Building Material Prices To Remain High Until At Least The Middle Of Next Year

It will take at least until the summer of 2022 before we expect the price of some building materials, notably concrete, bricks, and cement, to drop. Construction firms' suppliers first need to improve their historically low levels of inventories. The price of timber and steel will probably settle down earlier.

Construction work in the center of Brussels, Belgium

Building material prices have soared

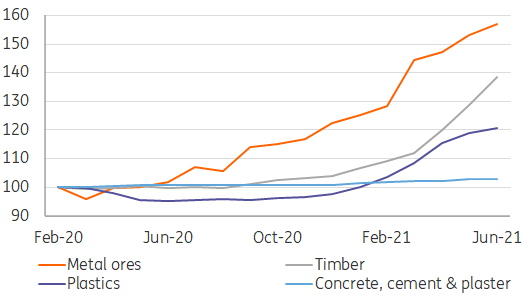

Building material prices have soared over the last six months, along with many other products. The cost of raw materials such as timber, plastics, and steel have particularly surged. Supply chain disruptions, due to the Covid-crisis, decreased the supply of building materials just as output remained resilient during the pandemic. This has resulted in shortages and price hikes.

Raw material prices for metals and timber have come down from recent peaks. However, this is not yet reflected in the producer prices because it takes some time before these make their way through the supply chain. Besides that, the data lags a bit, as July and August producer prices are not published until now and are probably already showing some flattening.

Soaring prices for building material inputs

Producer Price Index in the European Union. Index February 2020=100

Source: Eurostat, ING Research

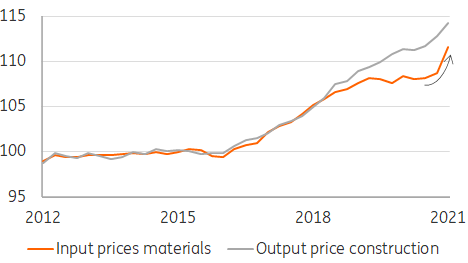

Contractors' margins are diminishing

The building materials' price hikes have put building companies' profit margins under pressure. This can easily lead to loss-making projects as profit margins are thin in the construction sector, generally about 2 to 4%. The development of output prices of construction projects and input prices of building materials are in general closely related. However, from 2018 until the end of 2020, contractors' output prices increased faster than the input prices which could have resulted in higher profits. Yet, due to the higher building material costs input prices are catching up quickly and saw their biggest increase in the first quarter of 2021 since 2004 and this puts pressure on those margins.

Contractors' input prices are catching up

Construction prices for new residential buildings in the European Union. Quarterly data index 2015=100

Source: Eurostat, ING Research

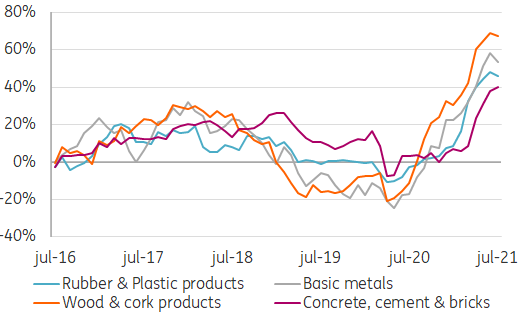

A large number of suppliers are still planning price increases

Although there have been some recent price decreases of raw materials such as timber, particularly in the US, and steel, European building material companies are still dealing with higher costs. As a result, many European manufactures are expecting to increase their output prices even more. In July, according to a European Commission survey, some 40% of concrete, cement, and bricks suppliers said they expected to raise their prices even further. For timber and steel, the percentage of companies that expect to raise the sale price is even higher. Nevertheless, it looks like the peak is over for these products but shortages of labor and the uncertain development of the Delta variant could also delay stabilizing or downward price adjustments.

