Breathe, Breathe In The Air

After digesting the latest employment data, I couldn’t help but think of the classic Pink Floyd song, “Breathe.” You could almost hear Federal Reserve (Fed) Chairman Powell breathe a sigh of relief following the release of the May jobs report. Pressure, external—and in some cases perhaps internal—seemed to be building for the Fed to begin their discussions about when/how to begin tapering their current quantitative easing (QE) program. While the May employment data continued to show progress being made within the nation’s labor markets, it fell short of creating any urgency for the Fed to shift course in the immediate future.

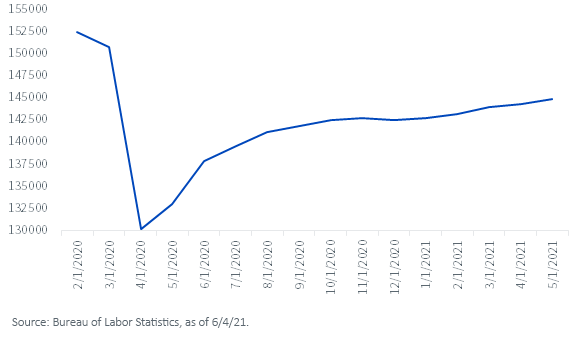

Total Nonfarm Payrolls

Total nonfarm payrolls (NFPs) rose by +559,000 in May, once again falling visibly below the consensus forecast of +675,000. If there is a silver lining, at least this time around, it’s that it wasn’t the “worst miss” on record. As you can see in the above graph, the pace of improvement for NFPs has definitely trailed off. Through October, job gains had recovered 55% of the plunge in job losses that occurred during the height of the pandemic shutdown in March/April 2020. However, that figure has only managed to climb to about 66% through May. In other words, incremental progress of only a little more than 10% over the last seven months.

A great deal of attention has been placed on inflation of late, and rightfully so, in my opinion. However, Powell & Co. have tended to downplay that portion of their dual mandate (it’s just transitory, remember?) and instead focus on the employment aspect to continue to justify their unprecedentedly stimulative monetary policy. While the unemployment rate fell -0.3 pp to 5.8%, this had more to do with a decline in the civilian labor force as the “participation rate” dropped during the month. Based upon the May jobs data, the employment part of the equation still has a way to go, especially in Powell’s eyes.

Certainly, there has been a lot of discussion as to why job gains are not necessarily lining up with the broader economic recovery. Without going too far down that rabbit hole, generous unemployment benefits that serve as a disincentive to return to work have been mentioned as one probable cause while childcare and continued health concerns also enter the mix. There’s no doubt the Fed is fully aware of these potential factors as well, which is why, up to this point anyway, Powell has been taking a more cautious approach to removing any accommodation.

Conclusion

How about we wrap up this blog post with a quick thought about the upcoming FOMC meeting on June 16? While there are no meaningful changes expected to the Fed’s policy statement, I am curious to see how Powell responds to questions at the presser regarding any discussions that have taken place around an “exit strategy,” aka tapering. Also, this meeting will have the Fed’s updated Summary of Economic Projections. Specifically, I’m looking at their Fed Funds estimates (blue dots). While 2024 was still the median forecast in March, the number of Fed officials looking for a rate hike in 2023 did increase a bit from the prior estimate. Will this trend continue? That’s what I’m interested to see.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more