A Secular Bull Market In Commodity Stocks

I want you to pay special attention to this blog because it can make you a lot of money. Here’s the thing: there was a secular bull market in technology stocks from 2009 through 2021 that investors made a lot of money in. So it’s understandable that investors are obsessed with buying the dip in tech. But it’s over. Tech is going lower.

The new secular bull market is in commodities. Few understand this which is why it is still in the early days. If I can persuade you of this I believe it could change your financial future. It’s that big. In order to do so, I’m going to discuss three commodity stocks that I own: leading copper miner Freeport McMoran (FCX), steel manufacturer Steel Dynamics (STLD), and coal miner CONSOL Energy (CEIX). In each case the fundamentals are stellar and the stocks are starting to work – in a big way.

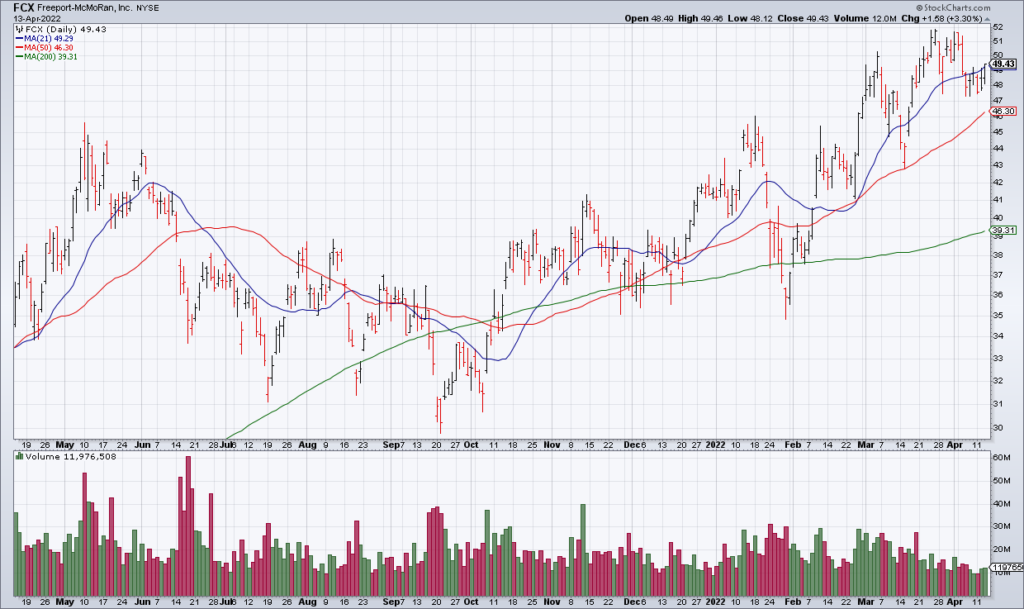

(Click on image to enlarge)

Let’s start with the most well-known: FCX. FCX produced almost 4 billion pounds of copper in 2021 and they received an average price of $4.33 per pound. That’s up from the $2.95 per pound they received in 2020. As a result, FCX’s revenue was +61% in 2021 and adjusted EPS jumped to $3.31 from 54 cents. FCX closed Wednesday at $49.43 giving it a 15x multiple on 2021 EPS. If I’m right that this is the beginning of a commodities bull market, FCX is a bargain. I see it hitting $100 in 24 months.

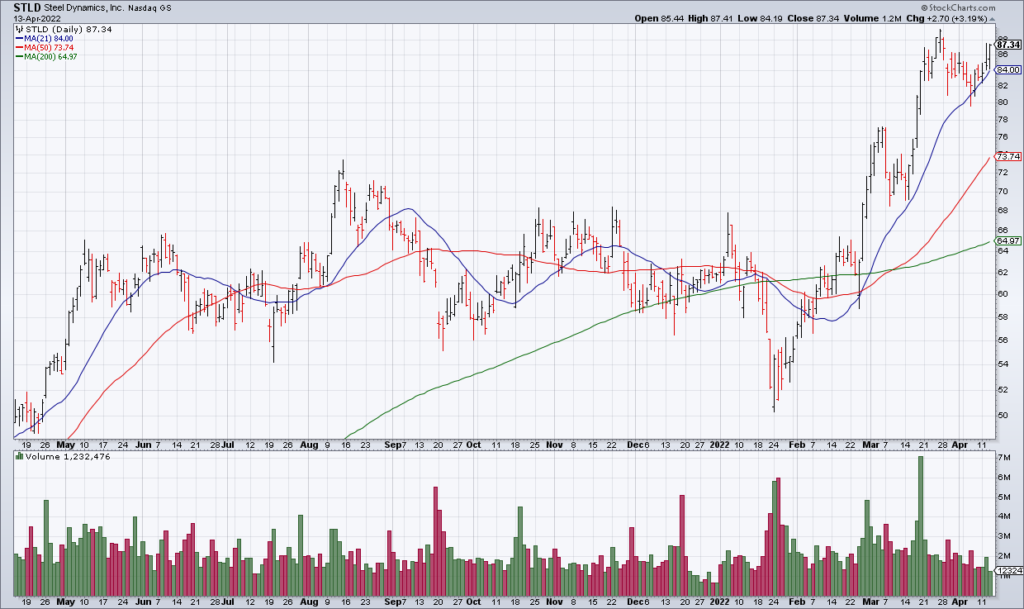

(Click on image to enlarge)

The same kind of analysis applies to STLD. STLD produced almost 10 million tons of steel in 2021 and received an average price of $1381 per ton – up from $770 a ton they received in 2020. Are you surprised when I tell you that STLD’s revenue nearly doubled in 2021? Or that its EPS increased to $15.56 from $2.59? STLD closed Wednesday at $87.34 giving it a multiple of less than 6x 2021 EPS. I see STLD hitting $200 in 24 months.

(Click on image to enlarge)

Last let’s talk about CEIX. Coal! It’s a four-letter word to some. But the bottom line is that the world needs coal to keep the lights on as Robert Bryce argued in his excellent book on electricity A Question Of Power. CEIX received an average of $51.27 for each ton of coal it sold in 4Q21 compared to $39.05 in 4Q20 – and it expects to receive $55-$57 in 2022. Are you surprised then when you look at the chart above and see that CEIX is at all time highs? My 24-month price target for CEIX is $100.

In conclusion, I don’t blame investors for being obsessed with buying the dip in tech. People made fortunes in Apple, Google, and Amazon last decade. But that period of market history is over. It will take investors a while to realize that commodities is where it’s at now. If you recognize that early, I believe you stand to make a lot of money.

1Q22 Performance (through 3/31/22):

— Top Gun Financial (@TopGunFP) April 5, 2022

Top Gun Long/Short: +24.55%

NASDAQ: -9.10%

S&P: -4.95%