AgMaster Report - Wednesday, March 3

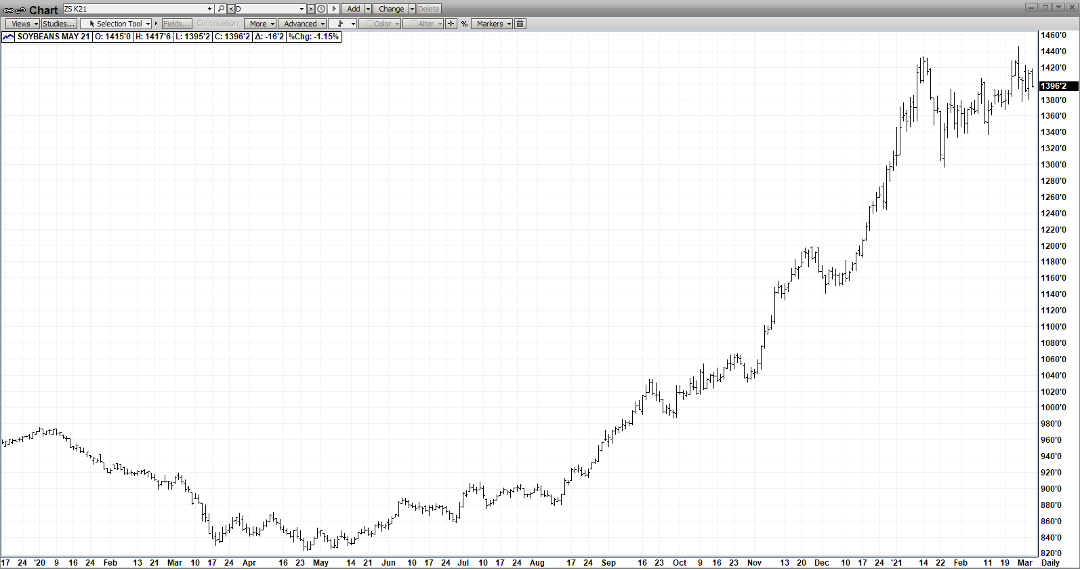

MAY BEANS

(Click on image to enlarge)

The CBOT has morphed into a “supply Bull” from a “demand Bull” as S/A supplies come on line -at lower prices than the US – cutting into mkt share! But the S/A problematical weather is still an issue with N Brazil too wet for harvest & Argentina too dry for proper crop development! The attention will shift from old crop to new crop – as there is absolutely no margin for error in the upcoming US row crop season! Stocks – severely depleted by El Nina in S/A & record demand from China – have reached 6-7 year lows & desperately need to be replenished by an ample US Harvest! We see sideways to up – from now until early summer until we have a better handle on US production & yield

MAY CORN

(Click on image to enlarge)

As you can see, May Corn has drifted into a sideways trading pattern. The upside is limited by waning exports as S/A supplies – newly on-line & cheaper than the US – have encroached on our export share! The downside is limited by extreme supply uncertainty as the “jury is still out” on the ultimate size of the drought-ravaged S/A crop – as well as the upcoming US crop! One bullish wildcard is the expected dramatic recovery of the US economy – energized by widespread vaccination & the passage of the Covid Relief Package! Much elevated ethanol demand should be a welcome by-product! The USDA issues very important reports this month – the 3/9 WASDE & THE 3/31 PLTG & QTLY STOCKS! Some argue the Corn has already gone up far enough – following its $2.00 rise since mid-2020! However, it wasn’t that long ago -that we had $8.00 corn! And if El Nina invades the US in a few months, then we’re too cheap today!!

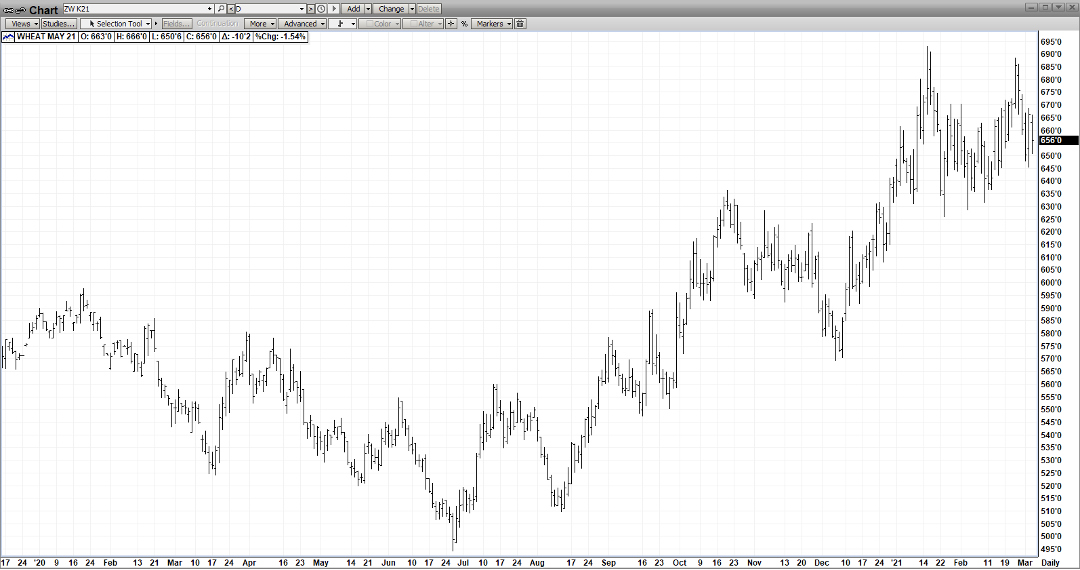

MAY WHEAT

(Click on image to enlarge)

May Wht closed up 16 cents yesterday on the back on lower crop ratings for the plain states – issued by the USDA Mon afternoon! Previously, the contact tickled the 690 level off the bitter cold snap which we all suffered thru a few weeks back! But today, the mkt is back lower – being essentially range-bound – like its sister mkt – corn & beans! The mkt will need better exports & help from C & B to resume its up!!

