A Bright Shiny Year Awaits Gold Bugs

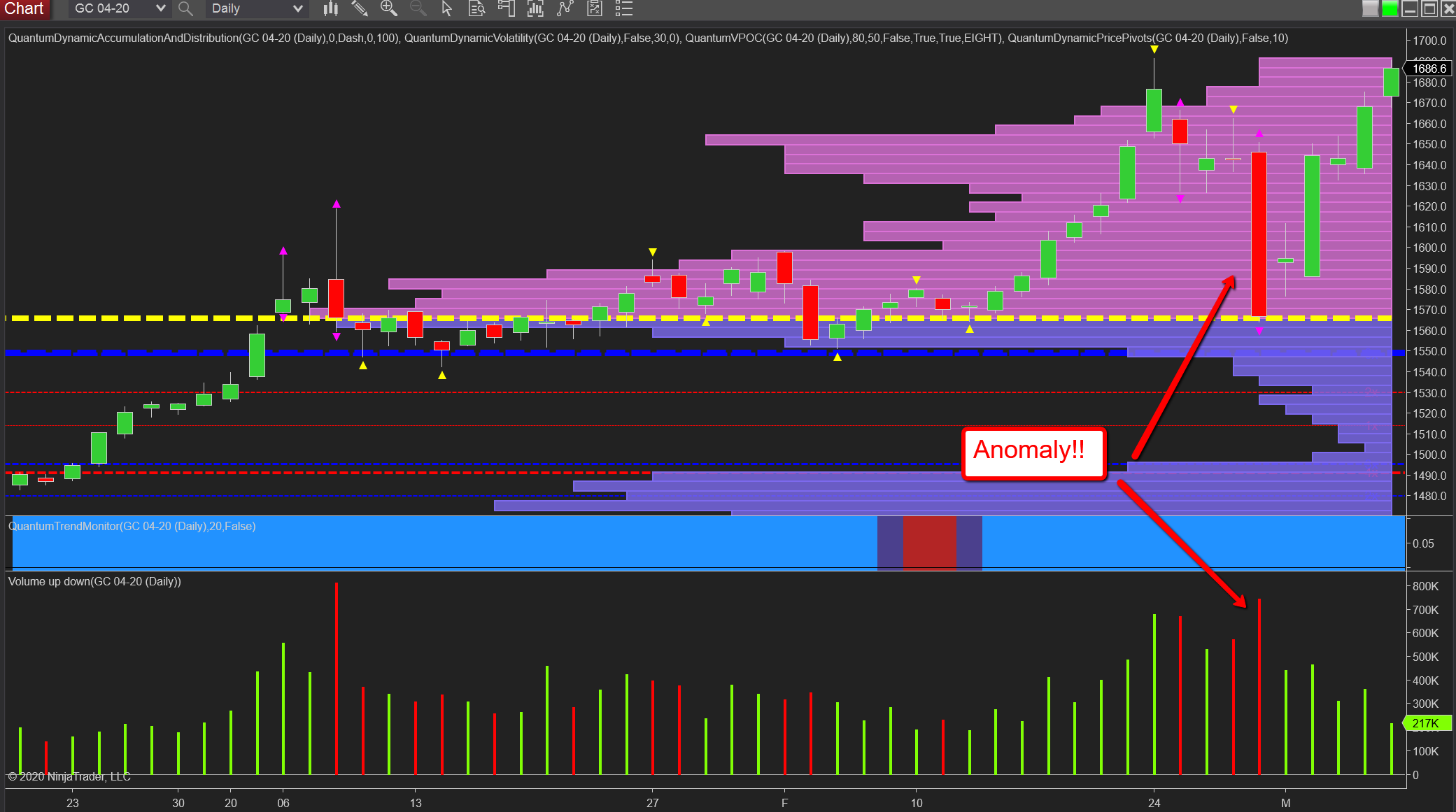

In last week’s post on gold, I drew your attention to the extreme price action of Friday last, and in particular the associated volume which was clearly an anomaly. For a move of such dramatic proportions, we should see extreme volume, and we did not. The conclusion? A lack of participation by the big operators and therefore a trap being laid with a reversal in prospect. This was also confirmed further by the volatility indicator which triggers on any move outside the average true range and so signals the likelihood of congestion or a reversal. In this case, the reversal was instant and equally dramatic with gold now driving higher and towards the elusive $1700 per ounce, a journey helped by safe-haven flows, and weakness in the US dollar, and certainly not as a result of a hedge to inflation which remains as unreachable as ever!

(Click on image to enlarge)

So where next for gold? And for this, we need to consider the monthly chart which puts the last few weeks of price action into context. Here we see the price action for the last ten years. The dramatic rally of 2011, the decline which followed, and the extended congestion phase of the past six years. This is perhaps the most significant aspect, with immense platforms of support now in place and acting as the springboard for the current rally as we break away from the volume point of control and move aggressively higher. Note the strength of this region with the VPOC itself ( yellow dashed line) and the blue and red dashed lines of the accumulation and distribution indicator, all combining. More recently the congestion around $1520 has been broken and we now have a perfect technical chart for a strong trend higher for gold. Will we see the highs of 2011 touched again? It seems likely given the volume now driving the market, particularly through 2019 as the break higher developed strength. And with a low volume node now approaching a move to $1700 per ounce and beyond is imminent. And from there, towards the $1896 per ounce high of 2012. A bright shiny year for the gold awaits.

(Click on image to enlarge)

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more