Breakout Trading Strategies With Double Confirmation

Applying Double Confirmation on a Breakout Trade

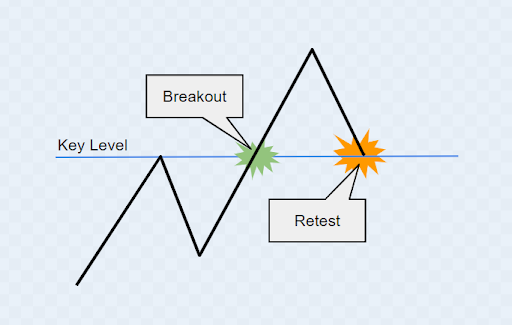

Breakout Pattern Anatomy

The price formation of the breakout is placed where the key level has established itself. The price pushes forward to break the key level. Usually, the price approaches that level to retest its boundary. With momentum, it confirms that this price level is indeed a valid key level.

A breakout trader would want to trade these breakouts especially when the price is pushed just enough to break that level. If that level breaks, the price will continue along the upward march.

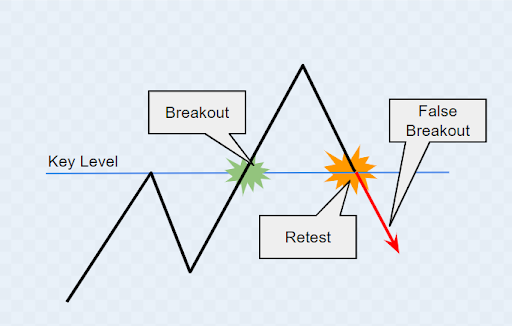

But, success is not always guaranteed. As seen by an earlier sign, a false breakout can be expected because a breakout was not well established. This is when a false price can shoot above and soon after back down, both moving through the key level. This is also known as a fake-out.

Breakout Phase 1

The market can play either towards a full breakout or a fakeout. The trader’s patience is what is key. Plenty of discretion is needed, or it can be a dangerous game. To keep out of trouble, a trader should use the price action confirmation, in order to validate that the breaking of the key level is well established. Confirm that the price has a high enough probability in order to continue the direction of the breakout.

Confirming The Confirmation

Allowing the price to make the breakout, waiting for it to return back to test the key level, and finally buying the position right on the spot is a common method but not a recommended one. However, this is not safe trading, the breakout formation can naturally be discovered as a false breakout. So, we need further confirmation before we can confidently jump into the trade.

Double-take on The Confirmation

To establish another confirmation, take the highest peak that price achieved after the breakout and this will be the newly established confirmation level. The green light will be given if breaking out of the confirmation after the key level was successfully tested. The final confirmation will show a higher probability to succeed with the price while continuing in its desired price direction. Now, this is when the trade can be continued.

Take note: while attempting to test the key level - if moved lower than the key level, then moved up, passed the confirmation level - The probability of the continuation of this direction is less. Be warned not to take the trade or rather, to take it with more caution in smaller position size.

In Conclusion

Wait for confirmation to understand the true nature of the break. Breaking key levels cannot be traded as is, because we may not be sure if it is a false break, a fakeout, or a real break. Always to obtain confirmation - notice the return of price back to the key level, retest it and observe whether or not it breaks the peak that was created prior to the breakout. Once the final break is confirmed, there is a much higher probability of success and it is a precise time to enter into the trade.

Gil Ben Hur has a passion for educating traders. He writes articles and blogs about trading strategies, tips, and psychological tools as well as other interesting financial information. He is also ...

more