Why The Stock Market's Muted Reaction To Rate Cuts

Equity investors remain relatively hesitant, despite the Federal Reserve cutting rates twice so far this year. Normally, the stock market would enjoy a rally, especially when the 10y yield drops to a record low. However, nothing of the sort has taken place, as it has become more apparent that low yields indicate economic weakness, even recession. The lower the rates fall, the worse it is for the stock market. We no longer hear cheers going up from the trading floors on the afternoon when the Fed announces a rate cut. Why the silence?

Milton Friedman, as far back as the early 1990s, warned that the low-interest rates are a sign of economic distress. His observations were made with respect to Japan after its equities and real estate markets burst in the late 1980s. He foresaw years of weak growth, deflation and near-zero interest rates as that country struggled to re-ignite its economy. He argued that banks would not extend credit and businesses and consumers would reign in spending and promote savings in a world of low-interest rates. This is precisely what has taken place in Japan for more than two decades and what is now occurring in the European Union.

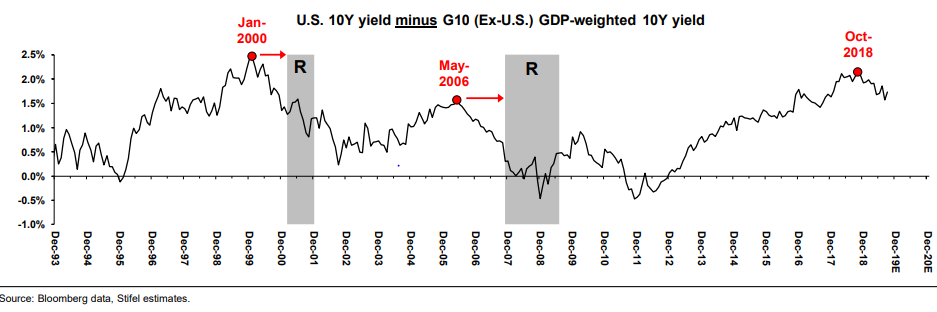

So, has the Federal Reserve responded adequately to the threat of a recession? The accompanying chart, prepared by Stifel, compares the US 10y yield to the 10y yield in the G-10 countries ( ex-U.S.). Historically, the peak spread of the U.S. minus non-U.S. 10Y yield has resulted in a recession within the space of 12 months. We have reached the point where that rate spread is at a historic high. Foreign central banks have been more pro-active in lowering rates to the point where they offer negative deposit rates and government bond yields are negative as far out as 10 years and beyond in some cases.

(Click on image to enlarge)

Stifel rightly argues that despite the Fed’s rate cut yesterday, US monetary conditions are too tight. The spread of more than 200bps between the US on the one hand and Europe and Japan on the other hand remain high by historical standards. The US monetary authorities do not appear to recognize adequately the deflationary pressures from a variety of sources (including the trade war, rising debt levels, and demographic and technological changes). Is the muted stock market reaction to the recent Fed moves a recognition that a recession is on its way?