1.9 Trillion Reasons To Rethink Precious Metals

Indian hip-hop star and gold enthusiast Bappi Lahiri. His gold is down year-to-date, like everyone else's (Image via The Quint).

Where's Your Gold Now?

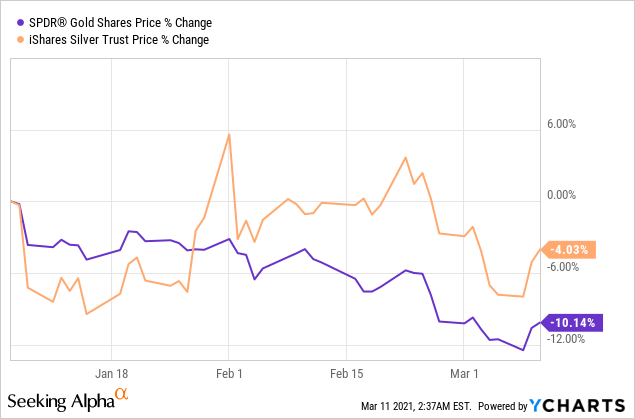

January 6th, 2021. That was the day after the Democrats won the two Senate runoff elections in Georgia. It was the first day the market knew for sure that an enormous COVID relief spending bill would pass both Houses of Congress and get signed into law. The House passed that $1.9 trillion spending bill on Wednesday, but since January 6th, investors knew it was coming eventually. The Democrats had the votes. So how have gold and silver done since then? Not well.

There was that head-fake silver rally at the beginning of February, but both the iShares Silver Trust (SLV) and the SPDR Gold Trust (GLD) are in the red since Jan 6th.

"That's Just Paper Silver And Gold"

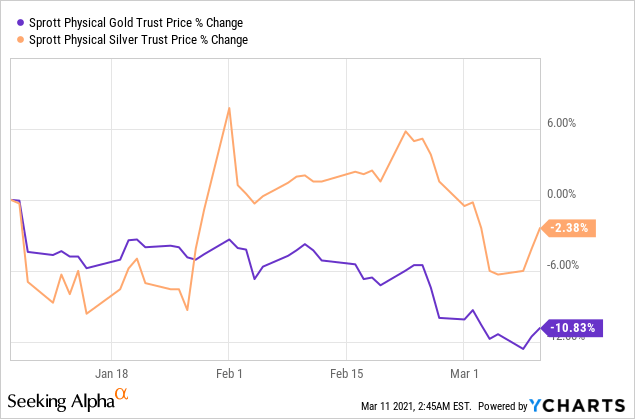

Okay, let's look at the Sprott Physical Gold Trust (PHYS) and the Sprott Physical Silver Trust (PSLV).

They're down since Jan 6th as well.

Updating Your Beliefs On Precious Metals

Several years ago, we interviewed a leading Super Forecaster from Phil Tetlock's Good Judgment Project. We were reminded of that last month by this tweet.

When's the last time you updated your beliefs on precious metals?

If you own precious metals because you believed massive, deficit-financed government spending would boost gold and silver as inflation hedges, you now have 1.9 trillion reasons to update that belief.

Modern Monetary Theory Describes Reality

There are a lot of things in the $1.9 trillion dollar spending bill reasonable people can oppose politically. For example, it's going to bail out poorly-run cities and states. But it's probably not going to spark a lot of inflation. Modern Monetary Theory may be controversial, but the results of the previous COVID relief spending (not to mention spending for the wars and bank bailouts earlier this century) suggest it describes reality fairly well. What causes inflation isn't government deficits per se, but too large a supply of money chasing too few goods and services. Here's a simple thought experiment to illustrate.

What If The Checks Were For $150k Instead?

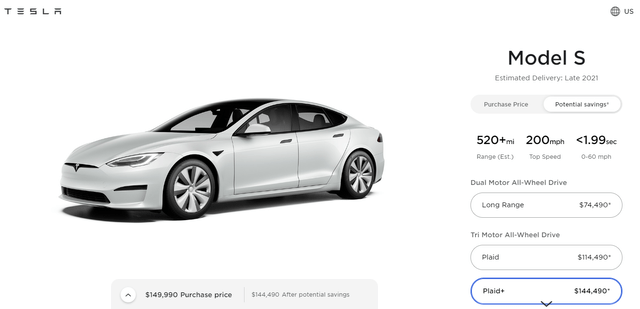

The $1.9 trillion "American Rescue Act" includes $1,400 checks for most Americans. What if those checks were $150,000 ones instead? In that case, most Americans would be able to afford a fully-loaded Model S Plaid+ from Tesla (our #1 stock on Monday).

Screen capture via Tesla.

Zero-to-sixty miles per hour in less than two seconds. Sounds like fun. Except Tesla only delivered about 57,000 Model S and Model X cars combined in 2020. If the government gave most Americans $150k, there wouldn't be anywhere near enough Model S Plaid+ cars for everyone who could afford the current price tag, so that price tag would shoot up. We'd have a huge spike in inflation because there'd be too much money chasing too few goods.

Giving most Americans $1,400 most likely won't lead to a spike in inflation though. That's because it's not large enough, and most Americans are broke. One credit card bill or mortgage payment and that $1,400 will be gone.

