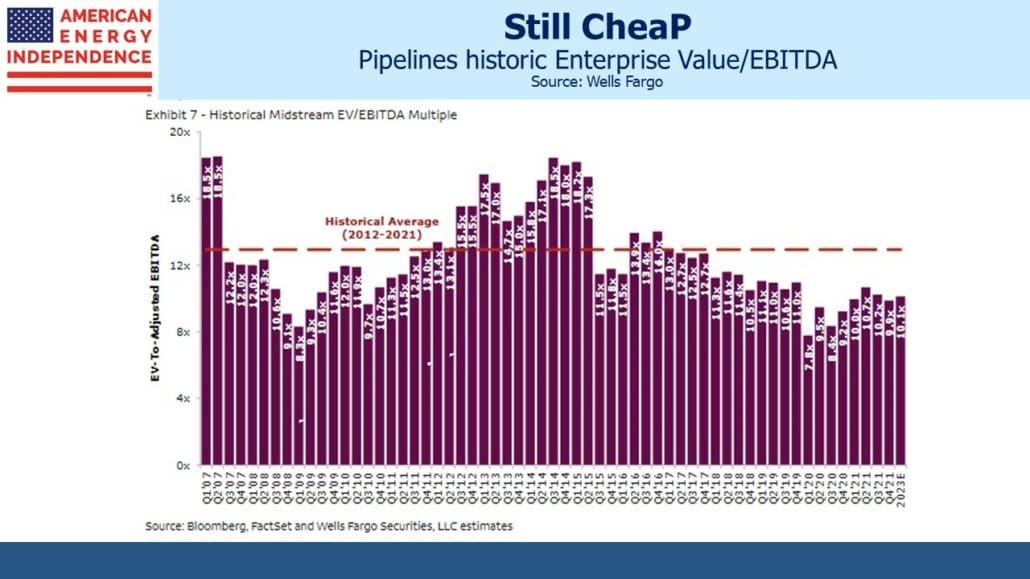

After the kind of run the energy sector has had, it’s reasonable to ask if it’s still cheap. On an Enterprise Value/EBITDA (EV/EBITDA) basis midstream is still well below its long-term average. If the current 10X EV/EBITDA is re-rated to 12X, assuming 50/50 debt/equity that would mean a 40% price increase from here. For several years the fear that the energy transition would lead to the early retirement of pipelines weighed on the sector, lowering terminal values. As it becomes increasingly clear that this transition, like those before it (wood to coal, coal to oil/gas) will take decades, equity investors should adopt the more realistic assessment that bond investors in the sector have always retained (see Pipeline Bond Investors Are More Bullish Than Equity Buyers).

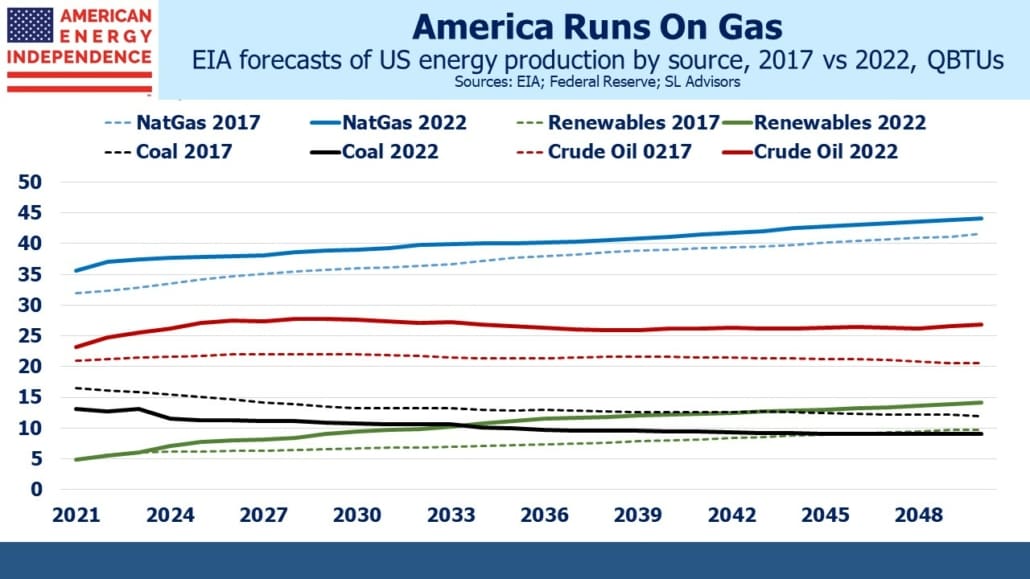

The US Energy Information Administration (EIA) forecasts continued growth in the production of natural gas, crude oil, and renewable power through 2050. Few have noticed that since 2017 the EIA has revised up its forecast long-term output of natural gas nearly as much as renewable power. Crude oil has been revised up even further. The renewables increase matches the reduction in coal output. The numbers tell a different story than much of the liberal media.

Wells Fargo estimates that adding ten years to the expected economic life of midstream infrastructure provides a 1.0X uplift in EV/EBITDA, which we estimate is worth 20% on equity prices.

Moreover, the energy sector’s weighting in the S&P500 has almost doubled from its low of 2.1% reached in 2020. As it recovers, the cost of being underweight becomes more significant, something abundantly clear to investors so far this year. There are anecdotal reports of generalist investors adding to energy exposure.

The sector still has a long recovery ahead of it.

Disclosure: We are invested in all the components of the American Energy Independence Index via the ETF that ...

more