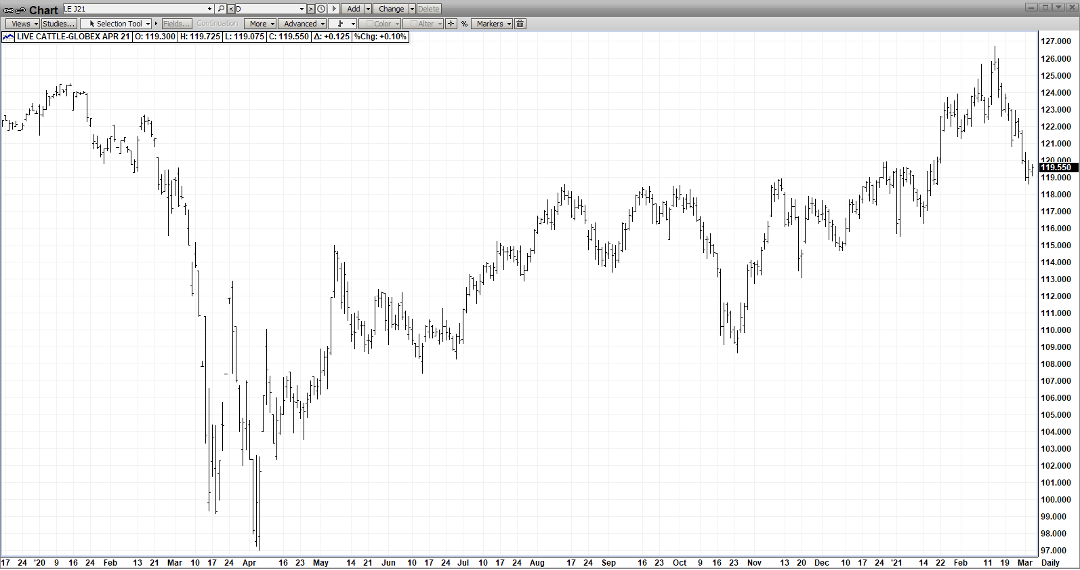

APRIL CATTLE

(Click on image to enlarge)

Apr Cat has corrected $8.00 (127-119) due to more slaughter, heavier average weights & slack foreign demand! Also, recent Cattle-on-Feed reports have jacked up the placements!However, the “Ace in the Hole” is a refurbished US economy that should dramatically increase domestic demand – as restaurants re-open & consumers soon get a freshly-minted stimulus check in their hands!

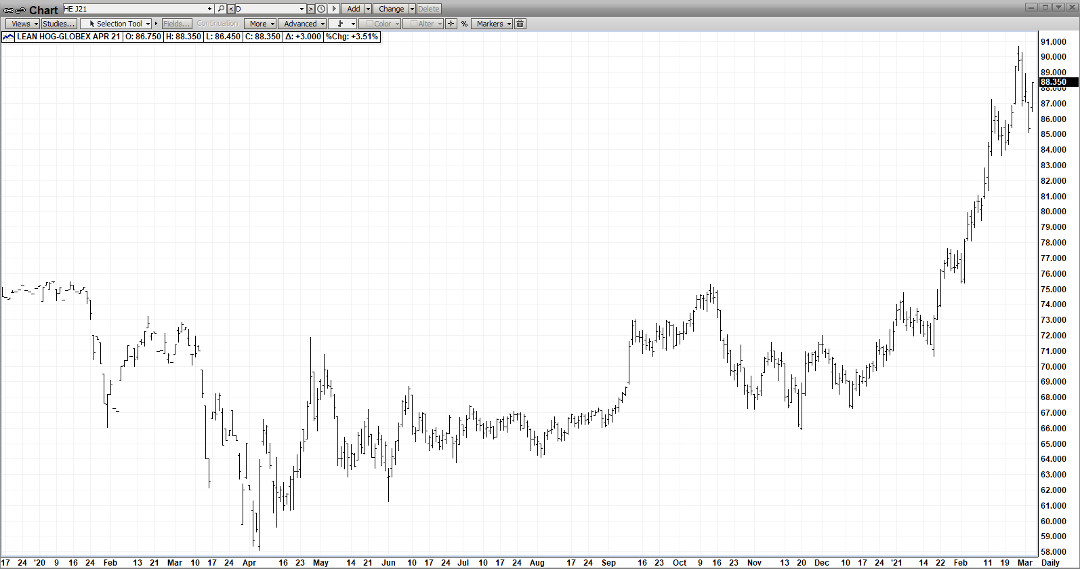

APRIL HOGS

(Click on image to enlarge)

The marked disparity between Apr Hogs – today limit-up & only $2.00 off its highs – and Apr Cat – currently $7.00 off its highs is very simple! CHINA DEMAND! It was widely expected to diminish into 2021 – as China successfully rebuilt its hog herd – but recent flares ups of ASF have changed that narrative – with their appetite for our pork returning to 2020 levels! That coupled with increased domestic demand off the restaurant re-openings bodes well for the Hog Mkt in 2021!