Bristol-Myers Squibb: Strong Quality And Attractive Valuation

Smart investing doesn't need to be too complex or sophisticated. On the contrary, a simple and straightforward idea can many times produce superior returns. Bristol-Myers Squibb (BMY) is a top-quality company in pharmaceuticals, the fundamentals are solid, and the stock is attractively priced at current levels. This can be an effective combination for market-beating returns in the years ahead.

A High-Quality Business

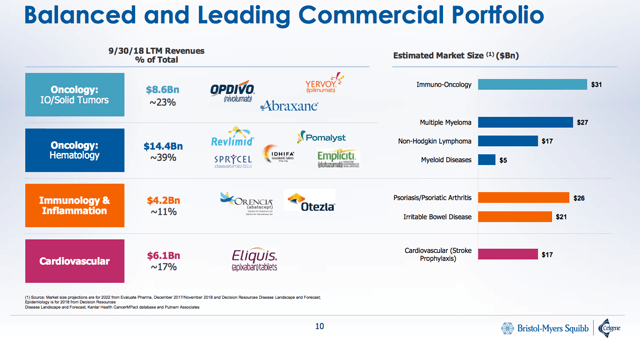

Through internal developments, partnerships, and acquisitions, Bristol-Myers Squibb has built a strong portfolio of drugs and a deep pipeline of products with promising potential in the years ahead.

Patent protection provides pricing power and profitability, and big cash flow generation generates the resources for massive investments in research and development for further growth. The size of the business provides a key layer of competitive strength in the industry, as a big player such as Bristol-Myers Squibb benefits from scale advantages, distribution capabilities, and a global salesforce that smaller competitors cannot match.

The recent acquisition of Celgene is not without risk, but the move makes sense from a financial and strategic perspective. Management estimates that the acquisition will be accretive to earnings per share by 40%, and run-rate cost synergies from the acquisition are expected to be $2.5 billion over three years.

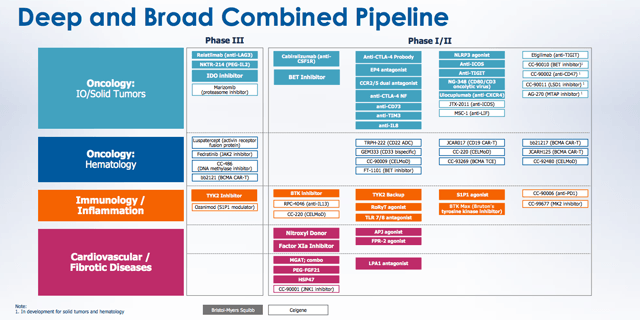

Size and diversification provide competitive strengths while also reducing drug-specific risk. Besides, the integrated company has plenty of opportunities for growth, both when looking at the current portfolio and the development pipeline. Management is working on 8 launches over the next 24 months; if the company can in fact deliver, this could be a powerful driver for the stock price.

Source: Bristol-Myers Squibb

Source: Bristol-Myers Squibb

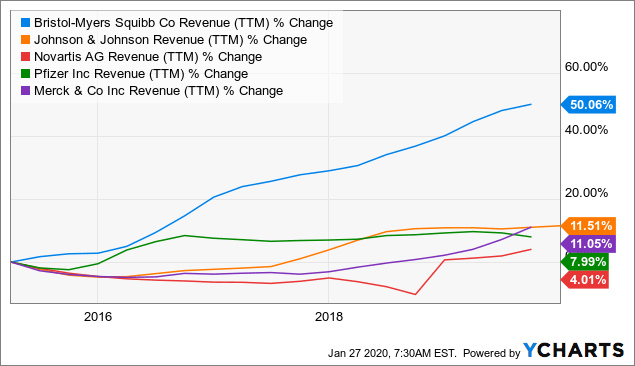

Even before the Celgene acquisition, Bristol-Myers Squibb has proven its ability to produce industry-leading performance over the long term.

The chart below shows revenue growth rates for Bristol-Myers Squibb versus other big industry players like Johnson & Johnson (JNJ), Novartis (NVS), Pfizer (PFE) and Merck (MRK). The company has outgrown its peers by a considerable margin over the past five years.

Data by YCharts

When it comes to creating value for shareholders, revenue growth and profitability are the two critical drivers to consider. In essence, investors want the company to increase revenue over time, and also to retain a large share of revenue and capital as profits.

The table shows return on assets, return on equity, return on investment and operating margin for Bristol-Myers Squibb in comparison to Johnson & Johnson, Novartis, Pfizer, and Merck. Bristol-Myers Squibb is ahead of the pack in terms of ROA, ROE, and ROI and it comes in the second position behind Merck in operating margin.

| ROA | ROE | ROI | Op Margin | |

| BMY | 12.4% | 35.9% | 25.4% | 23.4% |

| JNJ | 9.2% | 23.8% | 17% | 19.9% |

| NVS | 9.2% | 20.5% | 11.5% | 17.3% |

| PFE | 10.1% | 26.3% | 10.2% | 36.7% |

| MRK | 11.2% | 34.3% | 11.7% | 25.6% |

Data Source: FinViz

Relative Valuation

Valuation is quite attractive in comparison to other stocks in the sector, especially since Bristol-Myers Squibb is a high-quality business. The table shows adjusted PE, adjusted forward PE, price to earnings growth, price to sales, price to cash flow and dividend yield for Bristol-Myers Squibb versus the median values in the sector. The stock is priced at a discount across the 6 valuation indicators considered.

