Cannabis Central: These Marijuana- Related Companies Pay Dividends

Investors who don’t want to invest in the volatile, high valuation, unprofitable and non-dividend paying marijuana pure-play "pot" stocks but would still like some exposure to the burgeoning market sector should consider investing in companies with indirect exposure to this sector. There are several consumer goods (beverage, food, and tobacco) and bio-pharmaceutical companies that have ventured into the marijuana space but continue to generate the majority of their revenues and earnings in their primary business. This article identifies 12 such companies and analyzes 7 of them for your investing consideration.

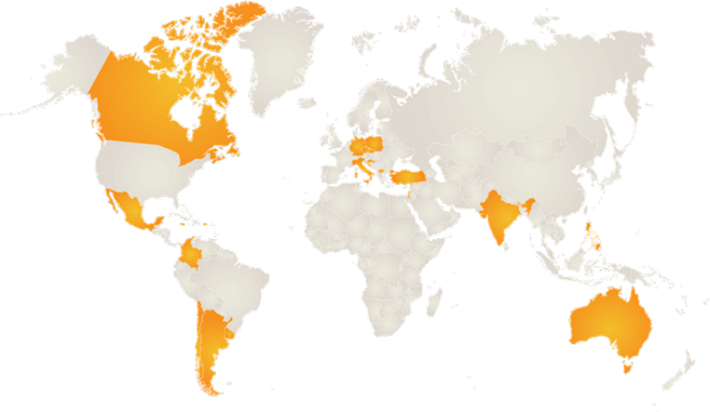

An increasing number of countries (21) have legalized cannabis for medical, and in some cases, recreational use. The image below shows legalization by country.

Source: Cannabisbusinesstimes.com

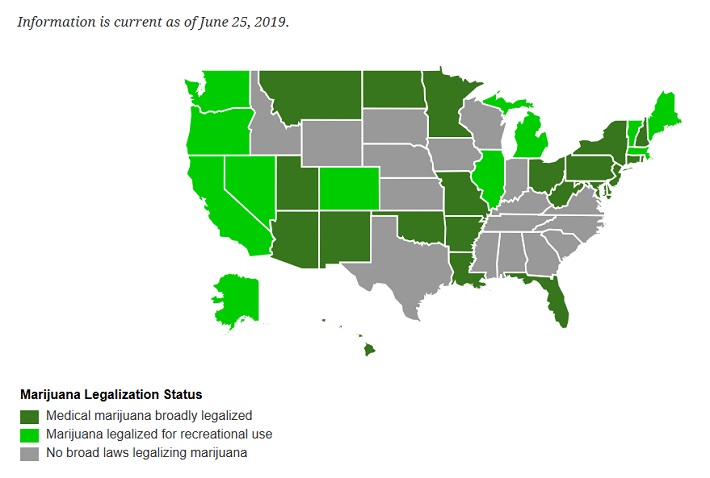

Marijuana has been at least partially legalized in the U.S. states. 33 U.S. states (although it has so far not been legalized on the federal level) allow the medical use of marijuana of which 11 states, as well as the District of Columbia, allow the recreational use of marijuana by adults, with age restrictions ranging from 18 to 21.

Source: governing.com

An analysis of the "pot" stock universe has identified 12 consumer goods & bio-pharmaceutical companies that have indirect exposure to the marijuana sector, pay dividends and have below-average beta scores:

- Compass Diversified Holdings (NYSE: CODI)

- Yield: 7.7%

- Beta: 1.05

- Mkt. Cap.: $1.2B

- Altria Group Inc. (NYSE: MO)

- Yield: 6.9%

- Beta: 0.37

- P/E Ratio: 13

- Mkt. Cap.: $86.9B

- AbbVie Inc. (NYSE: ABBV)

- Yield: 6.6%

- Beta: 0.95

- P/E Ratio: 23.7

- Mkt. Cap.: $96.8B

- Imperial (Tobacco) Brands PLC (OTCQX: IMBBY)

- Yield: 6.3%

- Beta: 0.61

- Mkt. Cap.: $24.6B

- Amsterdam Commodities NV (OTCPK: ACNFF)

- Yield: 5.3%

- Beta: 0.82

- P/E Ratio: 14.9

- Mkt. Cap: $531M

- Molson Coors Brewing Co. (NYSE: TAP)

- Yield: 4.4%

- Beta: 0.76

- P/E Ratio: 12.4

- Mkt. Cap.: $11.4B

- Novartis AG (NYSE: NVS)

