You Can Watch Sentiment Change

“Davidson” submits:

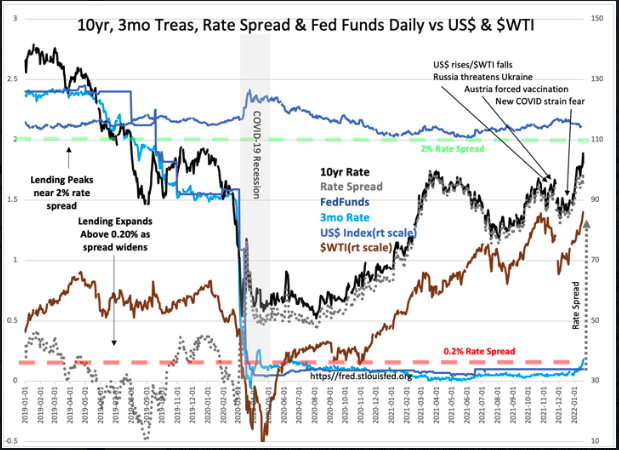

The COVID-shutdown vs economic reopening themes have wobbled back and forth since April 2020. It essentially depends on your bias for fundamentals or price trends for your outlook and decision-making. Since April 2021 when we saw a peak in 10yr Treasury rates, the headlines mostly focused on whether the high-valued tech issues would continue to perform. There was a summer slump correlated with falling oil prices and 10yr rates followed by a brief rebound only to fall once again with Russia’s threats and various onerous country responses to Omicron. The mild illness reported for Omicron stood in stark contrast to headlines, country responses, and another plunge in oil prices/10yr rates. As the headlines have turned more positive and the current administration loses the media support it wielded the past several years (in my opinion the current administration more or less controlled the media focus much of the past 10yrs), the reopening theme has taken charge. This has left a sharp demarcation point when WTI dropped to $66 on Dec 3rd, 2021.

The current move to higher oil prices and higher 10yr Treasury rates is very positive for equity markets. Markets are now more focused on offsetting inflation fears than they are conserving cash for fear of an economic correction. Importantly, the T-Bill/10yr Treas rate spread is widening as 10yr rates rise faster than T-Bill rates. This spurs financial institution lending and in turn this spurs economic expansion. The speed at which this is occurring stretches one’s imagination. Note also, the US$ having strengthened with the collapsing oil prices as global capital pooled in the US is now returning to previous levels. The global panic is easing by this indicator and a very good sign.

Net/net, we can expect higher equity prices ahead. As more capital exits fixed income, I believe it will find a home in equities favoring the reopening theme with most of this capital proving to be directed by inexperienced newly-minted global investors. Anything with a price trend and a narrative will likely soar the next few years. Oil near $200/BBL? XOM near 200shr? It is impossible to predict movements like these. The one surety of markets is that prior negative themes can melt away quickly if a profit opportunity presents. This means that the abandonment of the oil/gas sector by institutions and foundations seeking to comply with the ESG virtue signal experienced the past 7yrs could be reversed in a short period.

Interesting times ahead!

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more