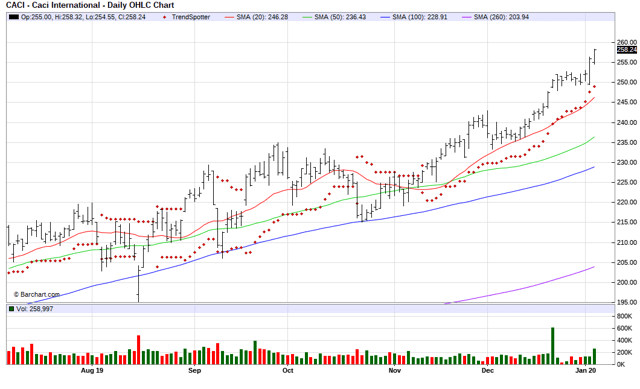

CACI International - Chart Of The Day

The Chart of the Day belongs to the IT and network solutions company CACI International (CACI). I found the stock by sorting Barchart's Top Stocks to Own list first by the most frequent number of new highs in the last month then used the Flipchart feature to review the charts for consistent price appreciation in the last month.Since the Trend Spotter signaled a buy on 11/12 the stock gained 12.44%.

CACI International Inc provides the IT and network solutions needed to prevail in today's new era of defense, intelligence, and e-government. From systems integration and managed network solutions to knowledge management, engineering, simulation, and information assurance, we deliver the IT applications and infrastructures our federal customers use to improve communications and collaboration, secure the integrity of information systems and networks, enhance data collection and analysis, and increase efficiency and mission effectiveness. Company's solutions lead the transformation of defense and intelligence, assure homeland security, enhance decision-making, and help government to work smarter, faster, and more responsively.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 67.60+ Weighted Alpha

- 78.59% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 8.93% in the last month

- Relative Strength index 82.30%

- Technical support level at 225.75

- Recently traded at 258.24 with a 50 day moving average of 236.43

Fundamental factors:

- Market Cap $6.41 billion

- P/E 25.77

- Revenue expected to grow 13.70% this year and another 5.60% next year

- Earnings estimated to increase 17.30% this year, an additional 12.90% next year and continue to compound at an annual rate of 14.20% for the next 5 years

- Wall Street analysts issued 3 strong buy, 8 buy and 3 hold recommendations on the stock

- The individual investors following the stock on Motley Fool voted 163 to 14 that the stock will beat the market

Disclosure: None.

$CACI is a good find.