Building material suppliers expect to raise prices further

Balance of manufactures in European Union which expects to increase/decrease output prices (over next 3 months)

Source: European Commission, ING Research

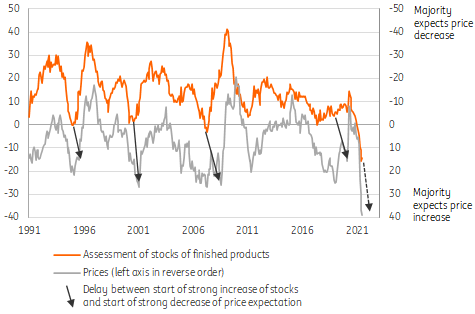

Inventories have to improve first

Before suppliers even think about lowering sales prices, they have to see an improvement in their inventories. That's because a rise in their stock increases the competition and puts downward pressure on prices. For example, at the beginning of the financial crisis, building material suppliers started to see an increase in their inventories from April 2007 but it took until August 2008 before an increasing number of companies were indicating that they planned to decrease those sale prices.

Prices for timber and steel are more vulnerable than those of concrete, cement, and bricks

For steel and timber, there is a global market with a huge number of buyers and sellers. This makes these markets competitive and transparent and this results in a more direct pass-through in the value chain of price changes of raw materials. Conversely, the markets for concrete, cement, and bricks are more local. This is due to the characteristics of these materials. They are large and heavy and therefore difficult and costly to transport. This makes these markets less competitive. The pass-through of procurement price fluctuations is therefore slower. This could also explain why prices of steel and timber have surged more than others, as you can see in our first chart.

Cost of cement, concrete, and bricks probably won't fall before Q2 2022

Assessment of stocks of finished products and expected development of prices by building material suppliers (eg. cement, concrete & bricks), European Union (Balance on positive and negative answers in %)

Source: European Commission, ING Research

High prices for concrete and cement until at least mid-2022

Correlation analysis shows that sales prices of building materials such as concrete, bricks, and cement react with a delay of approximately six to nine months to changes in the assessment of their inventories. However, at the moment we don’t see any improvement in inventories for these building materials. In fact, quite the opposite. A record number of building material suppliers reported in July that they value their inventory of finished products as (too) low.

Therefore we first need to see some stock improvement, before the prices of these building materials stabilize, let alone decrease. So, taking the six to nine months price delay into account, we don’t expect prices of concrete and cement to come down before the summer of 2022.

Price of timber will settle down earlier

The sales price of timber and steel has a less delayed correlation. Building suppliers of these materials almost directly indicate fewer price increases when they see an improvement in their inventories. There is only a time lag of one or two months between the improvement of stocks and price changes. In addition, the value chains first have to start up. This could still take some time after curtailing it, perhaps too much, during the Covid-crisis.

For example, transport is still a big problem. Due to the value chain disruptions, we expect shortages of timber and steel to remain an issue until at least early 2022. Therefore high prices for timber and steel for construction projects will remain for the coming quarters before settling down.

How construction companies cope with procurement price risks

As profit margins are thin and lead times for construction projects are long, contractors have to closely follow the price movements of building materials and use hedging policies to minimize losses. There are several strategies that companies can follow. All of them have their pros and cons en most large building companies make use of a combination of the strategies:

- Use a price escalation clause: This makes it possible for contractors to pass on procurement price increases to the customer. This is mainly done in larger infrastructure projects and non-residential ones where the customer is a local or civil government or a (large) company. Price clauses in the residential market where customers are often private consumers are more difficult to achieve and therefore not common.

- Directly procure building materials: Contractors can directly procure the building materials at the moment the building project deal is closed. This secures them the calculated procurement price of the moment of closing the deal. They can do this in two ways: Firstly, they can agree on the price with a supplier and ensure delivery of the materials at the moment needed in the building process. However, it must be said that suppliers are sometimes reluctant to such long-term contracts as the price risk is handed over to them. The second is that contractors can buy the building materials directly, let them be delivered directly and store them until needed. This is also a remedy against impending material shortages. Yet, this results in (high) storage costs and a decrease in working capital.

- Commodity futures: If those two strategies are not possible, a hedge with a commodity future is an option. However, this also has its difficulties. Price futures exist for some raw materials but not for the semi-finished products that contractors often use. In addition, the duration of the future and the amount has to match. Finding “the perfect hedge” with commodity futures could therefore be challenging. Futures are also complicated financial products which have to be constantly monitored. Therefore not many building companies use futures to hedge their procurement price risks.

- Do nothing: The last option is to “take it as it is”. This has the advantage that it gives the firm a competitive advantage as it takes over the price risk of the client. However, it makes the profit volatile.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more