Cannabis Central: Greenlane Q2 Financials Reveal Decline In Net Sales & Gross Profits

Greenlane Holdings, Inc. (GNLN), a sellers of premium cannabis accessories and specialty vaporization products, reported financial results for the second quarter ended June 30, 2020 today.

Greenlane has a unique (one might say a sleight-of-hand) way of reporting its quarterly financial performance by comparing the latest quarter with the latest 6 months and with the same quarter in the previous fiscal year. This method prevents a clear picture of how Q2 financial results compare with those of the previous quarter and masks the trend in performance. This report has done the analysis and gives you that comparison below:

Second Quarter 2020 Highlights (Unless otherwise stated, all amounts are in U.s. dollars and all comparisons are made between Q2 2020 and Q1 2020 results.)

- Net Sales: decreased 4.4% to $32.4M

- Gross Profit: decreased 8.2% to $6.7M

- SG&A Expenses: reduced by 18.3% to $12.5M

- Adj. EBITDA: increased 50% to ($4.4M)

- Cash on Hand: $41.8M

- Total Debt: $8.2M

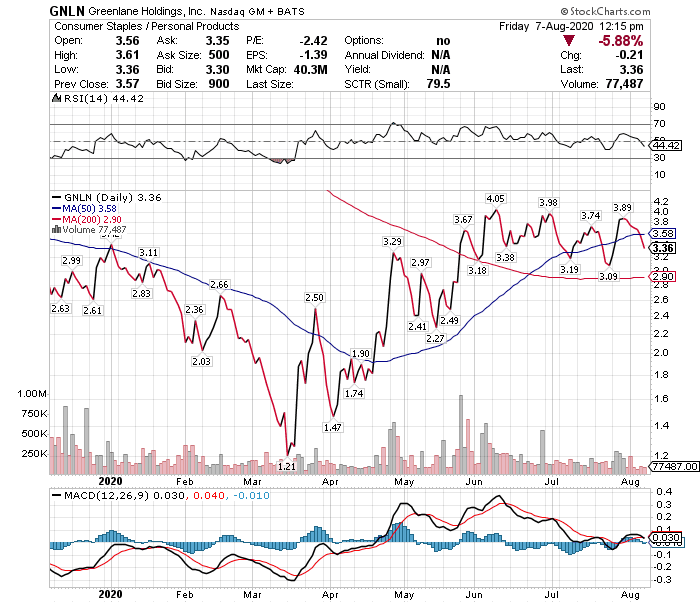

Stock Price Performance

Greenlane is one of the few "momentum" marijuana stocks (read this TalkMarkets article for details) as the stock is UP 18.4% YTD which is excellent when compared with munKNEE.com's Pot Stock Index of 25 equal-weighted, pure-play marijuana stocks which is DOWN 13% YTD.

Greenlane's sleight-of-hand in the way it reported its Q2 financials today has not deceived anyone as its stock price today so clearly shows.

(Click on image to enlarge)

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

$GNLN is looking good to me!