China: Challenges Shift From Supply Chain To Global Demand

China‘s economy is recovering from the damage caused by Covid-19. The broken supply chain is not the top issue anymore. Weak global demand is. As a result, companies within China may focus more on the domestic market given stimulus from the “New Infra“ scheme. But the risk of a new trade and technology war is returning.

Broken supply chain no longer an issue if there is little demand

Back in February, city lockdowns kept Chinese workers away from factories. This created a sharp disruption in the global supply chain.

By mid-March however, many of these workers were finally able to leave their home towns and go back to work. But at the same time, buyers in the US and Europe were withdrawing orders. With no clear indication as to when global demand would recover, many Chinese factories were forced to lay off the workers they had just hired.

This has yet to be fully reflected in the GDP contraction of 6.8% year-on-year in the first quarter. More of this will be seen in the coming quarters as unemployment rates are high in buyers’ markets.

Manufacturers turn to the Chinese market

Factories are now turning to the domestic market. The moderate recovery of inbound tourism during the May Golden Week holiday, even with strict social distancing measures imposed, has given some hope to retailers and manufacturers.

Together with the new infrastructure plan, which is worth CNY8 trillion in 2020, China may be a more promising market for retailers and digital services.

The “New Infra” plan to support the economy

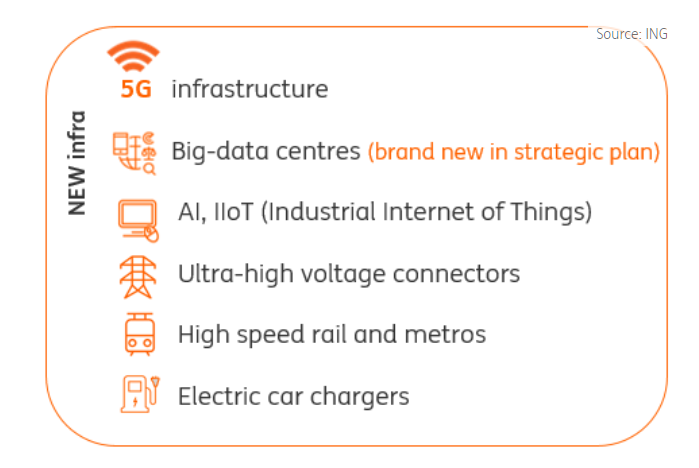

The Chinese government has created a theme of stimulus for the recovery, dubbed “New Infra”. It's ‘new’ because it has a lot of digitalisation elements compared to the ‘old’ infrastructure, which is largely bricks and mortar.

5G, a big-data centre, AI & Industrial Internet of Things (IIoT), ultra-high voltage connections, high-speed rails and metro networks, and electric-car chargers, are the major elements in the scheme. The plan consists of 22,000 projects, which is worth a total of CNY49.6 trillion over several years, of which 8 trillion yuan will be invested in 2020. Most of this is private investment, combined with government strategic planning.

Frankly, elements in the “New Infra’ scheme are not brand new, with the exception of the big-data centre project. The big-data centre idea seems to have emerged from the Covid-19 crisis, with many office workers forced to work from home, while factories have tried to control operation lines remotely without enough workers. These activities have increased the flow of data quite suddenly. The project could allow China to become the champion of remote working in the next decade and also more prepared for an aging population.

Recovery depends on trade and technology wars

Even with a well-planned stimulus scheme, a trade and technology war with the US would make China's road to recovery more difficult.

Our GDP forecast of -1.5% for the whole of 2020 is based on the assumption that trade and technology wars won't intensify. We may downgrade our GDP forecast if this assumption is wrong.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more