Analysis For Crude Oil Over The Daily, Weekly And Monthly Timeframes

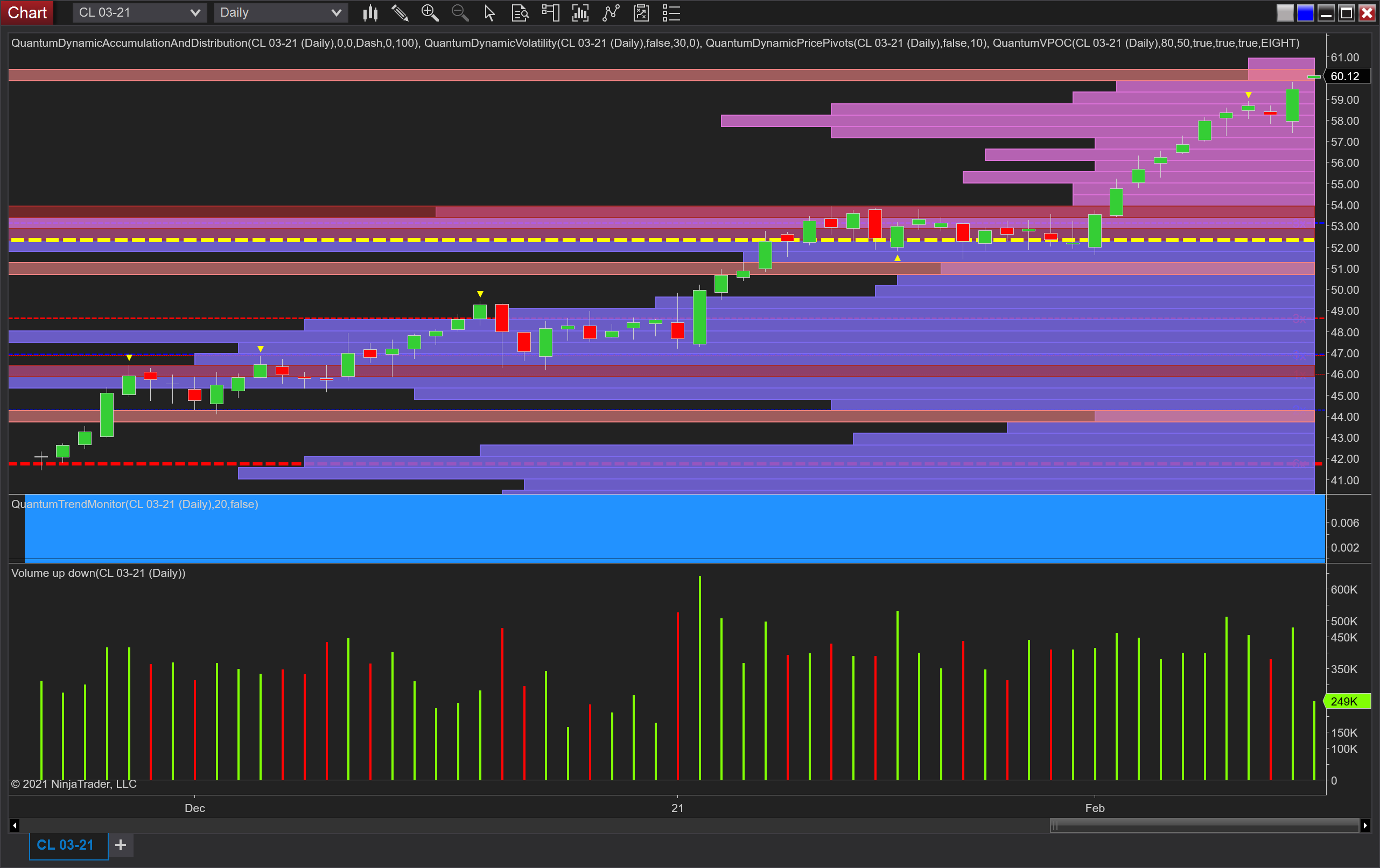

At the start of another trading week I thought it would be good to check in on oil again which I’ve been writing about during January and February, and in particular to consider it across various timeframes. Last week I considered the monthly chart and suggested we should expect to see congestion develop around the $62 per barrel area. But let’s start with the daily chart and Friday was a dramatic one for crude oil which rose on good volume and closed with a wide spread up candle, so volume and price were in agreement. This morning saw the price open gapped up and is currently trades at $60 per barrel at time of writing having come off the highs of $60.95 per barrel, but remember today is a holiday for US markets so the associated volume is relatively light which is what we would expect. Note too that on this timeframe we are almost at the extreme of the volume histogram (y-axis) and the VPOC itself is anchored at $52.30 per barrel and denoted with the yellow dashed line.

