World's Largest Asset Manager Compares Market To A Horror Movie, Warns Complacency Is Back

When the portfolio manager for the world's largest asset manager warns that, following a torrid market surge which saw virtually every major asset in January post positive returns, something which Deutsche Bank said had never before been seen, the market resembles a horror movie, it's probably a good idea to listen. Because that's just what BlackRock's Russ Koesterich has done in his latest blog post, asking "Have investors shifted market sentiment too quickly", and giving three specific reasons why that is indeed the case.

Here is Koesterich's take on why markets have gone from despair to euphoria in the blink of an eye, and why this signals that complacency is once again back.

* * *

Have investors shifted market sentiment too quickly?

As every fan of horror movies knows, the best way to elicit screams is to lull the audience into a false sense of security. It’s when everyone has relaxed, thinking the worst has past that the real fright occurs.

Since bottoming in late December, global equity markets have rallied more than 10% in dollar terms and market volatility has been cut in half. This raises the question: Have investors gone from panic to complacency too quickly? A few observations:

1. The economic data has not stabilized.

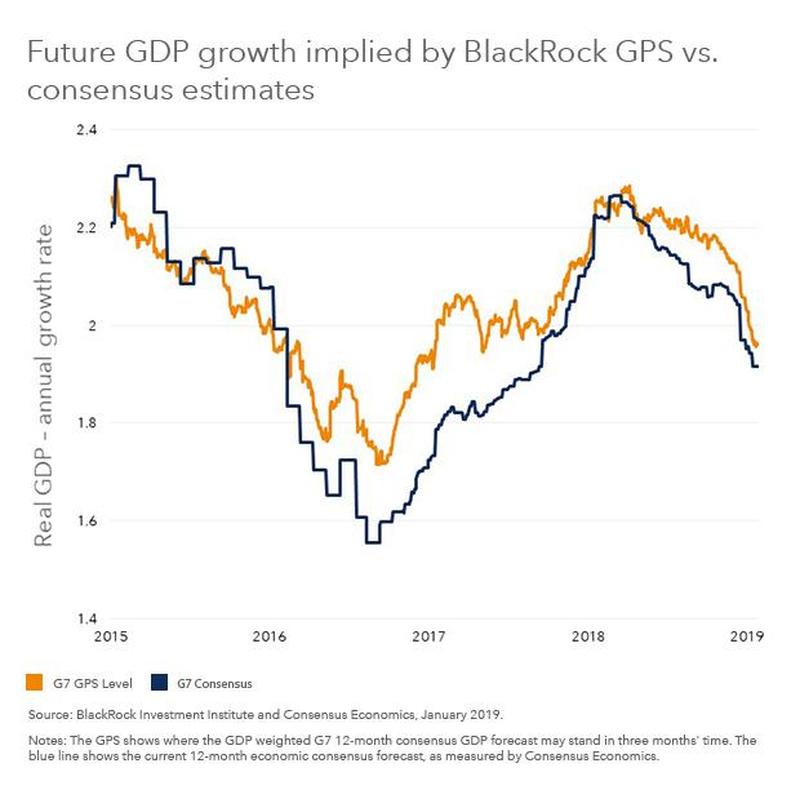

If part of what induced the unprecedented December selloff was the fear of an economic slowdown, it’s not clear why everyone has become more optimistic. While the global economy is not falling off a cliff, forward looking measures of growth continue to soften. China has been aggressively stimulating its economy, but the expected benefits have yet to materialize. At the same time, European data continues to disappoint, and even the U.S. is showing signs of weakness, particularly in housing. BlackRock’s proprietary measure of global growth still suggests further deceleration over the next six months (see Chart 1).

2. Volatility no longer looks too high relative to financial conditions.

As always happens in the midst of panic, implied volatility (measured by the VIX Index) spiked in December. At the peak, the VIX rose above 35, the highest level since February. Although volatility looked artificially high in December, it looks a bit too low today. Looking at the VIX relative to two measures of financial market conditions–high yield credit spreads and the St. Louis Fed Financial Stress Index–as well as forward looking economic indicators–the Chicago Fed National Activity Index–suggests that at 17 volatility appears about 10% too cheap. For volatility to remain low, financial conditions would arguably need to ease or forward looking measures of the economy improve.

3. It’s not obvious that political risk has dissipated.

Beyond vexing over a slowdown and a less dovish Federal Reserve, investors spent the holidays fretting over a host of geopolitical issues. No more. BlackRock’s geopolitical dashboard suggests that geopolitical worries have become less pronounced in recent weeks. In particular, investors appear much more sanguine on China and trade, despite the lack of a clear resolution.

To be sure, there is a counter argument to all the above: Risky assets have already discounted slower growth and less accommodative financial conditions. That was true in December, but it is less obvious today.

Markets have already retraced the December swoon. For example, high yield spreads–the difference in yield between high yield bonds and similar maturity Treasuries–increased by over 100 basis points (bps, or 1 percentage point) in December, indicating extreme risk aversion. However, since the start of the year spreads have subsequently reversed most of that move and are now back to levels last seen in early December.

It appears that investors are now convinced the fright has passed. That is normally the time to grip the arm rest a bit tighter.