A discounted valuation for Bristol-Myers Squibb makes the stock price look quite compelling, especially since the company is one of the best players in the sector in terms of fundamental quality and financial performance.

| BMY | Sector Median | % Diff. to Sector | |

| P/E Non-GAAP | 14.62 | 22.64 | -35.45% |

| P/E Non-GAAP (FWD) | 14.63 | 24.84 | -41.10% |

| PEG Non-GAAP | 1.45 | 2.16 | -32.66% |

| Price / Sales | 4.34 | 6.22 | -30.33% |

| Price / Cash Flow | 17.78 | 22.05 | -19.37% |

| Dividend Yield | 2.62% | 1.11% | 134.89% |

Source: Seeking Alpha Essential

Forward-Looking Valuation

Valuation is an art and a craft as much as a science. The true value of the business does not depend on past earnings, but on the earnings that the business is going to generate in the future. Unfortunately, the future can never be known with precision, it can only be estimated. That notwithstanding, looking at a company's valuation levels based on different estimates can be remarkably insightful.

The table below shows the forward price to earnings ratios for Bristol-Myers Squibb based on 3 levels of earnings expectations. The lowest estimate among Wall Street firms, the average estimate, and the highest earnings estimate among the analysts following the stock.

| Fiscal Period Ending | Low PE | Avg PE | High PE |

| Dec 2019 | 14.9 | 14.6 | 14.2 |

| Dec 2020 | 11.5 | 10.3 | 8.8 |

| Dec 2021 | 9.3 | 8.5 | 7.6 |

| Dec 2022 | 8.8 | 7.8 | 7.0 |

| Dec 2023 | 8.6 | 7.4 | 6.4 |

Source: Seeking Alpha

The data is telling a compelling story. Even under modest assumptions for earnings in the years ahead, Bristol-Myers Squibb looks very attractively priced.

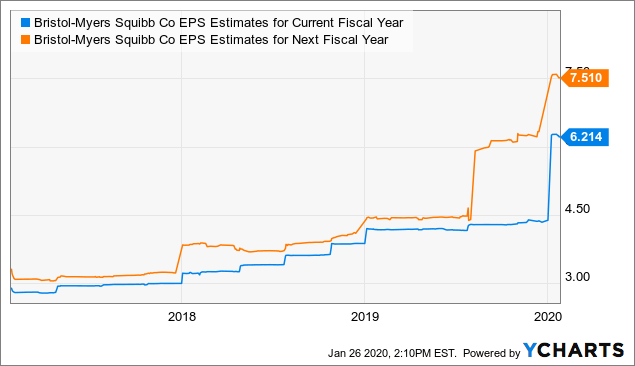

It is important to keep in mind that valuation is always dynamic as opposed to static. Ratios such as forward price to earnings are calculated on the basis of earnings expectations in the year ahead. If the company can consistently deliver numbers above expectations and those expectations tend to increase over time, then the stock price needs to rise too in order for the valuation to remain stable.

Earnings estimates for Bristol-Myers Squibb in both the current year and next year have consistently increased over time. This shows that management tends to underpromise and overdeliver when it comes to earnings guidance.

Data by YCharts

If past history is any valid guide for the future, it would be no surprise to see Bristol-Myers Squibb delivering above expectations in the future, and this would mean that the stock is even more undervalued than what current ratios are indicating.

Multi-Factor Perspective

Valuation should be interpreted in its due context. A company that generates strong profitability and consistently beats expectations deserves a higher valuation than a business with below-average profitability and underperforming expectations.

However, it can be challenging to incorporate multiple factors into the analysis and quantify them in order to see the complete picture. In that spirit, the PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors: financial quality, valuation, fundamental momentum, and relative strength.

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and the higher the ranking the higher the expected returns.

Bristol-Myers Squibb has a PowerFactors ranking of 99.9 as of the time of this writing. This means that the stock is in the top 0.1% of companies in the US stock markets based on financial quality, valuation, fundamental momentum, and relative strength together.

It is important to keep in mind that an algorithm such as PowerFactors is based on current data and current expectations about future data. This provides a valuable assessment based on hard data as opposed to opinions, but it also carries some limitations.

In essence, forward-looking returns will depend on the cash flows that the business can produce in the future. The algorithm is saying that Bristol-Myers Squibb is attractively priced based on current expectations and past history. But the company needs to continue bringing the right drugs to the market in order for those assumptions to materialize in the future.

Backtested data for quantitative algorithms should always be taken with a grain of salt. The backtest shows that a large number of companies with high PowerFactors rankings tend to deliver superior returns over the long term, but this does not tell us much about how a specific company such as Bristol-Myers Squibb will perform in a particular year such as 2020.

In other words, the main strength of a quantitative algorithm is that it provides a quantifiable approach based on hard data to make investment decisions supported by evidence. However, investors should always assess the business behind those numbers in order to analyze if the numbers are sustainable or not going forward.

Risk And Reward Going Forward

When looking at the risks, the Celgene acquisition carries significant integration risk and $32 billion in additional debt for the company. Based on management estimations, the combined company will produce $45 billion in free cash flow over the first three years, and canceling debt will be a priority in terms of capital allocation, so the risk should be contained over time. Nevertheless, these considerations cannot be overlooked.

Like all other players in the industry, Bristol-Myers Squibb is significantly exposed to regulatory uncertainty, patent expirations, and competition from generics. In this particular case, the growth prospects from Opdivo and Eliquis, as well as new launches, are particularly important to watch going forward.

But risk can never be eliminated or completely avoided in the stock market. The smart thing to do is assuming the risks that are well compensated with attractive upside potential.

In the case of Bristol-Myers Squibb, the company's fundamentals are remarkably solid, growth prospects are compelling, and the stock is very reasonably valued at current levels. For these reasons, Bristol-Myers Squibb looks well-positioned for attractive returns going forward.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BMY over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more