Why Reach For Yield When You Can Use A Ladder?

The current low-interest-rate environment is forcing many investors to reassess their risk tolerances. Typically, fixed-income investors have three main options when trying to “reach” for yield: 1. Move down in credit quality (i.e., take on more credit risk); 2. Increase duration (i.e., take on more interest rate risk); or 3. Move to alternative assets (i.e., those that can potentially incur other illiquidity and lockup provisions). Of course, all of these options pose the same question: Is the incremental yield worth the additional risk?

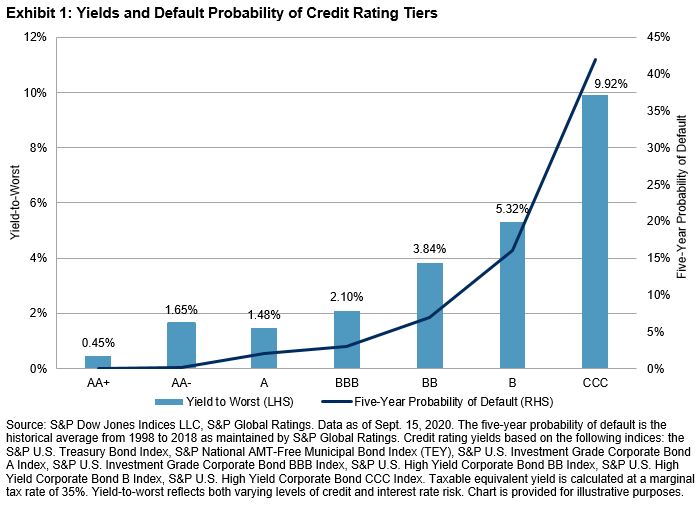

Staying within the U.S. fixed income asset class, Exhibit 1 shows the broad credit characteristics most investors are currently facing. As expected, a move from BBB investment-grade corporate bonds to BB “junk” bonds produces a 174 bps pick up in yield; however, investors must be willing to tolerate a significant deterioration in credit quality, as well as an exponential increase in default risk. Interestingly, the S&P National AMT-Free Municipal Bond Index has a taxable equivalent yield (TEY) that is 17 bps higher than the yield-to-worst of the S&P U.S. Investment Grade Corporate Bond A Index, offers higher credit quality (AA- versus A), and has a historical default probability of nearly 0%.

(Click on image to enlarge)

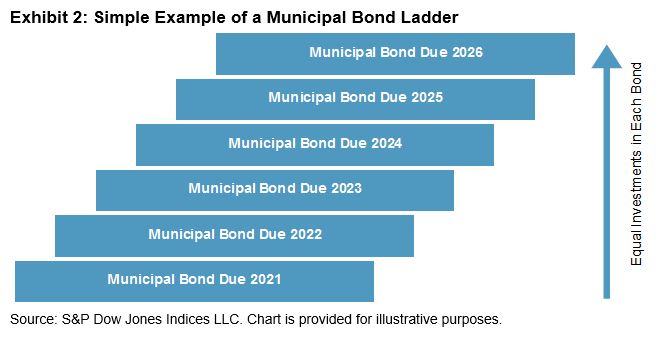

For investors uncomfortable with taking on additional credit risk or interest rate risk, a laddered approach presents an alternative. Bond laddering is a mechanism widely used by the investment community to mitigate the potential risks related to buying individual bonds. A ladder helps smooth out the effect of fluctuations in interest rates because there are bonds maturing every year based on the number of rungs in the ladder. When a bond matures, an investor could reinvest that principal in a new longer-term bond at the end of a ladder. Investors may then benefit from a new, higher interest rate while maintaining the length of the ladder. As shown in Exhibit 2, instead of buying one bond with a six-year maturity, investors can allocate to six different bonds, whereby each bond matures at a different year throughout the six-year horizon.

(Click on image to enlarge)

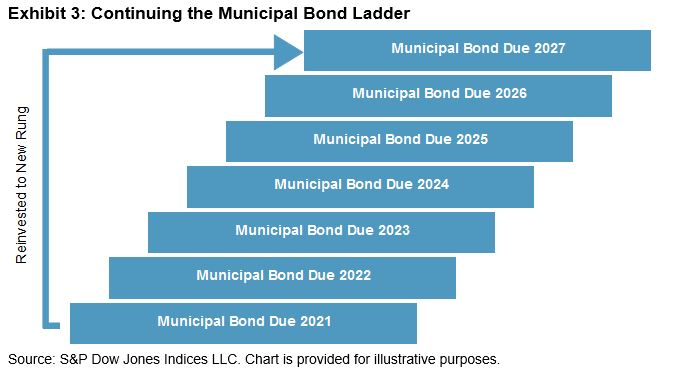

Investors determine how many rungs their municipal bond ladder should have based on their time horizon. If the goal is to keep the bond ladder in place over time, then as the earliest bond matures, the ladder strategy replaces it with a bond of equal principal at the longer end of the maturity ladder (see Exhibit 3).

(Click on image to enlarge)

The strategy illustrated in Exhibits 2 and 3 allows for the construction of a diversified portfolio of bonds from different issuers at each rung of the ladder. Taking this concept a step further, investors have the option of using ETFs that have been specifically designed to incorporate this same structure.

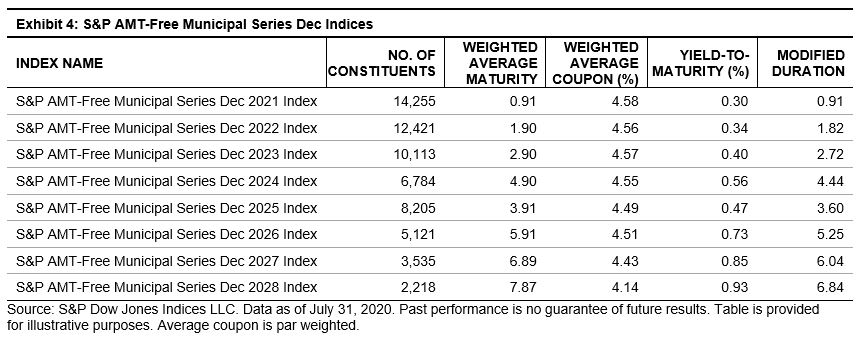

S&P Dow Jones Indices produces a series of indices that seek to track the municipal bond market: the S&P AMT-Free Municipal Series Indices (see Exhibit 4). These indices were designed to reflect the characteristics of a diversified group of bonds that are all high quality, fixed-rate, non-callable, and tax-exempt. Additionally, each index in the series is composed exclusively of municipal bonds that mature in the stated year, allowing for targeted return of principal and potential reinvestment.

(Click on image to enlarge)

As shown, bond ladders offer a simplified approach when navigating uncertain interest rate environments, while also providing relatively predictable levels of income. For more details and examples of how implementing a laddering strategy using indices can offer additional benefits, please be sure to read the recently updated education piece: Bond Laddering with the S&P AMT-Free Municipal Series Indices.

Please read our Disclaimers.

Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights ...

more