(Click on image to enlarge)

Moving to the weekly chart, we can see last week’s solid move with rising volume, but the key here is what lies ahead. First, we have the VPOC at $65 per barrel and then an extremely strong area of price based resistance as denoted with the blue dashed line of the accumulation and distribution indicator. So two solid reasons to expect congestion at this level.

(Click on image to enlarge)

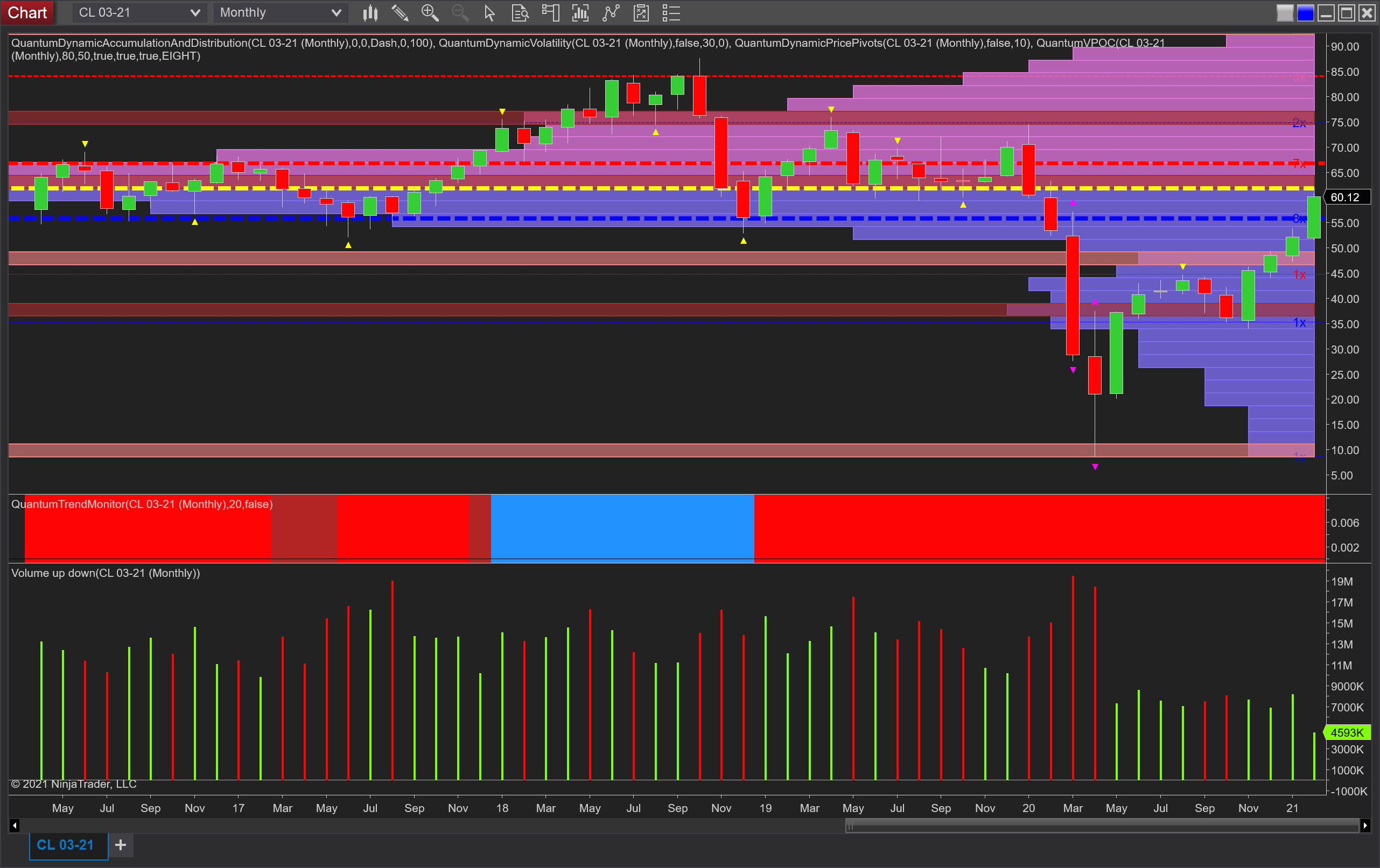

Finally back to our monthly chart where we are now starting to test the VPOC on this timeframe at $62 per barrel, and with further strong price-based resistance above at $67 per barrel as denoted with the red dashed line. So as I previously suggested oil has indeed achieved the current price relatively easily, but now with the VPOC’s on the weekly and monthly coming into play, expect an extended period of consolidation between $62 per barrel and $67 per barrel, before the longer-term bullish trend is likely to take hold with momentum.

(Click on image to enlarge)

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more