- Yield: 3.2%

- Beta: 0.52

- Mkt. Cap.: $46.7B

- Anheuser-Busch InBev SA (NYSE: BUD)

- Yield: 2.3%

- Beta: 1.17

- Mkt. Cap.: $193.0B

- The Scotts Miracle-Gro Company (NYSE: SMG)

- Yield: 2.1%

- Beta: 0.82

- P/E Ratio: 16.3

- Mkt. Cap: $6.1B

- Constellation Brands, Inc. (NYSE: STZ)

- Yield: 1.6%

- Beta: 0.73

- P/E Ratio: 14.3%

- Mkt. Cap.: $37.0B

- Innovative Industrial Properties Inc. (NYSE: IIPR)

- Yield: 1.4%

- Beta: 0.98

- Mkt. Cap.: $1.1B

- Associated British Foods (OTCPK: ASBFY)

- Yield: 0.9%

- Beta: 0.94

- P/E Ratio: 16.6

- Mkt. Cap.: $23.2B

Below is a commentary on 7 of the companies mentioned above:

1. AbbVie Inc.

AbbVie, a highly profitable $35B biotech company active in oncology and immunology, has introduced a FDA-approved marijuana-based drug called Marinol that is used for the treatment of nausea and vomiting in patients enduring chemotherapy and for increasing appetite in patients with HIV/AIDS or certain cancers. While Marinol is not a large revenue driver for AbbVie, it seems possible that AbbVie will continue to expand in this space if there is potential for increased medical usage of marijuana or marijuana-based products.

2. Altria Group Inc.

It makes sense that Altria, the largest tobacco company in the world (and with a 10% stake in Anheuser-Busch InBev (NYSE: BUD), one of the world’s largest beer companies) has entered the marijuana sector given that cigarette usage is declining in the U.S. and marijuana decriminalization is starting to take hold. In December 2018, Altria invested $1.8 billion in Canadian marijuana company Cronos Group Inc. (NASDAQ: CRON) - not an overly large stake for a company with a market capitalization of $93B - giving it a 45% stake in a global leader in the marijuana industry with an option to acquire another 10% of Cronos as well.

The above-mentioned stake will allow Altria to expand rapidly into the marijuana space, if and when marijuana gets legalized in the U.S. on the federal level, based on Cronos’s diversified business and know-how which would enable Altria to quickly pivot to become a leading provider of the substance.

3. Associated British Foods

Associated British Foods, a $24B London, UK-based company that operates in the sugar production and agricultural industries and produces beverages, cereals, and other food products has the potential to introduce marijuana-containing products snacks and beverages. and has already ventured into the marijuana industry by becoming a marijuana cultivator and supplier to the medical industry.

4. Constellation Brands, Inc.

Constellation Brands, one of the largest alcoholic beverages companies in the world - focused on the wine and spirits markets, but with a small beer segment, as well - invested $4B last summer in Canadian marijuana company Canopy Growth Corporation (NYSE: CGC). STZ sees significant potential for marijuana-infused beverages and, due to its experience in the beverages industry and its existing sales networks, anticipates becoming one of the biggest players in this burgeoning market.

5. Molson Coors Brewing Company

Molson Coors, an $11B beverage company focused on the global beer market, has moved into the marijuana industry through a joint venture with The Hydropothecary Corporation (NYSE: HEXO), a Canada-based marijuana producer. The joint venture will focus on producing marijuana-containing, but alcohol-free, beverages for the Canadian market initially, but will likely expand globally if legalization in other countries allows for entry into these markets and capture significant market share in overseas markets if the opportunity arises.

6. The Scotts Miracle-Gro Company

Scotts generated 13% of its previous fiscal-year sales from its subsidiary, Hawthorne Gardening, which supplies lighting, soil, nutrient, and hydroponic solutions to the North American cannabis-growing industry.

7. Novartis AG

Novartis, one of the world's largest drug manufacturers, has entered into a global agreement with major grower Tilray Inc. (NASDAQ: TLRY), through its Sandoz division, which allows Tilray to use the Sandoz supply chain, sales force and global distribution network to distribute its medical cannabis products to legal jurisdictions around the world.

Conclusion

Investors should take a close look at all relevant data points before making any decisions, especially in a higher-risk environment such as the emerging marijuana industry. Choosing lower-risk stocks which allow for some indirect exposure to the industry, such as the ones above, could be an opportune move for investors, especially for those that desire dividend income from their stock holdings.