World's Largest Sovereign Wealth Fund Is About To Dump $40 Billion In Bonds & Stocks

One of the world's biggest piles of oil money is taking some profits and planning to dump nearly $40 billion of assets on the market in the coming months in what Bloomberg described as a "historic" sale.

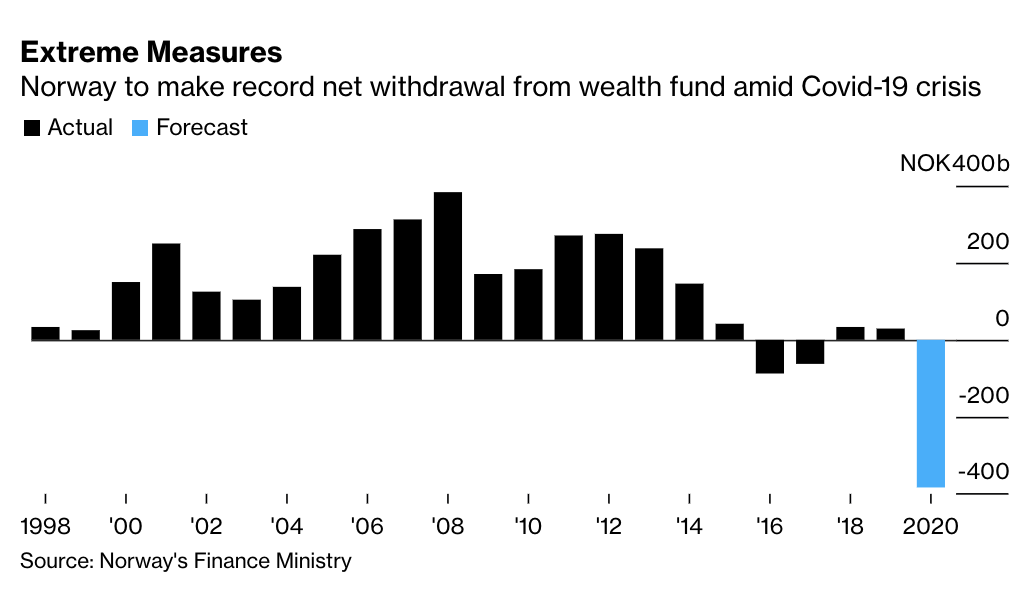

As a uniquely Norwegian scandal simmers in Stockholm, Norway is planning to liquidate $37 billion - 382 billion kroner - from its sovereign wealth fund, which is overseen by a manager hired by the country's central bank .

The decision could create serious problems for analysts still calling for the "V" shaped (or possibly "Z" shaped) rebound for markets, at least.

The unprecedented sale, which was announced in Norway’s revised budget for 2020, is >4x the previous record set in 2016. The sale, which is being undertaken to help Norway plug a gaping budget hole caused by the twin headwinds of the coronavirus and ensuing collapse in oil prices, "exposes the scale of the economic damage done" to Northern Europe's largest oil producer.

The withdrawal is "considerably more" than the dividend and interest payments collected by the fund each year (it invests in a range of asset types).

"It’s obviously an historic event," SEB Chief Strategist Erica Dalsto said. "But we’re also in a crisis that lacks historical parallels. This illustrates the double-whammy that’s hit the Norwegian economy, with repercussions from both containment measures and the oil-price collapse."

However, equity bulls can breath a sigh of relief - for now, at least - as Bloomberg claims the selling will focus on the central bank's bond portfolio.

But of course, that could in turn put even more pressure on emerging market economies and corporates, as sales such as these drive up interest rates.

Until 2016, Norway's petroleum-related income could more than cover its annual budget deficits, creating a generous subsidy for tax payers that has helped finance Norway's generous welfare state.

However, in 2016 and 2017, deposits were replaced by withdrawals as petroleum revenue dwindled. And thanks to the movements in commodity markets witnessed since the beginning of the year, 2020 might be a turning point. Though recent tweets by President Trump offered a glimmer of hope.

Crude Oil prices going up as Saudi Arabia cuts production levels. Our great Energy Companies, with millions of JOBS, are starting to look very good again. At the same time, gasoline prices at record lows (like a big Tax Cut). The BEST of all Worlds. “Transition To Greatness”

— Donald J. Trump (@realDonaldTrump) May 12, 2020

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more