Castle Could Crumble When IPO Lockup Expires

The 180-day lockup period for Castle Biosciences Inc. (CSTL) ends on January 21, 2020. When the lockup ends, company's pre-IPO shareholders and insiders may choose to sell more than 10.4 million shares of CSTL in the secondary market. The number of currently-restricted shares dwarfs the 4 million shares of CSTL offered in the IPO and significant sales of currently-restricted stock could flood the secondary market and negatively impact the stock price of CSTL when the lockup expires.

Trading in Castle Biosciences has been somewhat mixed during this six-month period, but CSTL has a return from IPO of nearly 100%. The stock had a first day return of 33.8%. We believe that CSTL's high return from IPO will make pre-IPO shareholders and company insiders particularly interested in cashing in on their gains.

Business Overview: Commercial Stage Bioscience Company Focused on Skin Cancers

Castle Biosciences is a commercial-stage company that develops and markets treatments for skin cancers. The company uses clinically-actionable, personalized genomic data that enables physicians to make more accurate treatment choices. This goes beyond the conventional approach of using only clinical and pathology factors. The company's product line offers non-invasive treatments produced by using an assessment of the specific risk factors of each patient by using proprietary algorithms to pinpoint those risks. In particular, the assessments identify risks of metastasis or recurrence of the skin cancer that may indicate a need for an escalation of treatment. The products also identify those with lower risks who may not need unnecessary surgical and medical interventions.

(Source: CSTL website)

Their lead product is DecisionDx-Melanoma, which identifies risks for patients with invasive cutaneous melanoma. The company also markets DecisionDX-UM, which identifies risks for patients with uveal melanoma. Both products qualify for Medicare coverage. Castle Biosciences also has two late-stage products being developed to treat cutaneous squamous cell carcinoma.

The company notes that there are over 5.5 million new cases of skin cancer diagnosed each year in the United States, which significantly exceeds the 1.6 million new cases of all other types of cancer combined. DecisionDx-Melanoma targets over 100,000 new cases of invasive cutaneous melanoma annually. Their late-stage products will treat approximately 300,000 patients with suspicious pigment lesions and around 200,000 patients with cutaneous squamous cell carcinoma. The company estimates their target market to be approximately $1.8 billion.

Company info was sourced from the company's website and S-1/A.

Financial Highlights

Castle Biosciences reported the following highlights for the end of the third quarter for fiscal 2019 ended September 30, 2018:

- Revenue reached $14.8 million, for an increase of $11.1 million from the same period last year

- The company produced 4,126 DecisionDx-Melanoma test reports versus 3,136 in the same period last year, which represented an increase of 32%.

- The company produced 356 DecisionDx-UM test reports versus 324 in the same period last year representing an increase of 10%

- Gross margin was $13.1 million or 88%

- Operating cash flow was were $0.8 million in the third quarter versus $(1.9) million in the same period last year

Financial highlights were sourced from the company's website.

Management Team

President and CEO Derek Maetzold founded the company in September 2007. He has been a board member since inception. He held senior positions at Encysive Pharmaceuticals, Integrated Communications, Schering-Plough, Sandoz Pharmaceuticals, and Amylin Pharmaceuticals. Mr. Maetzold earned a B.S. degree in Biology from George Mason University, and he completed coursework at the University of Calgary Health Sciences Center and the MBA program at the University of California, Riverside.

Chief Medical Officer Federico Monzon has served in his position since November 2015. He held positions at Invitae Corporation. He served as Director of Molecular Pathology at Baylor College of Medicine, and he held an academic appointment as Associate Professor in Pathology and Immunology. He holds an M.D. degree from the Universidad Nacional Autónoma de México. He completed his Pathology residency at Thomas Jefferson University and his Molecular Pathology fellowship at the University of Pittsburgh.

Company biographical information was sourced from the company's website.

Competition: Novartis, Amgen, and Roche

Castle Biosciences faces competition from the largest cancer treatment developers including Novartis (NVS), Amgen (AMGN), Roche, AbbVie (ABBV), Biogen Idec, GlaxoSmithKline, Sanofi, Pfizer (PFE), Bristol Myers Squibb (BMY), Merck (MRK), Astra Zeneca (AZN), Eli Lilly (LLY), Johnson & Johnson (JNJ), and Celgene.

Early Market Performance

The underwriters for Castle Biosciences priced its IPO at $16, at the high end of its expected price range of $14 to $16 per share. The stock had a first day return of 33.8%. The stock currently has a return from IPO of nearly 100%.

Conclusion

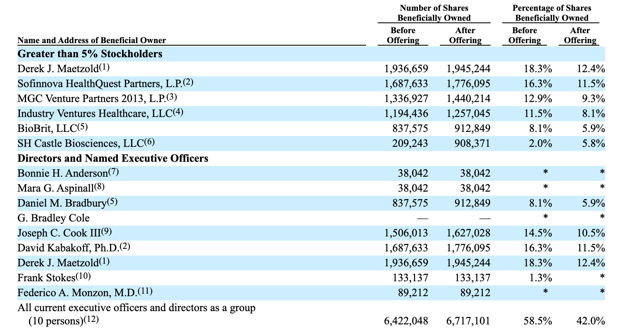

When the IPO lockup period for CSTL expires on January 21st, pre-IPO shareholders and company insiders will be able to sell large blocks of currently-restricted shares. We believe that they may feel especially motivated to cash in on some of their gains with the large 99.8% return from IPO. This group of pre-IPO shareholders and company insiders includes numerous executives and VC firms.

(Source: S-1/A)

With more than 10 million shares of CSTL subject to the lockup - and just 4 million shares offered in the IPO - there is a potential for significant sales of currently-restricted securities to flood the secondary market for CSTL when the IPO lockup expires. This kind of selling could cause a sharp, short-term downturn in share price. Aggressive, risk-tolerant investors should consider shorting shares of CSTL ahead of the IPO lockup expiration on January 21st or early in the January 21st trading session. Interested investors should cover short positions during the January 22nd and January 23rd trading sessions.

Disclosure: I am/we are short CSTL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclosure: I am/we are short CSTL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more