Commodities Led Last Week’s Broad Rally In Asset Classes

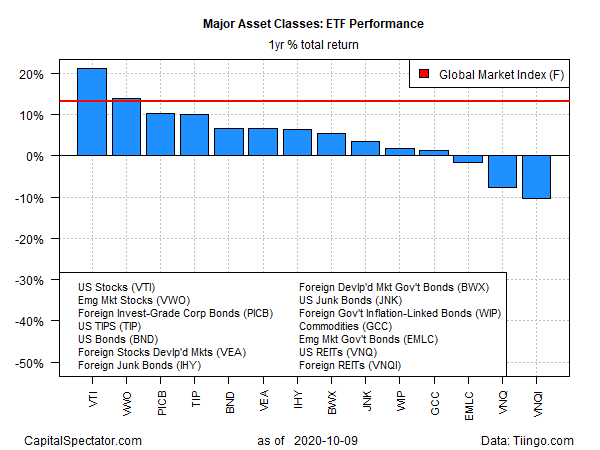

A broad, equal-weighted measure of commodities topped last week’s wide-ranging gains across the major asset classes, based on a set of exchange-traded funds. In close pursuit: US and emerging markets stocks.

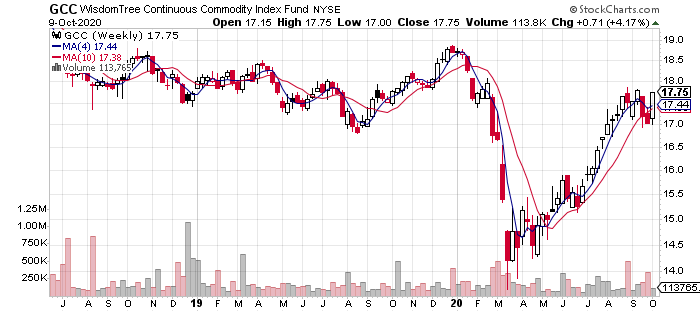

WisdomTree Continuous Commodity Index Fund (GCC) won last week’s horse race by a hair, delivering a 4.2% gain for the trading week through Oct. 9. Profiling the ETF on a weekly basis continues to show an ongoing rebound from the March coronavirus crash. But GCC may struggle to break above recent highs without a continuation of reflationary fuel in the economic data and news headlines.

Will tomorrow’s consumer inflation report (Oct. 13) offer an assist? Econoday.com’s consensus forecast sees the one-year trend for headline CPI ticking up to 1.4% for September from 1.3% in the previous month. Hardly the stuff to spark inflation worries since those gains continue to print well below the Federal Reserve’s 2% inflation target. On the other hand, core CPI (excluding energy and food) is also on track to edge higher to 1.8% year-over-year. Core measures of inflation tend to resonate more with central bankers and so this faster pace may carry more weight with inflationistas.

US equities also rallied last week. Vanguard Total US Stock Market (VTI) rose 4.1%, fractionally behind the gain in commodities. Shares in emerging markets also posted a similarly solid advance for the trading week: Vanguard FTSE Emerging Markets (VWO) rallied 4.0%.

Only one slice of the major asset classes lost ground last week: a broad measure of US investment-grade bonds. Vanguard Total US Bond Market (BND) slipped 0.2%, leaving the fund near its lowest close since early July.

The Global Markets Index (GMI.F) posted a strong gain last week. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, rose 2.7% — the strongest weekly increase since June.

For the one-year trend, US stocks continue to lead by a wide margin. VTI is up 22.0% on a total-return basis, far ahead of the rest of the field.

Although most of the major asset classes are posting one-year gains, three are under water for the trailing 12-month period. The deepest one-year setback at the moment: foreign real estate shares via Vanguard Global ex-US Real Estate (VNQI), which is down 10.2%.

GMI.F’s one-year performance, by contrast, is a strong 13.2% at Friday’s close.

Current drawdowns for the ETF proxies tracking the major asset classes range from a trivial 0.3% peak-to-trough decline for inflation-indexed Treasuries (TIPS) to a hefty 44% tumble for broadly defined commodities (GCC).

GMI.F’s current drawdown is a slight 0.9% loss off its previous high.

Disclosure: None.