Our guess is that the smart money figured that out after seeing the impact of the previous rounds of $1,200 and $600 checks, respectively, and, consequently, hasn't bid up precious metals since the Georgia Senate runoffs (with the exception of the brief delusion that SLV was going to be the next GameStop).

The Benefit Of Agnostic Security Selection

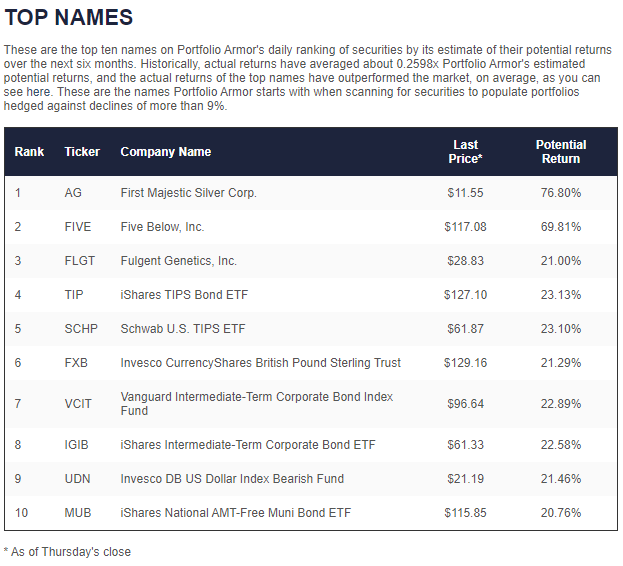

If you're in the business of selling precious metals, you're probably always going to be bullish on them. If you're a hard money advocate, you're probably always going to be bullish on gold and silver as well. Our system starts out agnostic about precious metals and every other asset class, including stocks. Its universe includes every stock, ETF, and ETN with options traded on it in the U.S. Every trading day, it analyzes each of them based on their past total returns and options market sentiment.

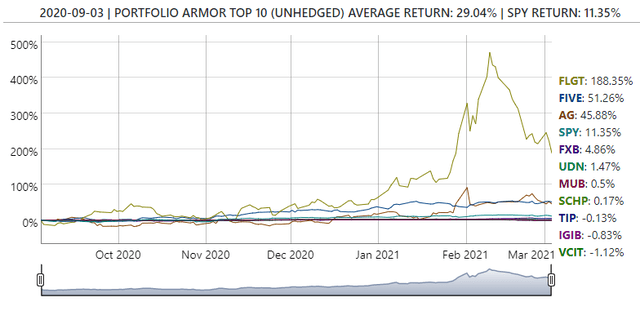

Sometimes it's been bullish on precious metals names. For example, it was bullish on First Majestic Silver (AG) on September 3rd.

Screen capture via Portfolio Armor on 9/3/2020

That time, betting on silver panned out.

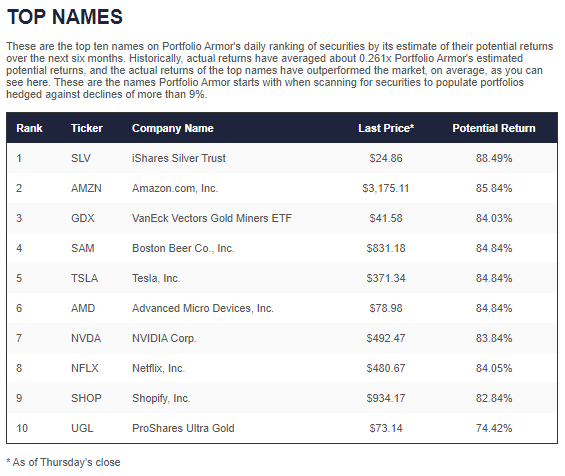

Our system was more bullish on precious metals the next week, including SLV, the VanEck Vectors Gold Miners (GDX), and ProShares Ultra Gold (UGL) in its top names on September 10th.

Screen capture via Portfolio Armor on 9/10/2020.

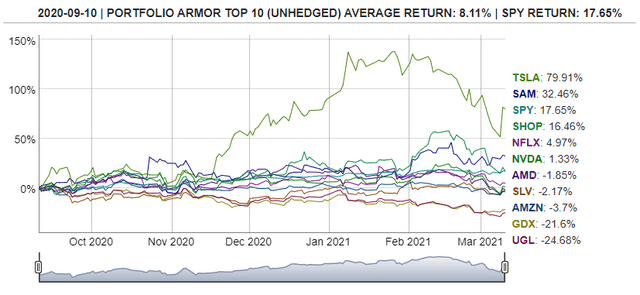

None of those precious metals bets panned out over the next six months.

As a consequence, the 15-week streak of our top names beating SPY came to an end.

September 10th's top names cohort ended our 15-week streak of beating SPY. Screen capture via our iPhone app.

On Jan 6th, after the Georgia Senate runoffs, there were no precious metals names in our top ten.

We're not going to pick winners every time. No one will. But we'll do better by analyzing our data objectively and not being reflexively bullish on precious metals all the time just because the government's running big deficits.