Aluminum Prices Hit Fresh Decade High As China Pledges More Support For Ailing Economy

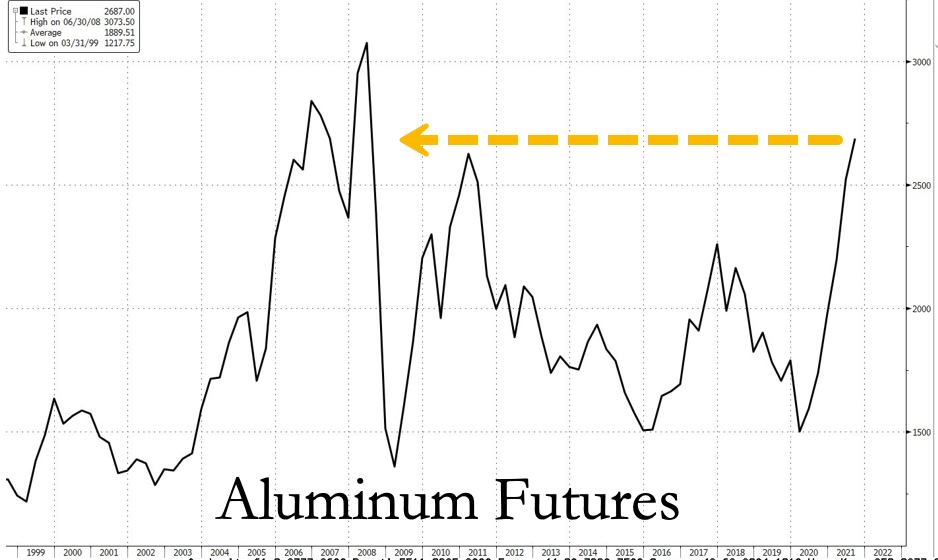

Aluminum prices on the London Metal Exchange and Shanghai Futures Exchanges reached fresh decade highs on Wednesday after the Chinese government pledged more support to keep the economy from slumping, according to Bloomberg.

The People's Bank of China (PBoC) is expected to expand credit to small- and medium-sized businesses and allocate credit to other parts of the economy to prevent a downturn. The latest news of credit expansion to cushion the economy was released in a statement by the State Council.

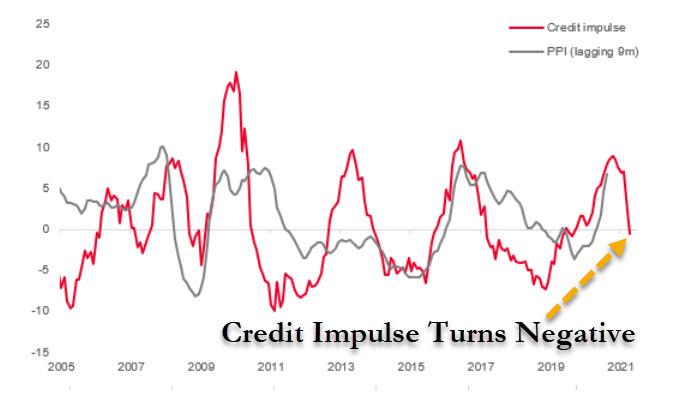

PBoC's credit expansion scheme comes as no surprise that the country's all-important credit impulse turned negative earlier this year. On a laggard basis, we suggested China was set to unleash a deflationary wave across the world...

According to the country's economic surprise index, economic data in China has been missing to the downside all year and eventually went negative in April.

(Click on image to enlarge)

This week, China's official Services (non-manufacturing) PMI Index collapsed, an ominous sign the economy is slowing.

Many are perplexed why Beijing is taking so long to address the sharp slowdown in its economy. But while the latest China credit - and now PMI - data is flashing a bright red alarm light that the global reflationary wave may be over or about to reverse. However, Beijing has come to the rescue with new pledges to aid their ailing economy.

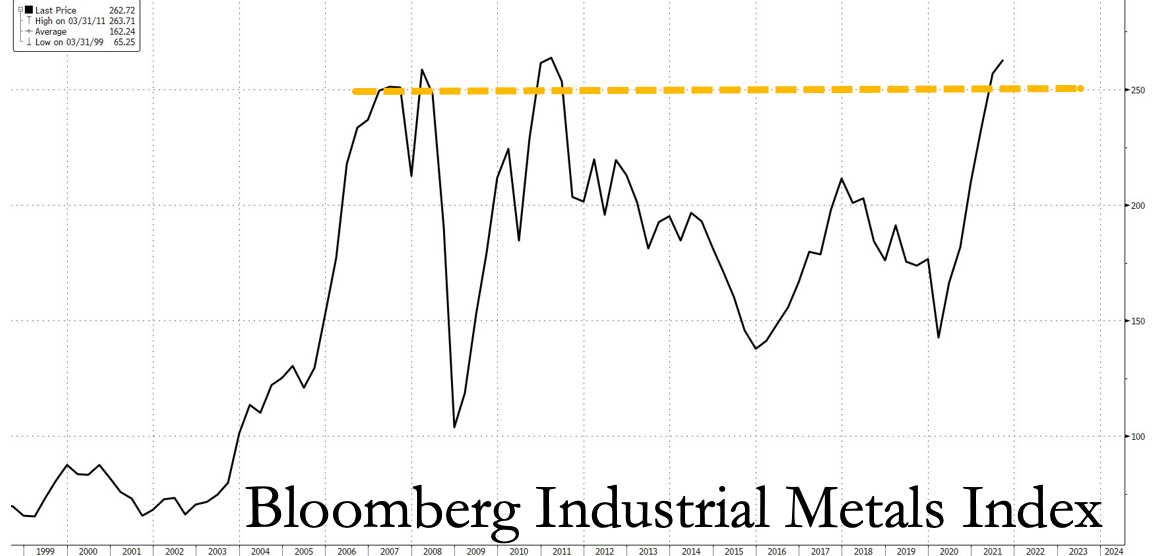

Of course, this means that stimulus-fueled demand will boost commodity prices and will be a boon for industrial metals - however temporary and misallocated that may eventually become.

Colin Hamilton, managing director for commodities research at BMO Capital Markets, told clients the latest "credit support would boost near term financial market sentiment towards commodity exposure in China. But we expect the impact on underlying physical demand to be more of an H1 2022 story."

Aluminum prices on the London Metal Exchange rose at 1.7% to $2,734.50 per ton, the highest level in more than a decade. Besides government support for the floundering economy, investors have been piling into the metal because of supply woes that may develop as China reduces power to smelters to cut carbon emissions.

(Click on image to enlarge)

The Bloomberg Industrial Metals Index has also reached decade highs.

(Click on image to enlarge)

China unleashing more credit, stoking what could be another round of commodity inflation, may further dent the Federal Reserve's narrative that inflation is "transitory."

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more