Braskem - Stock Of The Day

Summary

- 100% technical buy signal.

- 15 new highs and up 50.53% in the last month.

- 143.35% gain in the last year.

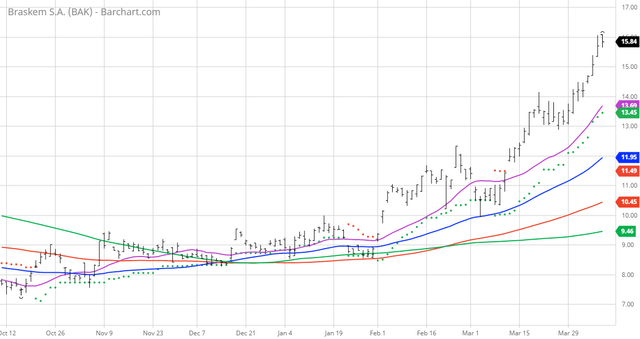

The Barchart Chart of the Day belongs to the Brazilian petrochemical company Braskem (NYSE: BAK). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 3/11 the stock gained 50.53%.

Braskem S.A., together with its subsidiaries, produces and sells thermoplastic resins. It operates through five segments: Chemicals, Polyolefins, Vinyls, United States and Europe, and Mexico. The Chemicals segment produces and sells ethylene, propylene butadiene, toluene, xylene, cumene, and benzene, as well as gasoline, diesel and liquefied petroleum gas, and other petroleum derivatives; and supplies electric energy, steam, compressed air, and other inputs to second-generation producers. The Polyolefins segment produces and sells polyethylene and polypropylene. The Vinyls segment produces and sells polyvinyl chloride, caustic soda, and chloride. The United States and Europe segment produces and sells polypropylene in the United States and Europe. The Mexico segment produces and sells ethylene, high-density polyethylene, and low-density polyethylene in Mexico. The company also manufactures, sells, imports, and exports chemicals, petrochemicals, and fuels; produces, supplies, and sells utilities, such as steam, water, compressed air, and industrial gases; and provides industrial services. The company was formerly known as Copene PetroquÃmica do Nordeste S.A. and changed its name to Braskem S.A. in 2002. Braskem S.A. was founded in 1972 and is headquartered in San Paulo, Brazil.

Barchart technical indicators:

- 100% technical buy signals

- 153.10+ Weighted Alpha

- 143.35% gain in the last month

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 50.53% in the last month

- Relative Strength Index 80.65%

- Technical support level at 15.34

- Recently traded at 15.85 with a 50 day moving average of 11.94

Fundamental factors:

- Market Cap $6.01 billion

- Revenue expected to grow 68.60% this year but be down by 7.00% next year

- Earnings estimated to increase 125.50% this year, an additional 98.80% next year and continue to compound at an annual rate of 18.20% for the next 5 years

- Wall Street analysts issued 1 strong buy, 2 buy and 1 hold recommendation on the stock

- The individual investors following the stock on Motley Fool voted 309 to 17 that the stock will beat the market

- 2,770 investors are monitoring the stock on Seeking Alpha

Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more