Cannabis Central: Aphria's Reported Q4 Financials Were Unexpectedly Terrible

Aphria Inc. (TSX: APHA; Nasdaq: APHA) today reported its financial results for Q4 ended May 31, 2020 and they were terrible with negative results across the board as outlined below: .

Q4 Financial Highlights (All amounts are expressed in Canadian dollars and compared to the previous quarter.)

- Net Revenue: increased 5.4% to $152,203M

- dried flower revenue (58% of gross sales) declined 5.9% to 70.1% of total revenue from 75.7%

- vape revenue (14% of gross sales) increased 473% to 13.8% of total revenue from 9.6%

- oils revenue (5% of gross sales) increased 10.8% to 16.1% of total revenue from 14.7%

- pre-roll revenue accounted for 12% of gross sales

- capsule revenue accounted for 0.5% of gross sales

- medical cannabis revenue declined 2.5% to 12.9% of total revenue

- adult-use cannabis revenue increased by 26.7% to 86.6% of total revenue

- wholesale revenue declined 97% to 0.5% of total revenue

- Net Income: declined to ($98,843M) from $5,697M

- Profit (Loss) per Share: declined to ($0.39) from $0.02

- Selling, general, and administrative costs: increased 129.1% to $116.6 million.

- Gross Profit: declined 20.4% to $47,390M

- Gross Margin: declined to 31.1% from 41.3%

- Earnings/Share: declined to ($0.43) from $0.05

- Adj. EBITDA: increased 49.2% to $8,558M

- Production Cost/Gram: declined 5.4% to $0.88

- Average retail selling prices:

- medical cannabis increased 3.4% to $6.63/g

- adult-use cannabis declined 4.4% to $5.23/g primarily as a result of a change in sales mix and price reductions in key markets to solidify market share.

- Qtr. End Cash/Equiv: declined 3.5% to $497,222M

Q4 Operating Highlights

- Received its European Union Good Manufacturing Practices certification allowing the Company to ship finished dried flower and finished oil for medicinal and research use in permitted jurisdictions throughout the European Union.

- Liquidated $39M Promissory Note for proceeds of approx. $26M.

- Reduced debt by eliminating $6.7M in annual cash interest costs by repurchasing an aggregate of approximately $127.5M convertible senior notes at a 25% discount to their face value.

- Recorded a non-cash impairment of $64.0M

- Recognized for Executive Gender Diversity by Globe and Mail's inaugural Report on Business Women Lead Here list, an annual benchmark of executive gender diversity in corporate Canada.

Subsequent Events

- Transferred its listing on the New York Stock Exchange to The Nasdaq Global Select Market ("Nasdaq") on June 8, 2020. The Company's primary listing on the Toronto Stock Exchange remains.

- Settled an outstanding dispute with Emblem Cannabis Corporation and Aleafia Health Inc. related to the termination of the parties' wholesale cannabis supply agreement on June 25, 2020.

- Filed Prospectus supplement for $100 million (USD) At-the-Market program.

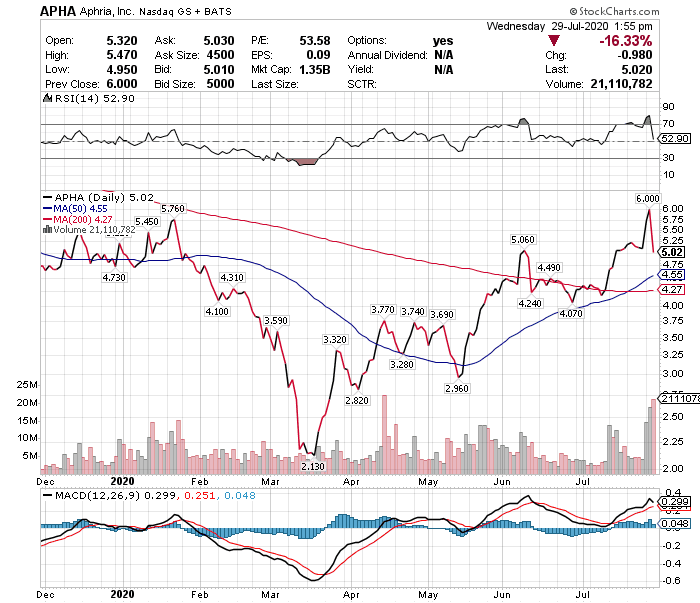

Stock Performance

After reaching its highest level for 2020 yesterday in anticipation of a favorable Q4 financial report today, it's stock price had dropped more than 16% by mid-day Wednesday as a result of the poor results as outlined above.

(Click on image to enlarge)

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more