Can Interest Rates Rise When Central Banks Are The Only Market Maker?

(Click on image to enlarge)

QUESTION: How can interest rates can rise when central banks are the only market maker, & pension funds FORCED to buy gov.debt by their statutes?

But why is the REPO crisis starting in the US where rates are WAY higher than in japan & Europe?

You would expect this crisis to start somewhere in European debt markets/ instruments…why isn’t all the capital that is fleeing to the US not financing REPOs?

ANSWER: This is laid out in the Repo Crisis Report (an update goes out this week). Central Banks do not control long-term rates. They set the short-term rate such as Fed Funds and Discount Rate. That is what Quantitative Easing was all about. The central banks began to BUY the long-term debt in hopes of “influencing” the long-term rates by reducing the supply of government long-term debt and in theory then the free market would have been willing to buy private long-term debt such as mortgages. That failed because banks had no confidence in the real estate market and were loaded to the gills with real estate debt which people were defaulting on.

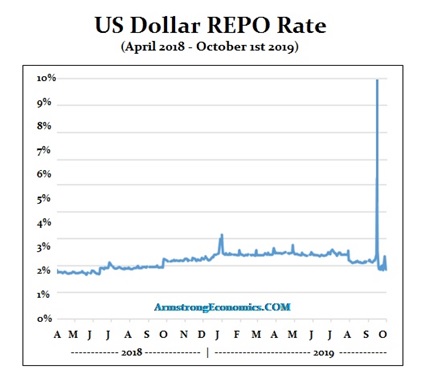

The Repo Crisis has begun in the states BECAUSE this is the only viable free market to speak of. Both Japan and Europe have destroyed the bond markets. The Repo Crisis is the manifestation of our forecast that we would enter a liquidity crisis by September 2019. We listed that as one of the major points to take homes from the May World Economic Conference in Rome.

The Repo Crisis is a liquidity crisis because of the collapse in confidence. Banks are unwilling to lend to each other because they are deeply concerned about a crisis in the international banking sector. The Fed was lowering short-term rates because the yield curve inverted on the 10yr-2yr during the 3rd quarter 2019. Then the Repo Crisis hit on September 17th. The forced the Fed to stop its intended policy to lower rates for the Free Market dictated otherwise.

The image that central banks are in control is an illusion. They too are subject to the Free Market. They are not in control of interest rates are they like to make everyone believe. If that were true, then there would have been no Repo Crisis to start with.

Disclosure: None.