2 Gold Miner Charts, Klondex Mines And Premier Gold

You know, during the bear market I did not do much public charting of gold stocks for obvious reasons (said bear market) and less obvious reasons (the pompom brigade was still pumping them out as if they had a single minded agenda or something). I have not done much with them here at the public site, although we have charted these the sector every step of the way in NFTRH reports and updates and kept tabs on individual stock charts as well.

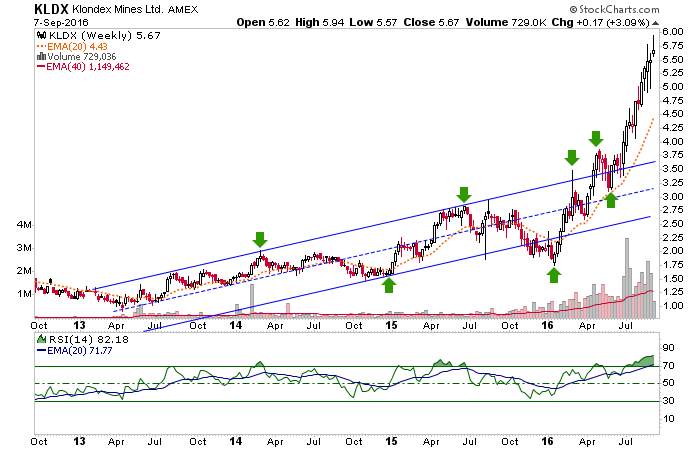

Anyway, here are 2 of my favorites (weekly charts), each of which began its bull market in 2013! Normally, I would have long-since sold a chart like this, but that of Klondex Mines (KLDX) seems to think this is a highly prospective company or something. It’s massively over bought, but having made enough mistakes over the years in selling for modest profits when massive ones lay out in the future (hello Intuitive Surgical) I have decided not to trade everything.While I have held and traded KLDX since 2013, the holding has been much more prominent than the trading, and it is still ongoing despite the steep up slope since the spring time.

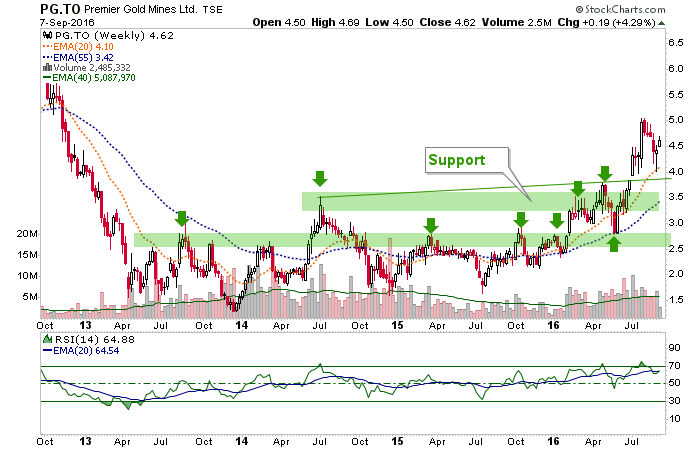

Premier Gold (PIRGF) also bottomed in 2013 and it has been a much easier ride (yes, less dynamic price performance is easier in a lot of ways for me). 3.50 might be as good as this is going to get on any pullback, and that assumes that a major sector correction takes place (so far a big assumption).

One of the above is a well run producer and the other a well run exploration/development miner. One operates in Nevada and the other in Canada and Nevada. So the location risk is good for each as well.I have been burned on a couple of ‘risk realized’ situations in the miners this year and that is all the more reason I try to understand who’s got the quality assets, management and favorable geopolitical location (with a big thank you to a few associates and subscribers who keep fundamental tabs on some of these miners).

Anyway, I just wanted to pop up a couple charts instead of always griping about policy makers or what have you. After all, we complain about these clowns but they are directly responsible for the speculative income that has come in this year. That goes for the regular stock market as well, so far in 2016.

Disclosure: Subscribe to more