Campbell's Is Cheap For Such A Stable Business

Image Source: Unsplash

Introduction

The Campbell Soup Company (CPB) is a business comprised of beloved food brands. Not only does the company own the Campbell's Soup brand, but also Swanson, Prego, Pace, V8, Pepperidge Farms, Snyder's, Kettle, Cape Cod, and more. I know I buy at least one of these brands every weekend. These established and desired brands are why the company has a very reliable revenue stream. But the bottom line is a bit more variable with the divestitures and acquisitions Campbell's has completed. Looking past these corporate actions shows a business that can net $750 million to $1 billion in earnings per year. With this, the company trades around a 17x P/E and offers a 3% dividend with just a 50% payout ratio. Taken altogether, Campbell's seems to be trading at fair value and offers income growth potential.

Financial History

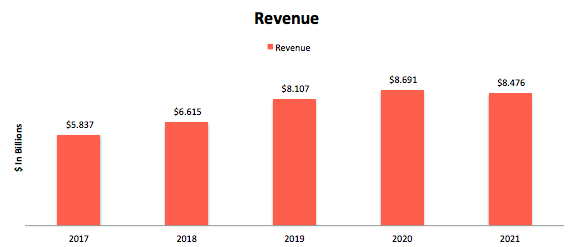

Campbell's Revenue (SEC.gov)

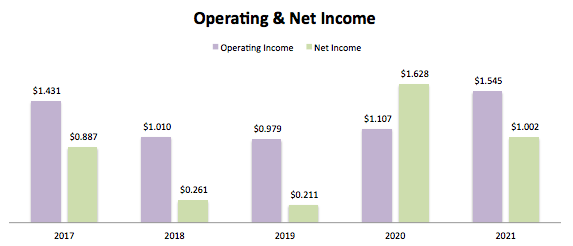

Campbell's Operating & Net Income (SEC.gov)

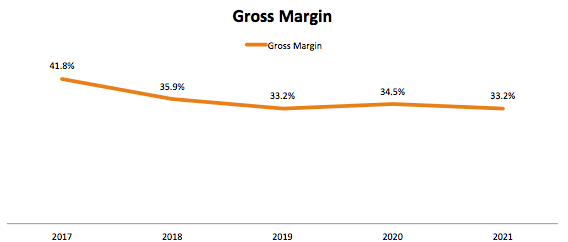

Campbell's Gross Margin (SEC.gov)

Campbell's, as expected, is a very stable company with its' notable brands. Revenue is very stable, and since the 2018 acquisitions of Snyder's-Lance and Pacific Foods, the business has steady revenue of around $8.5 billion a year. But looking down the income statement shows that operating and net income are not nearly as steady. This is due to high costs, as can be seen in the gross margin decline over the five years. Gross margins have shed 8.6% since 2017. Also affecting the bottom line are the various acquisitions and divestitures Campbell's has engaged in over the years. In any given year, there could be an earning/loss from discontinued operations or a boost in newly acquired operations. Since 2017, Campbell's has bought Pacific Foods & Snyder'ss-Lance and sold Campbell's Fresh, Garden Fresh Gourmet, Boathouse Farms, Arnott's, and Plum Baby. Therefore it is important to look at income from continuing operations, which was $1.008 billion in 2021. This is a 70% increase from 2019, primarily due to total costs being down 5% as a percent of revenue and interest expense declining 39% too. With the company's cost initiatives, this may be close to the new baseline for earnings.

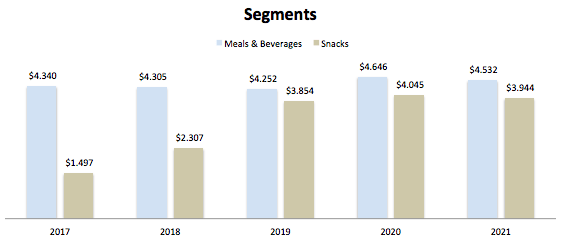

Campbell's Segment Revenue (SEC.gov)

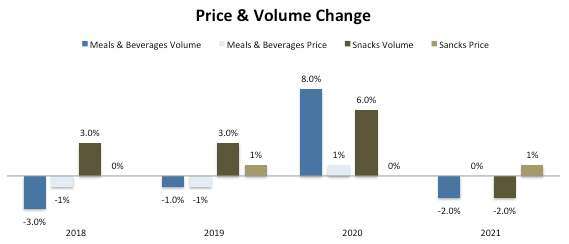

Campbell's Segment Volume & Price Changes (SEC.gov)

Looking at each segment shows that Meals & Beverages and Snack are both consistent. The Snyder's-Lance acquisition is the reason for the massive jump in revenue in Snacks. Over the last four years, Campbell's hasn't seen much volume growth in Meals & Beverages until 2020, when the segment volumes grew 8%. Snacks, on the other hand, have seen much better volume growth, with gains in three of the four years. On top of this, the company hasn't increased prices much, if any, over the past few years.

This Year

Over the past nine months of 2022, Campbell's has seen more consistent revenue but higher costs due to inflation. Revenue for the period was about flat at $6.575 billion, but costs of goods increased by 3%, while total costs increased by 2%. This resulted in a 12% decline in operating income and a 7% decrease in net income. The Meals & Beverages segment revenue declined 2% with a 6% decrease in volume and a 7% increase in pricing. Snacks revenue grew 2% on a 6% decline in volumes and a 6% increase in pricing. Overall, it seems cost control and pricing are the main factors of 2022. Inflationary pressures have increased costs across the board, and Campbell's has responded by increasing prices, which in turn was a wash as volume equally declined. I expect these same factors in quarter four and for the total net income to be moderately below the $1.008 billion in earnings from continued operation from 2021.

Balance Sheet

Campbell's doesn't have the best balance sheet but can easily survive with it due to the company's operational consistency. For liquidity, the business has a current ratio of 0.69x and a quick ratio of 0.29x. These are very low, and the company couldn't pay off all current debts if needed. But the business doe has a higher inventory turnover than most at 7x. Looking at debt load, Campbell's has a debt-to-equity of 2.49x, which is reasonable. On top of this, the business has a 6x times interest earned ratio. Altogether, Campbell's could have a better balance sheet, but the company is in no harm with these metrics.

Valuation

As of writing, Campbell's trades around the $50 price level. At this price, the company has a forward P/E of 17.67x using a 2022 estimated EPS of $2.83. The company also trades at a P/BV of 4.46x with a book value per share of $11.20. With a dividend of $1.48, Campbell's has a yield of around 3% and a payout ratio close to 50%. With all of this corresponding information, I think Campbell's is at fair value and has room to increase its dividend.

Conclusion

At 17x earnings, I like where Campbell's is priced at. The company has a very steady business and after the Snyder's-Lance purchase seems to be on track to net $750 million to $1 billion in earnings per year. The company also offers a nice dividend yield of 3% and has some room to grow. Overall, it is hard to find such stable stocks trading below 25x earnings, but it seems Campbell's is one.

More By This Author:

GoDaddy Valuation Justified By Growth

Progressive Corporation's Growth Continues With A Wobble In Q2

Tesla Doesn't Belong In This Group

Disclosure: I/we have no stock, option, or similar derivative position in any of the companies mentioned, and no plans to initiate and such positions within the next 72 hours.

Disclaimer: I ...

more