3 Reasons Why Inflation Will Rise And Support Gold Prices

Inflation rose in February, and it appears that more inflation is coming down the road. This development can, in fact, be good for gold.

The U.S. CPI inflation rate rose 0.4% in February, following a 0.3% increase in January. The jump was driven by a 6.4% spike in gasoline prices. The core CPI rose 0.1%, following no change in the preceding month.

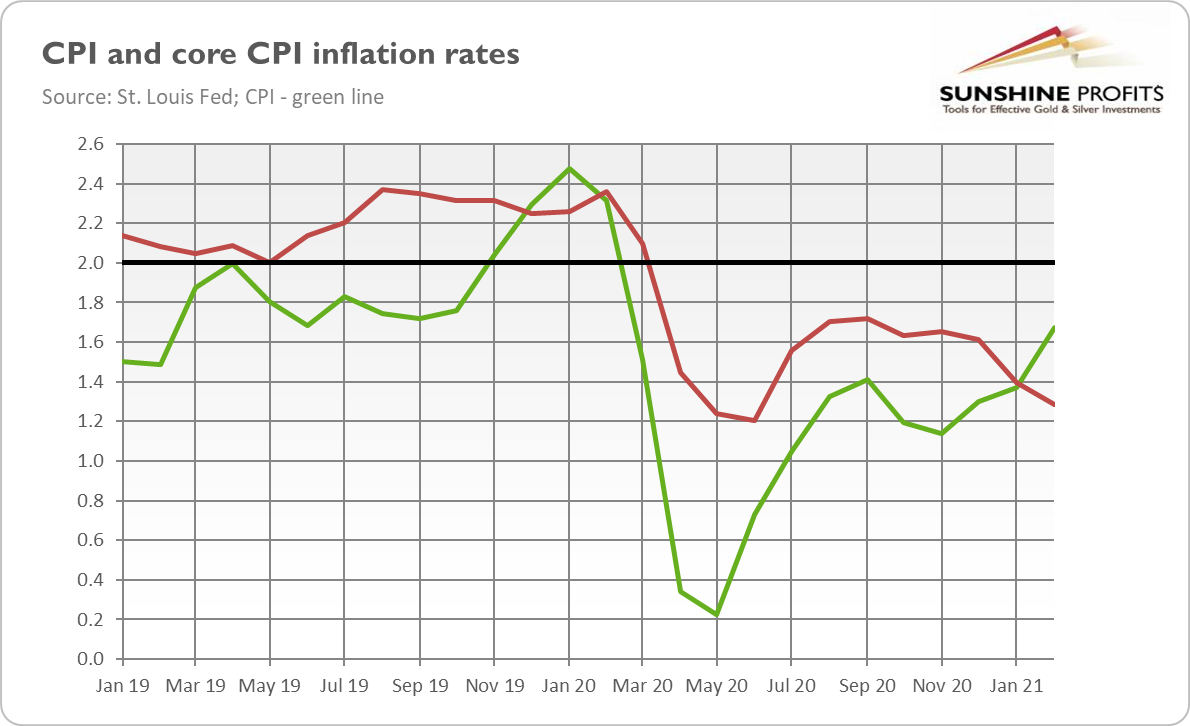

So, inflation rose a bit in February, which is more clearly seen on an annual basis. The overall CPI increased 1.7 percent over the last 12 months, following a 1.4% increase in January. The core CPI rose 1.3%, following a 1.4% rise in the preceding month. Hence, as the chart below shows, although inflation remains below the Fed’s target, it has increased significantly since the bottom in May 2020.

And it may rise further in the coming months.

The first reason is purely statistical and relates to the low base effect. I’m referring here to the fact that oil prices have seen a deep plunge in March and April 2020 (remember negative WTI oil prices?), so we will see a surge here on an annual basis.

Second, manufacturers are struggling with significant price increases for raw materials and intermediate goods. Because of disruptions in supply chains and logistics (it’s not easy to obtain containers and get product through ports in these times), there is a rise in input and transportation costs. Entrepreneurs are also reporting shortages. In the Institute for Supply Management’s February manufacturing report, we can read following producers’ comments:

- “Supply chains are depleted; inventories up and down the supply chain are empty. Lead times increasing, prices increasing, [and] demand increasing.”

- “Prices are going up, and lead times are growing longer by the day. While business and backlog remain strong, the supply chain is going to be stretched very [thin] to keep up.”

- “Things are now out of control. Everything is a mess, and we are seeing wide-scale shortages.”

- “Labor shortages at suppliers are affecting material deliveries and prices.”

- “We have seen our new-order log increase by 40 percent over the last two months. We are overloaded with orders and do not have the personnel to get product out the door on schedule.”

- “Prices are rising so rapidly that many are wondering if [the situation] is sustainable. Shortages have the industry concerned for supply going forward, at least deep into the second quarter.”

It doesn’t look good. We have a full production inflation. Indeed, the price of only one commodity was reported to decline in February (dairy) – the rest of them moved up, and several of them are in short supply. And the ISM Prices Index registered 86%, following 82.1% in January. It means that raw materials prices increased for the ninth consecutive month to their highest reading since July 2008, or the midst of the Great Recession.

Third, the easy fiscal and monetary policies should help to increase inflation. In December, Republicans passed their fiscal stimulus, and just this week Congress has passed Biden’s $1.9 trillion Covid relief bill, the most extensive stimulus measures in American history. All this will add to the mammoth pile of public debt. In February, the U.S. government posted a fiscal deficit of $311 billion, a record high for the month. In just the first five months of the 2021 fiscal year, the budget deficit has already risen to a record $1.047 trillion. Whoa, that’s a lot of new debt that the Fed will have to monetize!

Implications for Gold

What does all this mean for gold prices? Well, higher inflation should help the yellow metal, which is considered to be an inflation hedge. Higher inflation would also keep the real interest rates at the very low, negative level, which should also support gold prices. It goes without saying that gold needs a catalyst for a new rally. As the chart below shows, although gold has rebounded slightly this week, it still remains in a bearish trend.

Having said that, investors should remember about two things. First, inflation doesn’t have to be helpful for gold prices, if it triggers expectations of a more hawkish Fed. In such a scenario, the rise in the bond yields may outweigh (at least initially) the positive factors. However, the Fed is going to tolerate higher inflation, so it’s likely that the federal funds rate will stay behind the inflation curve.

Second, higher inflation does not have to help gold right away. What I mean is that as long we have an economic recovery and decent economic growth, Mr. Market may simply focus on growth and shrug off higher inflation. However, I bet that the current period of economic recovery will be followed by a period of stagflation, i.e., a period of stagnation and inflation. In such an environment gold will shine. This will not happen tomorrow, but it will happen eventually.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it ...

more