A Tarnished Outlook For Silver, Unlike Gold

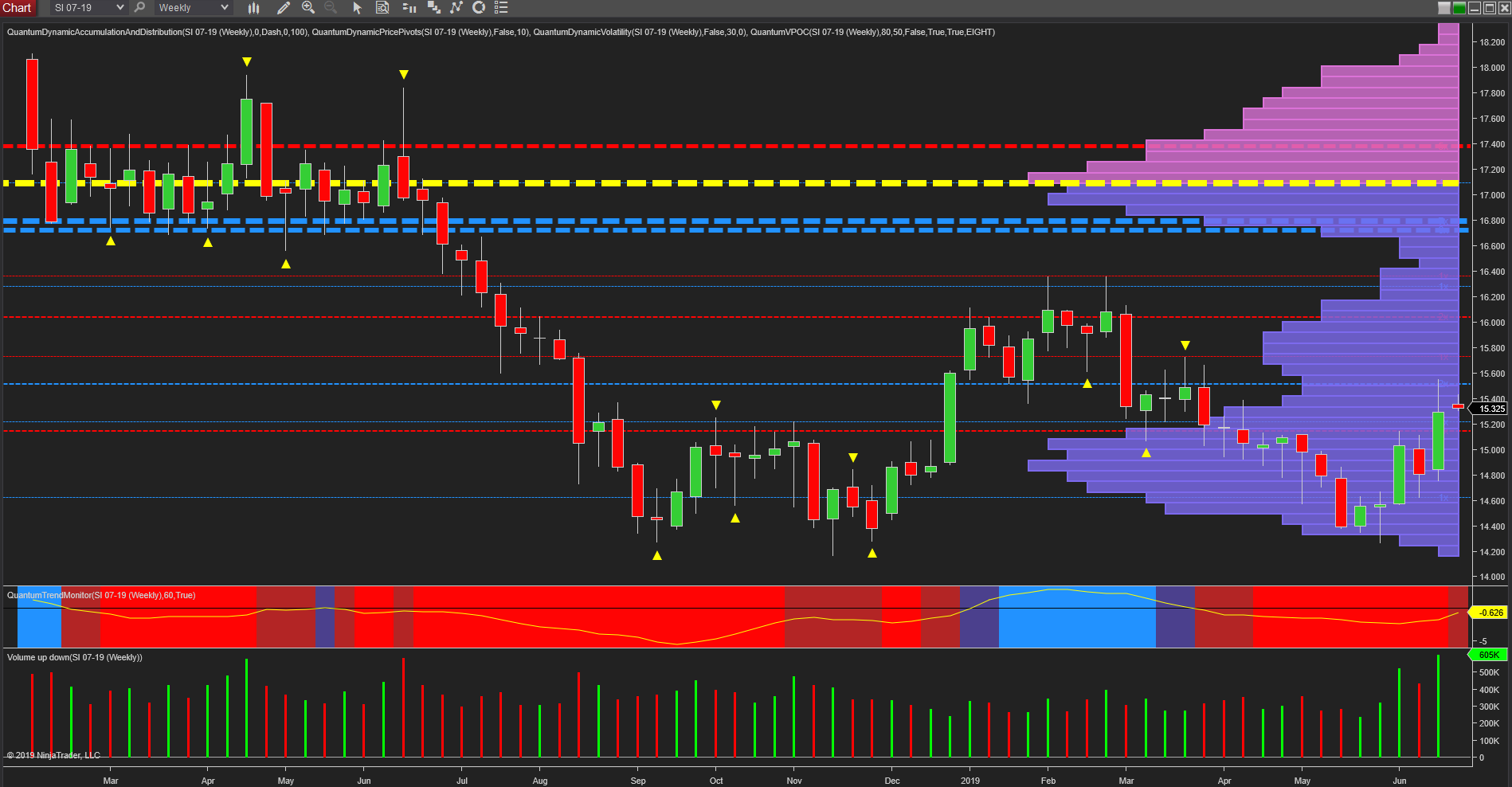

It’s always interesting to follow any analysis of gold with that for silver, and for alternative investors, the picture here is less rosy with the industrial metal continuing to trade in a tight range, and yet to develop any longer-term bullish momentum. In addition, any return to a longer-term trend higher has some serious barriers to overcome on the weekly timeframe.

If we begin with last week’s price action, the candle itself closed with a deep wick to the upper body on good volume, suggesting a degree of selling as the metal hit minor resistance in the $15.50 per ounce area as denoted with the blue dashed line of the accumulation and distribution indicator. This weakness has continued in today’s trading, and whilst silver opened gapped up, as did gold, there has been no equivalent follow through in bullish sentiment with trading confined to a narrow range.

Between $15.60 per ounce and $16.00 per ounce we also have a high volume node on the volume point of control histogram to the right of the chart, so any move through here will require support volume to push the metal through this tough area, which once penetrated will then open the door to light volume to $16.80 per ounce.

However, at this price region problems begin again as we have two extremely strong regions of price based resistance in a cluster as denoted with the blue dashed lines of the accumulation and distribution indicator. These are immediately followed by the volume point of control itself denoted by the yellow dashed line and representing the deepest concentration of transacted volume. Finally at $17.40 per ounce we have yet another deep area of price resistance denoted with the red dashed line, before volume then falls away as we move into clearer waters above and through the $18 per ounce and above.

The last of these levels seems an awfully long way away, and for silver to reach these heady heights will require sustained and rising volume to drive the metal through the immense barriers now ahead. And even if this does occur, dragged higher by gold, progress is likely to be slow and labored, and at the very least, we can expect to see an extended congestion phase develop at the $17.10 per ounce area if silver does manage to claw its way higher. Either way, whether for investors or speculative day traders, there are likely to be much better opportunities in other markets for the immediate future.

(Click on image to enlarge)

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more